Manufacturers are introducing new technologies designed to help integrators offer more fire-related services, which can boost RMR and customer loyalty. // IMAGE COURTESY OF EDWARDS KIDDE CONNECTED SERVICES

Tech Helps Make Fire-Related Services a Hot Niche for Integrators

The fire alarm market can sometimes seem like a quiet segment of the security industry: Everybody needs it and nothing much really seems to change besides some code upgrades.

But don’t be fooled. Fire-related services can be a powerful tool for security dealers and integrators to tie themselves more closely to customers, increase their RMR and leverage their knowledge into increased sales and revenue.

“The core needs of end users have not materially changed; they want to keep their buildings compliant and occupants safe while leveraging technologies that are easy to use and maintain,” says James Taylor, senior offering director, connected life safety services at Honeywell, Charlotte, N.C. “While these core needs are being consistently met, we are seeing shifts in expectations driven by IoT and automation, which includes remote operations capabilities and readily available information.”

The same tech advances that have revolutionized the security industry in general are being adopted for fire services, upending the POTS (plain old telephone service) mindset and providing manufacturers and integrators with great opportunities to upgrade and enhance user systems.

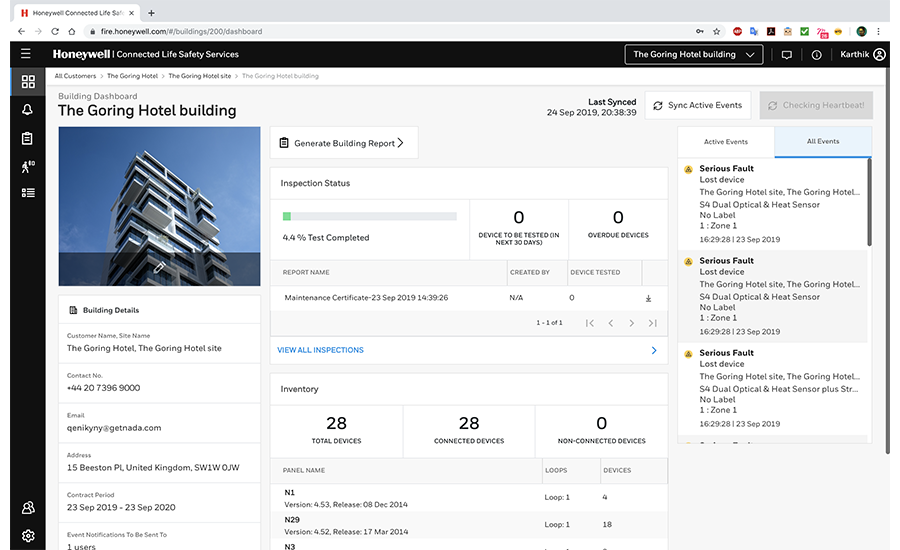

Honeywell’s Connected Life Safety Services (CLSS) solution uses a Honeywell panel and the CLSS platform to provide facility managers, dealers and integrators with rich data to support remote operations and other services. // IMAGE COURTESY OF HONEYWELL

Today’s end users and first responders want intuitive, user-friendly fire and life safety systems, says Tom Meyer, strategic accounts manager at Edwards and Kidde Engineered Systems, Bradenton, Fla. “End users ask what additional value their fire alarm systems provide; specifically, leveraging their fire and life safety system for other emergency event notifications, such as shelter-in-place, extreme weather, chemical spills, etc.”

Customers now expect information from their building in real time; if there is a service alarm, they want to see updates sent directly to their mobile device or on a web dashboard, Taylor says. “End users should be able to easily access compliance information, including test and inspection reports, at any time and from any device. … Testing should be quick, with as little disruption to operations as possible. Additionally, any maintenance or update recommendations should be shared with corresponding fire code compliance to help end users make the best decision for their facility.”

In recent years, the transition to cellular communications has made a big impact on the fire safety market, says Duane Warehime, vice president of national accounts at NAPCO Security Technologies, Amityville, N.Y. “For 50 years we’ve been selling systems connected to phone lines. Now carriers are not maintaining them and converting to VOIP, and integrators have been forced to look at alternatives including IP, cellular and radio networks, with cellular being the most popular,” he says.

