To Get Into Video, Act With Decisiveness & a Bias for Action

The famed World War II General George Patton once said: “A good plan violently executed now is better than a perfect plan next week.” When it comes to video monitoring, it seems like many monitoring centers are holding out for the perfect plan, always to be executed next week, next month or next few years.

The monitoring industry is currently at a crossroads. According to the 2023 Barnes Buchanan Industry Overview, monitoring and service revenue only grew from $32 billion to $34 billion from 2019 to 2022, which is a 2 percent compound annual growth rate (CAGR), falling far short of the ~6 percent average inflation during this period. In addition, over the years, the industry has averaged roughly 12 percent annual revenue attrition, which means that a monitoring company’s entire customer base turns over every eight years.

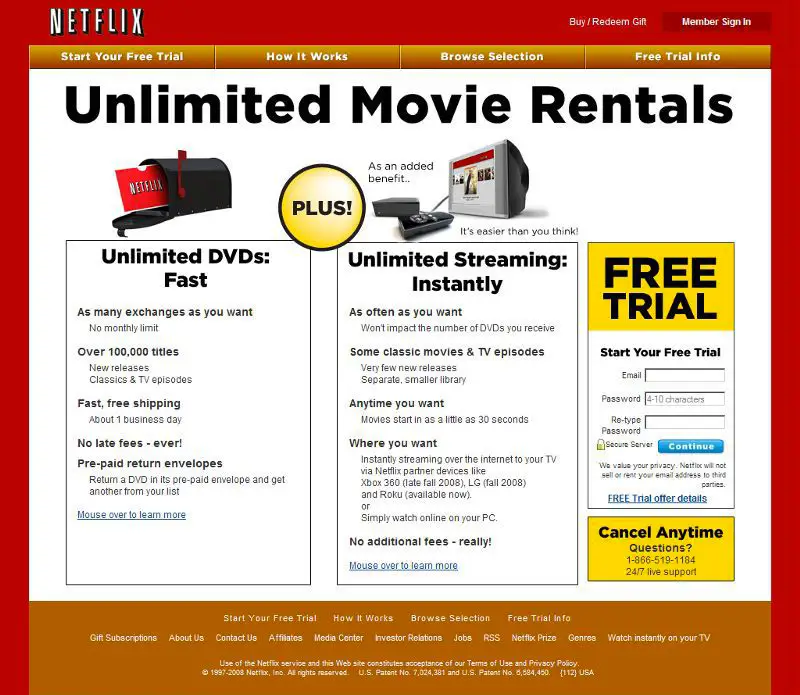

The implication of stagnating growth and high customer attrition rates means that alarm companies are increasingly under pressure to grow through acquisition to gain economies of scale and consolidate sales and marketing spend to mitigate attrition replacement costs. While this strategy can be effective for the largest players, to use an analogy, it is in essence a race to the top to see who can be the most dominant VHS rental chain when over-the-top (OTT) streaming is around the corner.

Most monitoring centers are running the wrong race. They’re fighting with each other to be Blockbuster when they should be trying to be Netflix, Hulu and SlingTV.

The ironic thing is that monitoring center executives mostly understand that video is the future, in a way that Blockbuster and family video executives didn’t necessarily recognize at the time. But they are moving far too slowly.

Imagine if Chairman of the Board Reed Hastings waited for Netflix to have thousands of titles and 1080p streaming before launching their streaming service? It would have been way too late. Another company would have already beaten him to the punch, and built up their customer base and brand loyalty, along with the requisite war chest for content licensing and creation efforts.

Netflix won because they were decisive and unafraid to release an imperfect product. In the process, they were able to collect customer feedback and continue iterating on their product to build something that deeply resonated with consumers.

Even in remote video monitoring, the largest players today are the ones who are unencumbered by the risk aversion of their alarm business and bet big on video. Players such as Stealth Monitoring, Pro-Vigil, EyeQ Monitoring, and Eyeforce Remote Guarding have built up highly profitable, low churn, high growth businesses because of their willingness to act decisively.

So, if an alarm monitoring center wants to invest in video, what are some of the things they should emphasize? Here are a few points to consider that address ability to scale, team engagement, autonomy, choosing technologies and measuring data:

Start small, but iterate quickly — Start by offering highly discounted rates and onboarding a small handful of customers. Your objective here isn’t to make money, it’s to collect customer feedback, figure out what works and what doesn’t, and build out processes that support the ability to scale. Offer a set of services, but don’t try to do just anything for anyone.

