SDM 2018 Security Industry Forecast: Moving Into High Gear

Results of the 2018 SDM Security Industry Forecast Study show that total industry revenue rose 8.5 percent last year, boosted by a thriving economy and high consumer and business confidence.

Last year was good, but 2018 could be great, say security integrators and security dealers who participated in the 2018 SDM Industry Forecast Study and Panel, a report that SDM has published annually since 1982.

The economy is roaring. The Conference Board announced in late November that consumer confidence had reached a 17-year high. Business confidence also is elevated. Core business spending rose 3 percent to 4 percent in 2017 and the same or better is expected in 2018, declares Kiplinger’s November 22 economic forecast, “Business Investment Slowly Gains Strength.”

The same publisher’s December 4 report, “Tight Inventory Spurs Prices,” says total housing starts will average 1.27 million units in 2018, a 5.6 percent increase from 2017. Single-family starts will climb 8.2 percent — all great news to security dealers like Tommy Smith, president/owner of KMT Systems Inc., Atlanta, which prewired 1,800 homes last year for more than eight different builders. “In Atlanta, the new construction market is back almost as strong as it was pre-2008,” Smith says.

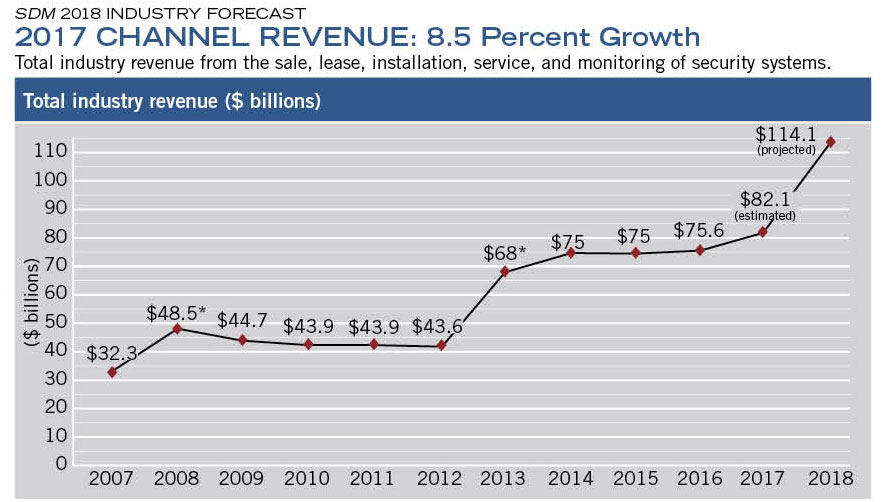

Many measures, but not all, are back to pre-2008 levels. While pre-recession industry growth rates were in the double-digits, since then the industry’s performance has been up and down. However, 2017 yielded a very healthy 8.5 percent increase in the industry’s total annual revenue, which went from $75.6 billion to $82.1 billion. (See related chart on page 44.) This revenue estimate, prepared for the SDM Industry Forecast Study by BNP Market Research, is calculated across SDM’s entire circulation database. It measures revenue from the sale, lease, installation, service and monitoring of security systems, including alarms, access control, video surveillance, life safety, connected-home and related low-voltage systems.

Among just the study’s respondents, 63 percent indicated that they expected total annual revenue to rise in 2017 (the survey was fielded in early-October 2017 so they had to estimate Q4), by an average of 15 percent higher. Among the same group of respondents, 69 percent expect to see their revenue rise in 2018, by an average of 22 percent higher.

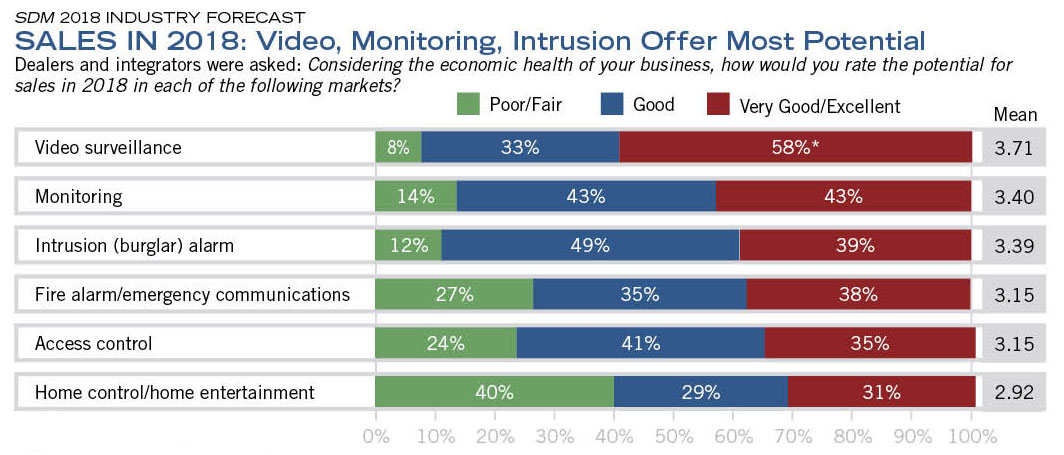

What will drive revenue increases in 2018? According to the study’s results, video surveillance is expected to have the highest sales potential, followed by monitoring. (See related chart on page 48.) The SDM Industry Forecast Study panelists concur with that. “I anticipate our greatest growth is going to be in our camera division, which is primarily monitored cameras; but we also do some high-end, standalone [un-monitored] cameras,” describes Susan Weinstein, vice president, Keyth Technologies, Highland Park, Ill. “We do have recurring attached to those because we also internally monitor the health and the functionality of the cameras.”

In Keyth Technologies’ market, which covers the Chicago metropolitan area, crime is a driving factor that will influence sales, particularly in the city of Chicago, Weinstein says. However, she cites economic conditions as the primary factor driving sales. “With our high-end residential client base, if the economic conditions are strong … they are just really willing to spend and to spend on security,” she notes.

The other panelists cite capital spending by businesses as their top factor to drive 2018 sales. “People are turning loose some money now where they hadn’t been in the last few years for businesses,” says Ray Cherry, vice president of sales at Dallas Security Systems, Dallas, a company that is about 95 percent commercial.

