SDM 2018 Top Systems Integrators Report: A Security Transformation Is Underway

In the security systems integration industry, while factors such as a great economy and stimulation of buyers by continued security threats are contributing to growth, it’s the morphing of security technology into broader business applications that is starting to drive noticeable demand.

Security integrators are benefiting from vital technology innovations that are far greater than just simple upgrades. One is the continuing gradual shift among end users to cloud-based platforms, which continues to boost new sales. But a more significant transformation is the evolution of security systems into business intelligence solutions — and that is vastly changing the function that security integrators perform for their clients and creating new business opportunities for integrators.

The 2018 Top Systems Integrators Report proves this trend. The report ranks security integrator companies by their North American systems integration revenue, which includes solutions such as design, project management, product, installation, programming, start-up, and training sold directly to an end-user customer or through a tier of contractors. Total North American systems integration revenue — which is different from total annual gross revenue — reached $3.31 billion in 2017.

A comparison between the top 100 companies ranked this year and the top 100 ranked last year shows a 48 percent decrease in systems integration revenue. However, this is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in 2017 are not ranked in 2018, such as Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), and others. (See “Dashboard: Top Systems Integrators Totals” table 5 of 6, for greater detail on this). Among companies for which a year-to-year comparison could be made, security system integration revenue actually increased 10.9 percent in 2017 — a significant increase, although still three percentage points below 2016’s 14 percent growth.

“The market remained relatively consistent in all areas, but there was an obvious uptick in customers’ desire for an integrated security solutions model where technology integrates into other asset-protection related services. Physical and operational security situational awareness and harnessing the intelligence for predictive analysis is becoming a key expectation, as we have the ability to influence more of our clients’ portfolio,” describes Allied Universal Security Systems, ranked No. 11, of the business climate last year.

No. 26, Interface Security Systems Holdings Inc., emphasizes that “commercial customers, particularly larger national accounts, are focused on upgrading to new IP-based systems and adding video analytics and other business optimization solutions to their stores.”

No. 1-ranked Convergint Technologies also notes the transformation of security technology into business intelligence solutions. “The market for security systems sales and integrated systems continued its strong growth in 2017. Video sales continues to dominate as customers begin to look beyond traditional security applications and start looking at using video for the analytics they can provide, in order to evaluate their manufacturing, improve processes, meet regulatory compliance, and more,” the company describes.

While the most significant growth for Convergint Technologies came from the financial/banking and government sectors, the retail market was weak due to disruption “caused by Amazon and other online retailers … .” it and other security integrators found.

The top three market segments that provided the most significant sources of revenue in 2017 were: corporate office space, education, and healthcare. (See “Top 3 Sectors” table 6 of 6.) These were unchanged from 2016.

“Security systems sales and integrated system projects represent the primary focus for Red Hawk due to the market size and growth potential. We see the market as strong, especially in education, office buildings, hospitality, healthcare, sports venues and casinos,” notes Red Hawk Fire & Security, No. 4. Nearly half of the company’s sales revenue originates from commercial fire alarm work.

Other security integrators concur that the education market — and other segments that feature similar open access, such as houses of worship — are producing gainful opportunities.

“Market about the same, but very competitive. New growth verticals opportunities strong. We are finding success in a lot of markets such as churches, private educational facilities, and industrial segments. The ability to offer a verified solution has definitely helped us in a competitive market,” reports Sonitrol SW Ohio, No. 47.

“School security systems, such as lock-down systems and surveillance cameras, along with shooter detection systems, will be in high demand,” notes APL Access & Security Inc., No. 54 on the SDM Top Systems Integrators Report.

“The school shootings are creating a big demand for our products and services,” says No. 49-ranked 3Sixty Integrated.

“The construction market is the largest driver of our business. In addition, we are seeing that more money is being allocated in the education segment to lock down campuses,” observes RedRock Security & Cabling Inc., ranked No. 42.

“Mitigating active-shooter threats, standardizing and upgrading access control systems, and determining how IoT technology fits into their security portfolio are top-of-mind for many of our customers and will continue to drive our business growth in 2018,” describes Access Systems Integration, No. 36.

American Alarm & Communications, a company that also ranks on the SDM 100 Report of recurring monthly revenue businesses, points out that active-shooter threats don’t just impact the educational market. “Active-shooter threats are leading to state government wanting city-wide integrated security with cities and towns,” the company says. In addition, “legalization of marijuana in Massachusetts is providing opportunities for integrated security solutions at dispensaries.”

Most of the Top Systems Integrators describe vast opportunities for sales, due to many factors including the robust economy and state of new construction; continued security threats to people, property and assets; and the ability of security technology such as video analytics to morph into business intelligence solutions. All of this gears up the security integration industry for solid growth in 2018.