The ironic thing is that monitoring center executives mostly understand that video is the future, in a way that Blockbuster and family video executives didn’t necessarily recognize at the time. But they are moving far too slowly.

You will make mistakes and you will disappoint customers, but because your operation is small, it won’t be meaningfully detrimental to your reputation. You’ll rapidly learn lessons in the process and iron out the kinks while building towards a video monitoring solution that is reliable, scalable and repeatable.

Engage, train your team and collect feedback — Get everyone internally on board and excited about it, from sales to operators and every touchpoint in between. Conduct comprehensive training programs for monitoring center operators, technicians and your sales team. Ensure they understand the technical aspects of video monitoring, including camera setup, video analytics and system troubleshooting.

Education is important to avoid overselling the capabilities of your system as well as managing customer expectations. Communicate regularly with your team and your customers to see what is/isn't working for you/them.

Segregate video monitoring and give them autonomy — The process of managing a video monitoring business is substantially different from alarm monitoring. Your customers are different, their expectations are different, the processes are different and the technology is most certainly different.

You want a hungry, tech-savvy leader who is eager to build a business from scratch and give them the creative and execution autonomy that is unencumbered by traditional alarm monitoring thinking.

One of the biggest reasons why France was rapidly defeated by the Germans in World War II is because French commanders had to wait for orders from Paris, and by the time they received orders, the intelligence the orders were based on were already long outdated, unable to keep up with rapid German Blitzkrieg advances. Give your video monitoring department execution autonomy. Don’t be like the French High Command in Paris.

Start with the technologies that others are successfully deploying — You really don’t need to “boil the ocean” in evaluating technologies that work well for video monitoring operations. For video alarm management, there’s one company that has probably around 90 percent market share in North America, and for cloud-based AI filtering, there are maybe two or three companies that have received a meaningful amount of venture capital funding and receive positive reviews from their customers.

Test them and go with a provider that can help you get off the ground. There’s no need to test dozens of solutions to figure out which ones work best. The overwhelming majority of them aren’t worth your time, and every minute you don’t get started is a minute where someone else is taking market share.

Measure your KPIs and make data-driven decisions — Video monitoring is a numbers game. The companies who run the most efficient operations are going to come out on top, especially if you’re adopting the dealer distribution model where you’re not directly responsible for sales and marketing efforts.

Here are some key performance indicators (KPIs) that you need to keep an eye on and the financial implications of these metrics:

- Missed alert rate (per 1000 cameras / month): Video monitoring operations are built on computer vision technology, which is still an imperfect science. Just like ChatGPT will sometimes give an answer with bogus sources, computer vision models will sometimes inexplicably miss an event that a human might otherwise catch. You want to make sure that you’ve done everything possible to minimize this risk and keep missed detections to a minimum. You want to select an AI vendor who has a reputation for reliable service and is willing to take accountability and make adjustments in the event of missed detections.

- Financial implication: Customer attrition. Lower missed detection → decreased risk of churn.

- False Alarm Rate (Per X cameras / Y time): A video monitoring operation’s costs are directly correlated to the time that operators expend in processing each alarm. A high number of false alarms can quickly turn a video monitoring business unprofitable, but it’s also a delicate balance because companies who index too heavily on false positive reduction can end up increasing the risk of missing alarms (thus, increasing risk of customer churn).

An AI partner that is industry-leading in both false alarm reduction and missed detection rate will help mitigate this risk. False alarm rates will be pretty easy to measure in the pilot process, but missed detection rates can be hard to determine until a deployment at scale. An AI partner’s reputation within the industry will be able to tell the other side of the story, so ask around.

- Financial Implication: Gross margins. Lower false alarms → higher gross margins

- Alarm Processing Times: After the AI model registers a detection, the human reaction after that is pivotal to deter a crime or lead to an arrest. Alarm processing times therefore should be measured, so that the risk of an unsuccessful crime deterrence after a successful detection is minimized.

- Financial Implication: Customer attrition. Faster response → lower attrition

Ultimately, if an alarm monitoring center is looking for a “how to execute in video” playbook, such a playbook doesn’t exist. To the extent that it does, they are internal processes that have been developed through trial and error by incumbent video monitoring companies that are held very close to the vest as trade secrets.

That leaves alarm companies with only a single remaining option if they wish to get into video: Just do it.

AUTHORS:

Steven Walker (left) is Vice President of Monitoring Operations - North America for Securitas Technology. Wes Usie (right) is President of CHeKT Professional Visual Monitoring, and Founder and CEO of Guardian Alarm Systems. Both Walker and Usie are chairs of The Monitoring Association (TMA) Surveillance & Video Verification Committee.