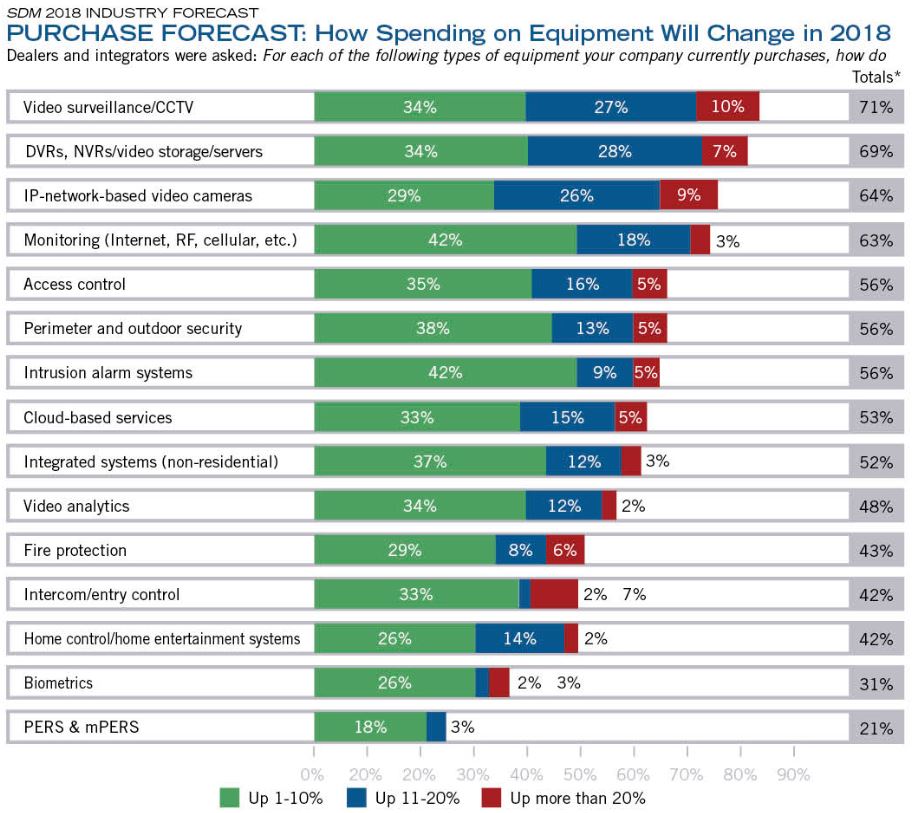

SDM Industry Forecast Study respondents were asked how they expect their level of spending on various types of equipment or services to change in 2018 compared with 2017. More than any other category, video surveillance topped the list of equipment on which security dealers and security integrators will increase their spending this year. Also notable is that 53 percent of respondents anticipate spending more on cloud-based services; this is up 4 percentage points from last year — evidence that sales of these types of services are indeed growing.

In general, security as a service — including monitoring — is helping the channel companies grow their recurring monthly revenue (RMR) and annual revenue. Among the SDM Industry Forecast Study respondents, 66 percent indicate that they offer remote video monitoring, 50 percent offer managed access control, 43 percent offer cloud-based video surveillance as a service (VSaaS), and 33 percent offer cloud-based access control as a service (ACaaS). Asked in this year’s study for the first time, the results show that 23 percent of respondents offer cyber security services to their customers.

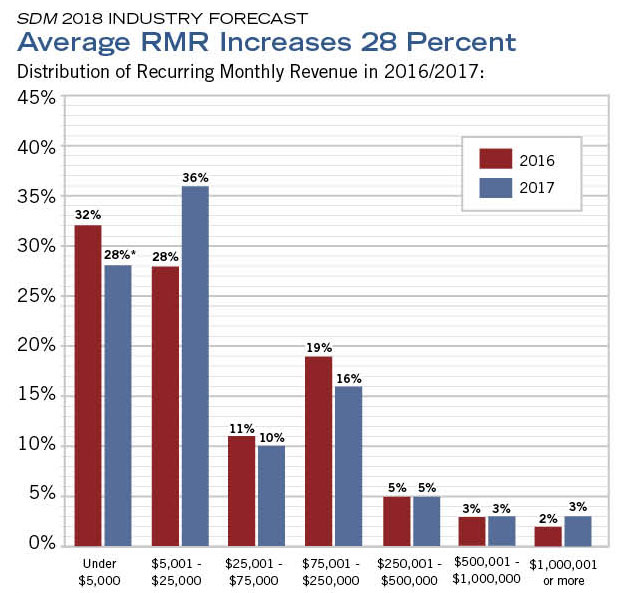

RMR will need to be watched this year. While some on the panel generally saw their RMR rise in 2017 from additional smart home products, interactive services, and video network monitoring services, fewer survey respondents increased their RMR in 2017 (72 percent compared with 83 percent last year). However, average RMR among survey respondents was still 28 percent higher. One in 10 survey respondents indicated that generating recurring revenue would be their biggest challenge in 2018.

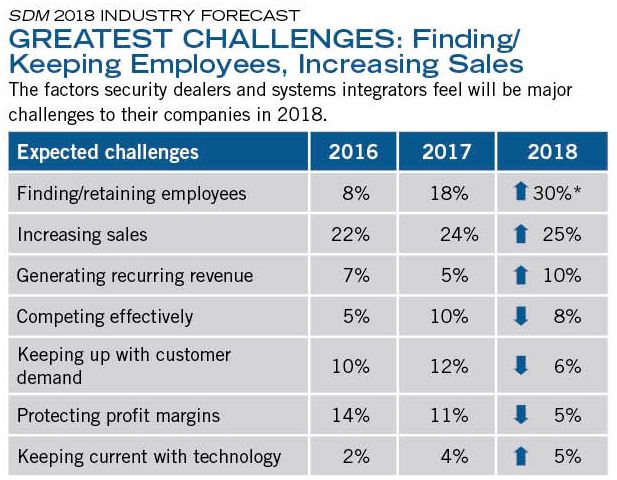

But the challenge that beat all was finding/retaining employees. Thirty percent of survey respondents selected this as their greatest challenge, up from 18 percent last year, putting it in the No. 1 spot for the first time since 2008. This may reflect the fact that all of the security dealers on the SDM Industry Forecast Study Panel indicated they are in an excellent sales period; further growth could be hindered by a lack of skilled workers.