Today’s fire alarm systems focus on ease of installation and connectivity, which benefits both end users and integrators. Pictured is a technician in the field, installing and programming a NAPCO FireLink panel in New York’s South Street Seaport area. // IMAGE COURTESY OF NAPCO

In the past year, this acceleration to cellular has been dramatic. “Dealers have realized this is the best option; it gives the dealer for the first time complete control over the communications path,” Warehime says. “In the past, you had to deal with the phone companies. If the end user changed carriers, we had to fix things.” Increased cellular use improves the customer experience and makes things easier for the integrator because the equipment is no longer in the hands of the end user. “When it’s built into a panel it becomes the communication path and it’s out of the reach of the end user,” Warehime says. “A lot of dealers enjoy that because it cuts down on service calls.”

How to Weather a Recession

Experts agree that fire-related services with an RMR component can be a good way for security dealers and integrators to insulate their businesses against an economic downturn — a valuable asset in light of the current fears of a global recession.

The COVID-19 pandemic underscored the importance of integrators growing RMR to bolster their income in uncertain times. “If there is one thing that was quite evident from the impact of the pandemic it is that RMR is the best way to navigate an environment that temporarily prohibits growth,” says Daniel Rosales, senior director technical services at Telguard, Atlanta. “By capturing the RMR that would normally go to telco entities, integrators are maximizing their profitability, which will help them endure situations that inhibit their ability to have new installation and hardware sales. The use of cellular as a way to expand on RMR is an easy proposition, as the difference in cost to the consumer allows for good margins for integrators while providing considerable savings to consumers.”

Brandon Clig, sales manager at Custom Alarm, Rochester, Minn. (SDM’s 2022 Dealer of the Year), agrees. “It’s great to have huge million-dollar sales, but it’s also nice to have a recurring [revenue] aspect to go with it,” says. “We are looking to start offering more general service [through an] RMR model on fire alarm systems we’re installing. We do inspections of fire alarm systems and we’re looking to offer more of a maintenance contract, not only to install up to code but maintain and inspect it annually.”

The fire niche is absolutely a way to weather a market downtown, Warehime adds. “Fire alarm companies are successfully taking cell communications and going to their customer base, cancelling phone lines and putting cell communications on the fire panel — literally just taking over the communications piece from the phone or IP carriers and adding revenue to their bottom line, just by going to their existing customers and upgrading,” he says.

Adding RMR to fire-related services is an incredible sales tool, especially for customers with multiple building locations, Warehime adds. To help its dealers present their case to end users, NAPCO has developed an app for integrators that allows them to plug in the numbers and demonstrate to customers how replacing POTS with cellular can save them money by cancelling phone lines, and more. “If you have thousands of buildings, that’s a big savings,” he adds.

Alee Rouhani, director of marketing at Digital Monitoring Products (DMP), Springfield, Mo., agrees. “Fire alarm systems are a great way for alarm dealers to gain RMR from the monitoring service and also from a service contract,” he says. “The fire alarm segment is a stable part of the market. These systems require inspections and most require monitoring. These are services that will not be going away any time soon.”

More end users are demanding control and knowledge through services that use panel data to provide insights and other services that help with system testing and maintenance. Pictured is a Telguard TG-7FS Fire Alarm Communicator installed at a Costco store location. // IMAGE COURTESY OF TELGUARD

Keeping Up to Code & Beyond

Because the fire-related services niche is so dependent on local codes, it’s important for integrators trying to grow the services to stay current with the latest fire alarm code changes. “In the life safety industry, codes and regulations help drive the demand for fire solutions,” says Mike Maher, senior sales director at Resideo, Austin, Texas. “For example, many states now require smoke detectors in every bedroom and a CO detector on each floor.”

Going beyond the basics can start with something as simple as converting customers from POTS to cellular, stressing the major cost savings for them of eliminating multiple phone lines. “The big thing for me is that surprisingly there are still millions of accounts on POTS that need to be converted,” Warehime says.

Clig adds, “Most end users continue to rely on our company to design systems that meet fire alarm codes; that’s what most end users are looking for,” he says. “We do work with fire marshals and other local building officials to go over additional codes [such as adding voice notification to certain occupancies or adding services such as CO detection].”

Starting with bare-bones code compliance, integrators can go on to sell customers on enhanced systems. “Most consumers care about meeting minimum requirements at low cost,” Rosales says. “When marketing fire services, it’s best to first try and be the provider for every aspect of the system, and provide a full view of the services and cover the alternatives. Start with the overall picture, where the integrator supplies and controls as much as possible. For example, rather than offer to monitor a fire system with existing phone lines where an integrator only charges for installation and monitoring, market the monitoring solution as being inclusive of the path itself (e.g., cellular) and cover how maintaining phone lines as the alternative would be more costly. Allow your vision for the system, which includes you collecting RMR, to be the primary solution that gets compared to other alternatives, and not the other way around.”