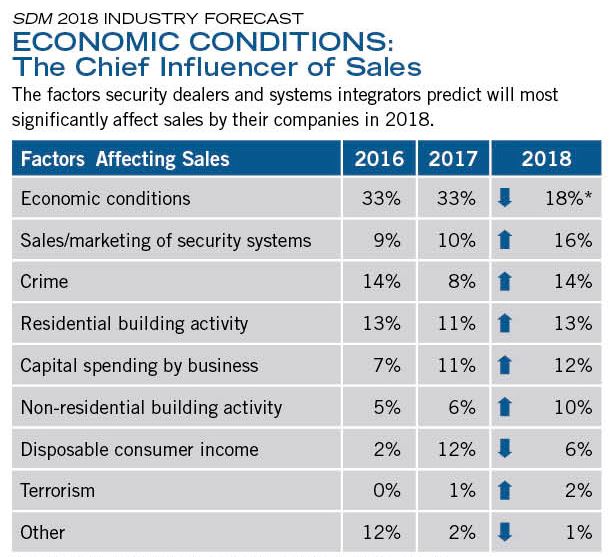

*percentage of dealers and integrators indicating each factor; 103 respondents

For at least the last decade, “economic conditions” has ranked as the top factor dealers and integrators think will significantly affect their sales. The factors in this list could have either a positive or a negative spin on sales. For example, the fact that in the current study, 18 percent of respondents selected economic conditions as their No. 1 factor affecting sales, compared with 33 percent the prior year, means respondents are expressing that as the economy has improved so have their sales.

In theory, many security dealers probably wished they had Steve Sopkin’s current challenge. “If you asked me today, it would be keeping up with customer demand. We’re about six weeks out right now for installations, and it’s tough keeping customers happy. That’s today,” says Sopkin, who is president of Mijac Alarm, Rancho Cucamonga, Calif., located approximately 40 miles east of Los Angeles.

“But I think over the next year there are just so many different options of where the industry is going and I think figuring out how to diversify my business in an intelligent manner without getting too spread out is going to be one of my greatest challenges, which directly relates to generating recurring revenue,” Sopkin says.

As he and the rest of the industry ponder how to position their businesses for 2018 and the coming years, there is reassurance in the fact that the economy is supporting their efforts for the foreseeable future.

*percentage of dealers and integrators rating each technology segment from Poor (1) to Excellent (5); 103 respondents

Dealers and integrators think video surveillance will be the most rewarding segment when it comes to producing sales in 2018. When asked to rate the potential for sales among various technology segments, they gave it an average rating of 3.71 out of 5. Following video surveillance were monitoring and intrusion (burglar) alarm — two segments where many changes also are underway in platforms and processes.

*percentage of dealers and integrators rating their spending in each technology segment from 1 to 7; 103 respondents

Dealers and integrators were asked to rate how their level of spending on equipment will change in 2018 compared with 2017. This table is based on a 7-point scale where 1/2 = down more than 10%; 3=down 1% to 10%; 4 = no change; 5 = up 1% to 10%; 6/7 = up more than 10%. This table shows only the “up” responses. The top five categoris with the most potential for growth in spending are video surveillance/CCTV; DVRs/NVRs/video storage/servers; IP network-based video cameras; monitoring; and access control.

The Industry Forecast Panel: 2018

SUSAN WEINSTEIN currently serves as vice president at Keyth Technologies in Highland Park, Ill. Keyth is a full-service alarm company providing custom security solutions throughout the entire Chicagoland area. Susan started with Keyth in 1986 and has held positions in customer relations, sales, and general management.

SUSAN WEINSTEIN currently serves as vice president at Keyth Technologies in Highland Park, Ill. Keyth is a full-service alarm company providing custom security solutions throughout the entire Chicagoland area. Susan started with Keyth in 1986 and has held positions in customer relations, sales, and general management. TOMMY SMITH is president/owner of KMT Systems Inc., a company he started 12 years ago. His experience and his passion for audio systems led him to obtain a low-voltage license and CEDIA certification. KMT Systems has become one of the leading companies in the residential new construction market in the Atlanta area. The company also operates a growing commercial business and received the Commercial Installation of the Year Award at Honeywell Connect 2016.

TOMMY SMITH is president/owner of KMT Systems Inc., a company he started 12 years ago. His experience and his passion for audio systems led him to obtain a low-voltage license and CEDIA certification. KMT Systems has become one of the leading companies in the residential new construction market in the Atlanta area. The company also operates a growing commercial business and received the Commercial Installation of the Year Award at Honeywell Connect 2016. STEVE SOPKIN is president of Mijac Alarm, based in Rancho Cucamonga, Calif., a third-generation family-run company that was founded in 1971. His experience includes becoming a subject matter expert for the state of California, helping to re-write the state’s exam for alarm technicians as well as sitting on the state’s board that reviews alarm company licensees that have been denied or pulled.

STEVE SOPKIN is president of Mijac Alarm, based in Rancho Cucamonga, Calif., a third-generation family-run company that was founded in 1971. His experience includes becoming a subject matter expert for the state of California, helping to re-write the state’s exam for alarm technicians as well as sitting on the state’s board that reviews alarm company licensees that have been denied or pulled. RAY CHERRY is vice president – sales, at Dallas, Texas-based Dallas Security Systems. He has served as president of the Dallas County Burglar & Fire Alarm Association (1989); vice president of the Texas Alarm Association (1992); and as a director and secretary of the National Burglar & Fire Alarm Association (1989-1995). He oversees all sales and marketing activities at Dallas Security Systems.

RAY CHERRY is vice president – sales, at Dallas, Texas-based Dallas Security Systems. He has served as president of the Dallas County Burglar & Fire Alarm Association (1989); vice president of the Texas Alarm Association (1992); and as a director and secretary of the National Burglar & Fire Alarm Association (1989-1995). He oversees all sales and marketing activities at Dallas Security Systems.

The Panel Weighs In on RMR

*percentage of dealers and integrators with RMR in each dollar range; 95 respondents

Among companies that generate recurring monthly revenue, 72 percent noted an increase in their RMR in 2017 over 2016. Average 2017 RMR was 28 percent higher than average 2016 RMR reported in the SDM Industry Forecast Study. This table shows the distribution of RMR in various dollar ranges, comparing 2017 with 2016.

SDM: Specifically looking at recurring monthlyrevenue (RMR), how do you expect your company’s 2017 RMR will have changed compared with 2016? And how do you expect 2018 RMR will change compared with 2017?

SUSAN WEINSTEIN: Our RMR is up about 12 percent this year, primarily because we had a rate increase. We don’t necessarily initiate an annual rate increase. We do it every three or four years, and only in certain categories of RMR. So maybe service plans would have a percentage increase one year, and then we would go maybe a couple years with no increase; and then increase the base monitoring for everybody, then take a little break. We also charge a little bit more monitoring fees for environmental devices such as carbon monoxide detectors, low-temperature sensors, and water detection sensors, so we might increase that a small amount.

So I don’t anticipate 2018 RMR having any major jump other than the increase of our account base just a small percentage, because this year we had our big rate increase.

TOMMY SMITH: This year we had about 35 percent increase in RMR. A lot of that has to do with bringing on some sales staff, adapting some of the product lines to the changing needs. The big factor for us was adding automation services; more and more people are asking for it, and that’s what’s increasing the bottom line.

In 2018, I expect [RMR growth] to be about 15 percent to 18 percent. We brought on an additional sales guy towards the end of the year. We expect with what they’re doing and the packages that we put together, we should see, again, about 15 percent next year.

STEVE SOPKIN: Our RMR has been pretty flat this year. I’m not so worried about it because our net profit has gone up so much. But in 2018 I see us adding an automation platform. And we’re also in negotiation to purchase another local security company with about $15,000 in RMR. So that will give us a boost towards growth.

In our area, we probably get 50 calls a month asking, “Can you beat zero?” Our residential market is kind of flat. So we’re going to add the whole automation platform with lights, locks, thermostats, etc., to see if we can’t gain a little bit more market share that way and serve the customer a little bit better.

RAY CHERRY: Our monitoring — it’s been pretty flat. It was up 3 percent. It’s a very stable base, but there’s not a whole lot of up or down on it. Now, we break out maintenance agreements separate from monitored systems, and maintenance agreements were up 7 percent, so people are catching on to doing that a little better now.

The sales we have are installs from that big increase, and much of them have montoring attached to them, but you know, you lose a few, then you gain. Hopefully you gain more than what you lose.

SDM: Are there more opportunities now in residential than there are for commercial in terms of monitoring unique things and adding on extra services to increase the monthly?

RAY CHERRY: Well, yeah. Everybody calls now about residential and asks about wireless cameras. And the ones we’ve tried, I hate to say — I don’t want to mention any names here.

SUSAN WEINSTEIN: They don’t work.

RAY CHERRY: They don’t work. I’ll tell you what. We put a nice alarm system with cameras in it for a fella that’s a prominent businessman here. We put the cameras in there and they didn’t work. I mean, we made it right — believe me — but, oh my gosh. I hadn’t wanted to look at a wireless camera in a house since, you know?

SUSAN WEINSTEIN: It’s one of the things that we looked at about five years ago, and realized that they don’t work. And therefore, they’re going to cause service drag. Because when they don’t work, my after-hours service technicians are going to need to respond to those calls. And we can’t charge for it, because it doesn’t work. My camera division does a lot of work in the city, in the residential neighborhoods. And we sell high-end, expensive cameras. RAY CHERRY: You all run cable to them, I’m sure, don’t you?

SUSAN WEINSTEIN: Absolutely, yeah. They’re not wireless.

SDM: Are you referring to the wireless technology failing or the quality of the image, or both?

SUSAN WEINSTEIN: Both.

The Panel Weighs In on Total Annual Revenue

*methodology changes.

The total size of the security installation channel in 2017 was $82.1 billion, an increase of 8.5 percent from 2016’s measure of $75.6 billion. This estimate is calculated across SDM’s entire circulation database, which is why it doesn’t necessarily reflect other results of the SDM Industry Forecast Study, which is conducted using a random sample methodology.

SDM: How do you expect your company’s 2017 overall revenues will have changed compared with 2016? And how do you expect 2018 overall revenues will change compared with 2017?

Susan Weinstein: We’re already up about 6 percent this year over last year, which is great because last year we were up 11 percent over the year before. It was our biggest growth year ever. I anticipate, based on what we have in the pipeline now, and where we were at this time last year, that we will probably be up 5 percent to 6 percent again next year, unless something dramatic occurs.

The type of installations we do are primarily high-end custom residential; we’re only about 20 percent light commercial. Consumer confidence is really, really important in our market — and consumer confidence is up. We find that our customers are really relatively eager to sign a contract and move forward with an installation. Whereas a couple of years ago they spent more time getting competitive quotes or pondering how they wanted to spend their money and where they wanted to put it.

Tommy Smith: We’ve been growing, I would say, beyond measure for the last few years. In 2017 we’re up about 13 percent over 2016. The big part of what makes us kind of unique — I know there are other companies that do it — is we have a very large builder base. Our company is divided into three divisions: new construction residential, residential sales and installation, and commercial.

Commercial is where we’ve really spent a lot of focus. We increased our commercial in 2017 about 25 percent versus 2016; with an overall growth (average among the three divisions) of about 13 percent in 2017.

We’re still expecting 13 percent to 15 percent in 2018, with the staff that we’ve hired.

Steve Sopkin: We expect our best year ever for overall sales growth. Our public works division doing county, city, and school work has done really well this past year. We have probably a 10 percent overall increase in gross sales.

But the interesting thing is that we’ve really only focused on our service division and our expenses. Even though we’ve grown 10 percent in gross sales, we have a net profit gain of probably over 20 percent. So we’re on track. We’re doing really well.

Ray Cherry: We’re probably 95 percent commercial. We still have a nice residential base that has been with us for a long time. As you know, Dallas is where a bunch of the free installs started, and it’s never stopped here. So residential is kind of tough here, you know?

Our fiscal year ends in June. But as far as a calendar year comparing our outright sales, they’re way up. Outright sales are up 26 percent this year over 2016. I think for a lot of businesses there’s more capital spending going on, and the economic conditions are good here, too. It’s just been a great year.

I don’t see it slowing down, really. The phone will probably stop ringing here in the next few days for the holidays. But the guys are putting out nice, big bids right now that we should have a real good shot at getting. I think as long as the economy holds up it’ll be another good one in 2018.

The Panel Weighs In on Factors Affecting Sales

*percentage of dealers and integrators indicating each factor; factors that received less than 5 percent response (including “controlling costs,” “inability/difficulty to obtain credit,” “training employees” and “diversifying my business”) are not shown; 103 respondents

“Finding/retaining employees” is the No. 1 challenge faced by dealers and integrators as they look out over the business landscape of 2018. Thirty percent of survey respondents selected this answer, up from 18 percent last year, putting it in the No. 1 spot for the first time since 2008 during the start of the Great Recession. This may reflect the fact that all of the dealers on the SDM Industry Forecast Panel indicated they are in an excellent sales period; further growth could be hindered by a lack of skilled workers.

SDM: What is the one factor you feel will have the most impact on sales of security systems by your company in 2018?

Susan Weinstein: My one answer is economic conditions, for my market. Again, we follow consumer spending trends. So with our high-end residential client base, if the economic conditions are strong — they’re tearing down homes, they’re building new ones; they’re putting additions on their homes — they are just really willing to spend and to spend on security.

And in the Chicago market the second thing we look at is crime, because that affects our camera division more so than consumer confidence does.

Tommy Smith: Actually, because we’re so tied to new construction — like Ray said, the commercial growth and capital spending is so much higher than it was a couple of years ago — for us I would say residential building and capital spending are two that I would highlight.

Steve Sopkin: I would probably say economic conditions; and I hate to bring up President Trump, but I do think that the overall confidence in the economy across the board for us has been really great. I’m a pretty staunch Republican. I don’t appreciate Trump in any way, but everything that he’s put into place is really driving the economy forward. I see new homes in the area, new buildings in the area, which creates a larger tax base for the cities to grow. And we do a lot of public sector stuff with prevailing wage, and that’s all a trickle down from the very top. So, economic conditions — 100 percent.

Also sales and marketing of security, a little bit. Crime, a little bit. But we just see a really, really strong growth here in Southern California.

Ray Cherry: They’re definitely the top two, but I believe I’d go with capital spending by business, just barely ahead of economic conditions. People are turning loose some money now where they hadn’t been in the last few years for businesses.

SDM: Specifically looking at recurring monthly revenue (RMR), how do you expect your company’s 2017 RMR will have changed compared with 2016? And how do you expect 2018 RMR will change compared with 2017?

Susan Weinstein: Our RMR is up about 12 percent this year, primarily because we had a rate increase. We don’t necessarily initiate an annual rate increase. We do it every three or four years, and only in certain categories of RMR. So maybe service plans would have a percentage increase one year, and then we would go maybe a couple years with no increase; and then increase the base monitoring for everybody, then take a little break. We also charge a little bit more monitoring fees for environmental devices such as carbon monoxide detectors, low-temperature sensors, and water detection sensors, so we might increase that a small amount.

So I don’t anticipate 2018 RMR having any major jump other than the increase of our account base just a small percentage, because this year we had our big rate increase.

Tommy Smith: This year we had about 35 percent increase in RMR. A lot of that has to do with bringing on some sales staff, adapting some of the product lines to the changing needs. The big factor for us was adding automation services; more and more people are asking for it, and that’s what’s increasing the bottom line.

In 2018, I expect [RMR growth] to be about 15 percent to 18 percent. We brought on an additional sales guy towards the end of the year. We expect with what they’re doing and the packages that we put together, we should see, again, about 15 percent next year.

Steve Sopkin: Our RMR has been pretty flat this year. I’m not so worried about it because our net profit has gone up so much. But in 2018 I see us adding an automation platform. And we’re also in negotiation to purchase another local security company with about $15,000 in RMR. So that will give us a boost towards growth.

In our area, we probably get 50 calls a month asking, “Can you beat zero?” Our residential market is kind of flat. So we’re going to add the whole automation platform with lights, locks, thermostats, etc., to see if we can’t gain a little bit more market share that way and serve the customer a little bit better.

Ray Cherry: Our monitoring — it’s been pretty flat. It was up 3 percent. It’s a very stable base, but there’s not a whole lot of up or down on it. Now, we break out maintenance agreements separate from monitored systems, and maintenance agreements were up 7 percent, so people are catching on to doing that a little better now.

The sales we have are installs from that big increase, and much of them have montoring attached to them, but you know, you lose a few, then you gain. Hopefully you gain more than what you lose.

SDM: Are there more opportunities now in residential than there are for commercial in terms of monitoring unique things and adding on extra services to increase the monthly?

Ray Cherry: Well, yeah. Everybody calls now about residential and asks about wireless cameras. And the ones we’ve tried, I hate to say — I don’t want to mention any names here.

Susan Weinstein: They don’t work.

Ray Cherry: They don’t work. I’ll tell you what. We put a nice alarm system with cameras in it for a fella that’s a prominent businessman here. We put the cameras in there and they didn’t work. I mean, we made it right — believe me — but, oh my gosh. I hadn’t wanted to look at a wireless camera in a house since, you know?

Susan Weinstein: It’s one of the things that we looked at about five years ago, and realized that they don’t work. And therefore, they’re going to cause service drag. Because when they don’t work, my after-hours service technicians are going to need to respond to those calls. And we can’t charge for it, because it doesn’t work.

My camera division does a lot of work in the city, in the residential neighborhoods. And we sell high-end, expensive cameras.

Ray Cherry: You all run cable to them, I’m sure, don’t you?

Susan Weinstein: Absolutely, yeah. They’re not wireless.

SDM: Are you referring to the wireless technology failing or the quality of the image, or both?

Susan Weinstein: Both.

The Panel Weighs in on What Keeps Them up at Night

SDM: What is the one factor you think will present the biggest challenge to your company in 2018?

Susan Weinstein: Well, I’m going to start with my old stand-by, which is finding and training employees. We can never find enough technicians.

We hire them young and we hire everybody that walks in who’s qualified to be hired. All they need is attitude and aptitude. No skills. I’d rather have no skills.

Steve Sopkin: No skills.

Tommy Smith: I would tend to agree with that. It’s very tough, and honestly, we’d like to hire people that don’t have any skill set in this field because they usually think they know everything, and then they do it different than we want it.

We’re always recruiting. We’ve got Lincoln Technical College here; we’ve got a relationship with them and a couple other schools. We’re always recruiting because part of our business — the builder business — the guys don’t really like to do. The residential installation, it’s the tougher work, I would say. Pulling wire and that kind of thing is where we have a hard time finding guys. The commercial [jobs], they’ve been with us; they don’t leave.

Number two would be protecting profit margins. With the market that we’re in, so many companies are giving away equipment. It’s hard to protect that margin when you’re having to do things for zeroes. We try not to do those deals, but sometimes we just have to; it’s about building RMR.

Steve Sopkin: If you asked me today, it would be keeping up with customer demand. We’re about six weeks out right now for installations, and it’s tough keeping customers happy. That’s today.

But I think over the next year there are just so many different options of where the industry is going and I think figuring out how to diversify my business in an intelligent manner without getting too spread out is going to be one of my greatest challenges, which directly relates to generating recurring revenue.

Ray Cherry: I’m going to go with keeping current with technology. The way these manufacturers change the software, it’s just a scramble to keep your techs up-to-date on everything they’re doing. The big camera manufacturers, they’ll come in and make something an end-of-life of product, and then you’ve got to upgrade everything. It’s quite a deal to keep up with.

The Panel Weighs in on Competition

*percentage of dealers and integrators indicating each choice, 103 respondents

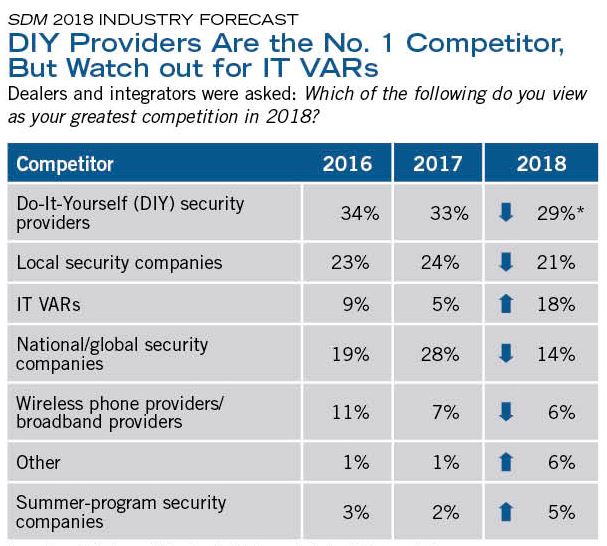

For the third consecutive year, SDM's Industry Forecast Study respondents selected DIY security providers as their foremost group of competitors. Local security companies are always a formidable competitor, but the category to watch this year is IT companies: 18 percent of respondents selectetd them as their greatest competition, up from 5 percent last year.

SDM: Which type of company do you view as your greatest competition in 2018 and why?

Susan Weinstein: Our true competition is local security companies and security integrators. Our perceived-by-our-customers competition is either do-it-yourself or wireless phone providers, or broadband providers. The most calls that we get regarding competitors in our space is always my cable company, my phone provider will do it for this much. They really aren’t our competitors in the end because those providers can’t service our customers.

But that takes an education, and sometimes they will cancel services with us — and they’re back within a year. But they will still try to make that breach into the broadband providers.

Tommy Smith: There’s a lot [of competition] in Atlanta. But honestly, this is kind of a toss-up between the local security and the national, because in Atlanta, all the locals are having to adapt to what the national companies are doing, unfortunately. I can name one after another; so many of them give so much equipment away. And I was stating with RMR growth; a lot of it has to do with automation.

The reason I say that’s one of the bigger problems is because I felt like we had an opportunity in the industry to change the industry where you didn’t have to give equipment away when the automation started making its way into the market. And some of these companies already have taken that approach, which has ruined the opportunity to make money up front.

So in Atlanta, all the ads from your wireless providers, your national companies, and now even your local companies are all saying the same thing: “Get automation, we’ll give you security.” They’re giving away all the automation equipment as well.

Steve Sopkin: I think for our commercial division, it’s probably local security companies and systems integrators. We’re about an hour outside of Los Angeles so it’s really local competition. For residential, it’s more the national companies that are doing the race to zero that we are in competition with for our residential client base.

For the most part, we are more of a high-line company, and our average age of a customer is probably 45 to 65. The under-45 market for us is rapidly going away. I think that anybody under 30 will never have somebody else do their own alarm system. These systems are becoming easier and easier to put in themselves. And they’re a little bit more tech-savvy, so I don’t foresee a future for residential alarm systems. It’s just going to be a really, really small section as time goes on.

Residential cameras have now been overshadowded. Where we would sell a $5,000 residential camera system, now people are putting in a Ring for $200. So, you know, things change. It may not be exactly the same setup, or the best level of security, but it is close enough for a lot of customers that I think that they are satisfied at some point.

SDM: What about monitoring? Do you think that they’re going to be satisfied with “monitor it yourself”? Or do you think that there will still be a need for professional monitoring, either on a full-time basis or an as-needed basis?

Steve Sopkin: I think it goes both ways. But I do see a problem with more and more police departments up in arms, and false alarm fines, etc. One of the alarm systems I just saw this past week on Indiegogo sends a text to you and 10 people in your neighborhood. So if your whole neighborhood put in this $10 motion sensor in their house and then [it activated], the app sends a text to all 10 of you in the neighborhood and everybody can look out. It’s brilliant. I think it’s a smashing idea; I wish I had thought of it.

I do see things changing more rapidly today than ever before for electronics. To be honest with you, I can’t tell if it’s my age or it’s actually this tidal wave where the electronics industry has finally gotten to a point where they’ve figured it out for manufacturing to make it smaller, cheaper, more reliable, etc. Before, you needed a technical person with 15 years’ experience to put this camera in. Today, you plug it in, you do the QR code on your phone, then you downloaded an app, and boom, you’ve got a camera. It’s changing. You’ve got to be smart enough to change [with] it, and figure out where your core market is, and where you’re making your money, where your expenses are going — and that’s what we’ve really, really concentrated on this past year.

Ray Cherry: I’m going off just a little bit here: it’s the IT value-added resellers. In this business, you knew who all your competitors were, and you actually knew who you were dealing with and all that. But now, these companies get out there and they’ll run all the cable for a business, and they may or may not be licensed with the state like they’re supposed to be, and they’ve got the business before you ever have a chance at it. That’s something you’ve got to really watch on the commercial side here. They’ll have a great-looking website, and can do security. In Texas you’ve got to have a license, but they skirt it and then by the time you report them they’ve already got it and they’re gone.

And they’re not paying the insurance and doing all the CEU credits and all that like we do. But they get in there and they’re gone, and that’s what we’ve really got to watch for.

Susan Weinstein: We find it helpful to notify our customers of that risk — because they don’t know and they don’t understand. That’s one of the things that we will put in our newsletter periodically.

Ray Cherry: Yeah, you can go online and see if they are licensed.

The Panel Weighs in on Productive Market Sectors

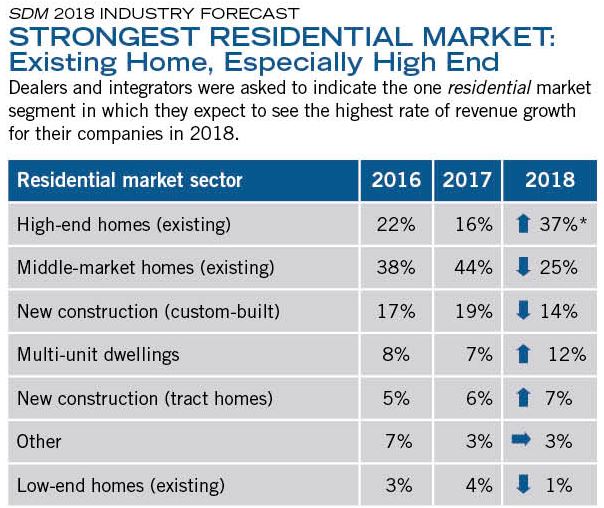

*percentage of dealers and integrators indicating each market; 77 respondents

The results of SDM's 2018 Industry Forecast Study show that 62 percent of dealers and integrators look to existing homes for their residential sales. However, more than 20 percent of companies rely on new construction. There are approximately 126 million households in the U.S.

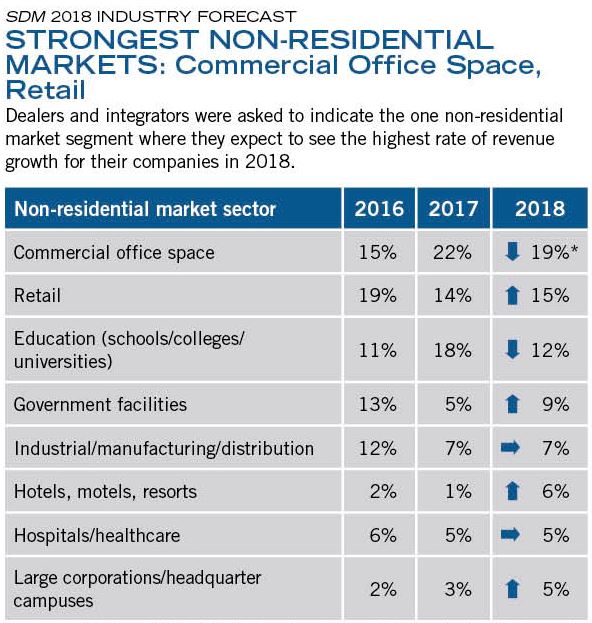

*percentage of dealers and integrators indicating each market, markets that received less than 5 percent response in the 2018 study are not shown; 77 respondents

The integrator channel expects its top three most fruitful segments in 2018 to be commercial office space, retail, and education. These are the same top three as last year; however, retail moved up from the No. 3 spot to No. 2, replacing education. Making the vertical market list for the first time is the category of “hotels, motels and resorts.”

SDM: What market sectors do you expect to have the most success with in 2018? Where do you see the growth coming from?

Susan Weinstein: I anticipate our greatest growth is going to be in our camera division, which is primarily monitored cameras; but we also do some high-end, standalone (just record). We do have recurring attached to those because we also internally monitor the health of the camera and the functionality of the cameras. So that’s going to be, I’m certain, our greatest area of growth in the Chicago market.

And then within that area of growth, I believe it’s going to be the city of Chicago. We’re getting a little bit of crime in the suburbs, which is where our primary office is and most of our business. But there is so much crime, especially with the high-end residential homes — in the Lincoln Park area, the Gold Coast area [of Chicago] — where the homeowners have detached garages and need to be able to safely come down the alley, pull into the garage, exit their vehicle, and get into their home.

I really feel that regardless of what happens in my market, crime is increasing in Chicago and police presence is decreasing.

I don’t want to say everybody has a burglar alarm, but my customers — a lot of them have security detail — so this is just another tier. This is something that we talk about with them: Where are the security tiers around their home? Maybe it starts with a wrought iron fence and then some bushes, and on and on and on. So every time one of those layers is penetrated, the homeowner has the opportunity for early warning that there’s somebody out there who has bad intentions. We have customers now that are going as far as to have cameras installed that monitor the sidewalks around their house.

So that’s going to be our greatest area of growth.

Tommy Smith: I would say, going back to what we talked about earlier with the economic activity in the commercial market, video and access are probably the two primary products with the video being monitored. There are several different services out there that do that.

And then in residential, because of how much new construction we do, we get about — this year — 1,800 homes with some type of wiring. We wire all of them for some national builders. That’s really helped us. Because we’re in there wiring their homes — their cables, their data jacks, or whatever they’re wanting. And that’s when we can get them the security deals as well.

How many different builders do you work with?

Tommy Smith: We’ve got about eight primary ones, and then some smaller [builders] that do custom and so forth.

In Atlanta, the new construction market is back almost as strong as it was pre-2008. Again, we’ve gone from 1,200 houses one year, to 1,500 the next, to 1,800 this year total. We probably service 70 or so communities throughout metro Atlanta.

We’re pre-wiring the services all the way down to the cable jacks. Any other low-voltage services that the builder includes in the houses are sold as options.

SDM: What percentage are you converting?

Tommy Smith: Most of them, we’re not doing security. Out of the houses we do, about 25 percent we sell security to right now. We don’t actually meet with the clients, seeing as they chose not to buy at the design center; they carried on with the service they had. And that’s why we’ve increased sales staff for next year to focus on that 75 percent that we’re not capturing.

Steve Sopkin: Our residential side is more the home automation. We’re going to give that a shot. For the second [market] our commercial is really the public sector with city and county work, public schools, all prevailing-wage applications. All of the cities locally here in Southern California are putting more money into it. They have more money because of houses being built, etc. That’s where we’re going.

Ray Cherry: I hate to say this, but what I’m getting a lot of calls on is churches needing better security. I hate to throw that out there with what’s been going on, but we’ve gotten some calls and they’re serious about it. They’re coming up with the money from the congregation to put in what they need to have done.

They’re locking the doors — you know, access control. Almost always in a church you’ve got to put crash bars where they can get right out. Then, they’re heavy with both access and cameras. Of course, y’all know it can be much harder to run wire in a church.

Susan Weinstein: We’ve seen that as well, at some of the local temples here.

You know, there’s Homeland Security money available for them.

Tommy Smith: We have had an extreme number of calls about it. We’ve done churches that have schools in them — we’ve added access control.

The Panel Weighs in on New Products & Services

SDM: What, if any, new revenue generating services or products did your company add in 2017?

Susan Weinstein: Ours would be within our camera division; and that would be our SolarWinds, where we monitor the health and the functionality of the cameras. [For example,] for cameras that are recording on a local level we can receive early notification when the cameras are not functioning properly. Otherwise, by the time the customer finds out there’s a problem, it’s after they’ve had some type of an incident.

That’s been good for us. It also takes me back to modifying my earlier statement when we talked about forecasting for RMR [in 2018]. But…if our camera division continues to grow at the rate we anticipate and then some, that will really greatly impact our recurring, because we charge recurring for everything we do, and the camera recurring is fairly substantial.

And then additionally we provide monitored cameras. And that’s a relatively hefty monthly fee.

Tommy Smith: Some of us [on the Industry Forecast Panel] are Honeywell houses, which we have always been. We have integrated using Alarm.com now, as well. Some of the other competitors in Atlanta also use Honeywell, so we wanted to have an alternative product line to combat that so that we don’t lose a sale just because we’re both selling the same thing.

We have incorporated more video monitoring services. I think that’s going to be a big future. Again, I think the DIYs and all these things are great, and I think there’s a market for it. But I truly believe that as much as people think they want to do it themselves, they realize after a little while, they don’t want to be at dinner and get that call and try to figure out what to do. So I strongly believe that there will always be a need for professional monitored systems.

And then the other thing we’re looking at is we’ve added several different maintenance agreements to our product lines as well.

SDM: When it comes to video monitoring, what are the different types of services that you offer?

Tommy Smith: It depends on what it is. For the construction industry, we use the Videofied product for video verification, which we were using before Honeywell purchased it. And the I-View Now product; we’ve got a few customers on that as well. It’s very similar; it just connects to a DVR instead of straight wireless technology. It sends you the video clips and all that. It’s actually being monitored by the central station, similar to Videofied, but it actually connects through the DVR.

Steve Sopkin: About the only thing we added was [a video doorbell product] and it was just a really big fail for us. It’s been tough and here’s the reason why: it depends on the customer’s Wi-Fi speed and connectivity and type of doorbell (electronic versus not). And it is a consumer product that they can buy off the shelf for $25 more than I can buy it for. I mean, we make $20 bucks on it. We’ve been back to almost every single client. I’ve given them money back for some of them. It’s just been tough. That’s been the only thing that we’ve tried.

Hey, would you like to buy some? I have a couple in stock.

Tommy Smith: I’m sorry to hear that, because we actually just got one of our builders to agree to put them in standard, but they don’t use any kind of digital doorbells.

Steve Sopkin: Yeah, it’s digital doorbell, but even more important it’s the speed of the Internet for the customer. And that’s where the expectation comes in because they want the camera to come up immediately. It doesn’t come up until the guy rings the doorbell, they get the notification, and they look at it. And they’re looking at it and looking at it, and finally they see the photo and the guy’s gone.

So then you’ve got to go back in the history. It doesn’t meet the customer expectation quite yet unless you ensure that all the other systems that you’ve tied to are 100 percent working for you.

Ray Cherry: I guess you could say we’ve taken on some more access and camera product lines without any trouble. We used to kind of just keep it to a few minimum, but we’ve opened it up and it’s really helped to generate more sales without any problems.

You’ve got to get more training in there for everybody, but it’s worked out okay.

We’ve always been a huge DSX dealer because of our relationship there. We still sell a ton of DSX, of course, but we’ve taken on other access control lines. You used to worry about getting all the techs trained on the different [systems]; but it hasn’t been a problem — and it’s helped sales quite a bit.

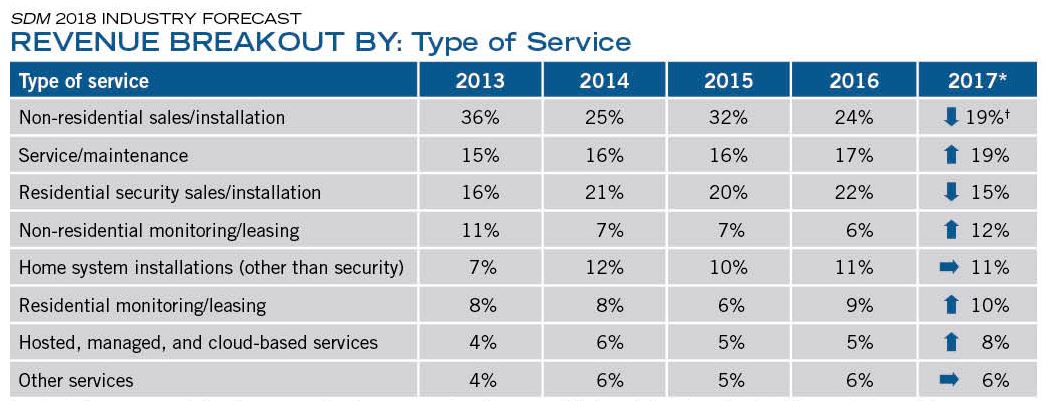

*year in which revenue was counted

†average percentage of revenue per service category among all dealers and integrators participating in the survey; 92 respondents

SDM’s Industry Forecast Survey tracks how dealers’ and integrators’ total revenue is distributed among types of services. Together, 34 percent of revenue comes from non-residential and residential sales/installation; however, this is down from 46 percent in 2016. The share of revenue from hosted/managed/cloud-based services is finally inching up, comprising an average of 8 percent of survey respondents’ revenue.

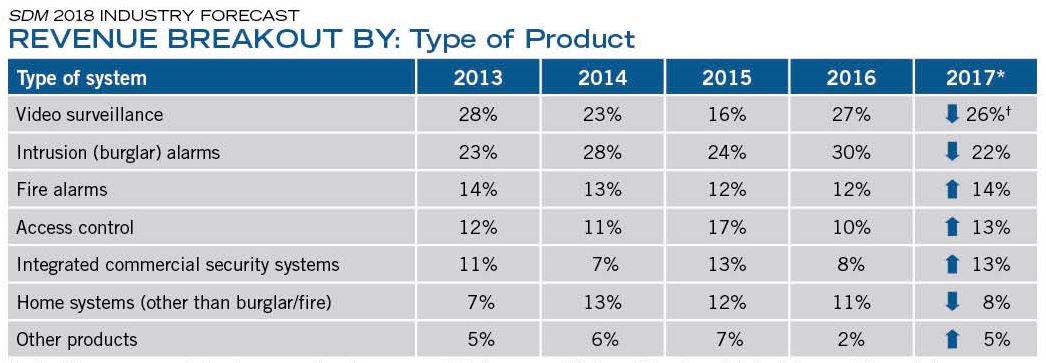

*year in which revenue was counted

†average percentage of revenue per product category among all dealers and integrators participating in the survey; 99 respondents

SDM’s Industry Forecast Survey tracks how dealers’ and integrators’ total revenue is distributed among types of products. The 2017 results show how the channel is strongly diversified in its product offerings, with video surveillance and intrusion alarms being the top two categories.