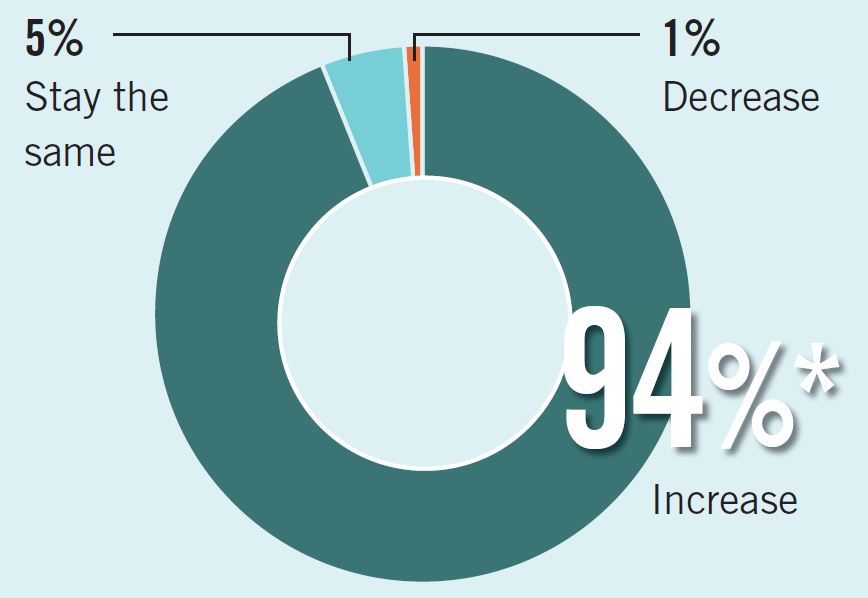

More than nine of 10 Top Systems Integrators (94 percent) expect their 2018 revenues to exceed 2017’s, which is even higher than the prior year’s 86 percent of security integrators who thought the same. The average expected revenue increase is 12 percent in 2018.

“We believe the security market is very strong and the evolving technology solutions the industry continues to make available to us makes that possible,” says No. 75-ranked Sonitrol of Sacramento & Orange County, Cybex Security Solutions.

The 2018 Top Systems Integrators Report

23rd Annual Report

View/Download this table as a PDF

| 2018 Rank |

2017 Rank |

Company & Headquarters Location | North American Systems Integration Revenue, 2017 | Number of New Projects, 2017 | Largest Project Size | Smallest Project Size | Top 3 Markets Contributing to Revenue | Full-time Employees | Business Locations |

| 1 | 2 | Convergint Technologies Schaumburg, Ill. |

$842,460,787 | 14840 | $8,700,000 | 2500 | corp, financial, govt | 2,622 | 89 |

| 2 | 3 | ADT Boca Raton, Fla. |

$286,000,000e | na | na | na | na | 18,000e | 200e |

| 3 | 4 | Securitas Electronic Security Uniontown, Ohio |

$270,000,000 | na | na | na | financial, commercial, corp | 1,200 | 350e |

| 4 | 7 | Red Hawk Fire & Security Boca Raton, Fla. |

$264,000,000 | 5934 | $2,200,000 | $1,000 | health, education, corp | 1,402 | 46 |

| 5 | 9 | Kastle Systems International Falls Church, Va. |

$100,000,000 | na | na | na | corp, financial, govt | 540 | 11 |

| 6 | 6 | Vector Security Inc. Warrendale, Pa. |

$99,780,268 | 5,855 | $577,000 | $99 | retail, corp, industrial | 1,198 | 32 |

| 7 | 8 | G4S Secure Integration Omaha, Neb. |

$99,209,000e | na | na | na | na | 550e | 15e |

| 8 | 10 | Securadyne Systems LLC Dallas, Texas |

$71,233,000 | na | na | na | na | 294 | 18 |

| 9 | 18 | Tech Systems Inc. Duluth, Ga. |

$58,046,000 | na | $2,000,000 | $1,000 | corp, health, financial | 294 | 2 |

| 10 | 12 | Unlimited Technology Inc. Chester Springs, Pa. |

$47,237,144 | 684 | $6,500,000 | $50 | utilities, industrial, health | 121 | 5 |

| 11 | 14 | Allied Universal Security Systems Santa Ana, Calif. |

$45,959,332 | 2,200 | $2,600,000 | $1,000 | health, corp, utilities | 280 | 12 |

| 12 | 50 | A3 Communications Inc. Irmo, S.C. |

$45,018,817 | 915 | $1,181,326 | $210 | education, govt, industrial | 136 | 6 |

| 13 | 16 | RFI Communications & Security Systems San Jose, Calif. |

$43,402,300 | 1,876 | $1,300,000 | $4,200 | corp, health, education | 192 | 4 |

| 14 | 25 | LVC Companies Inc. Minneapolis, Minn. |

$41,950,000 | 1,730 | $1,485,000 | $250 | govt, industrial, gaming | 209 | 8 |

| 15 | 15 | AFA Protective Systems Inc. Syosset, N.Y. |

$40,687,000 | 6,798 | $900,000 | $500 | retail, airports, corp | 396 | 16 |

| 16 | 13 | Securityhunter Inc. Baltimore, Md. | $40,456,370 | 119 | $3,137,026 | $6,699 | govt | 34 | 1 |

| 17 | Electric Guard Dog Columbia, S.C. |

$37,464,899 | 428 | na | na | transport, industrial | 128 | 1 | |

| 18 | 17 | Entech Sales and Service LLC Dallas, Texas |

$37,320,000 | 147 | $1,547,320 | $1,000 | health, education, telecommunications / datacenter | 273 | 6 |

| 19 | 23 | GSI Troy, Mich. |

$31,957,762 | 775 | $2,878,000 | $195 | industrial, utilities, entertainment | 110 | 3 |

| 20 | 22 | Security Corporation Novi, Mich. |

$29,819,818 | 1,460 | na | na | utilities, financial, education | 113 | 2 |

| 21 | 19 | Intertech Ci Pittsburgh, Pa. |

$28,535,388 | 772 | $723,441 | $1,884 | govt, education, oil/gas | 145 | 7 |

| 22 | 26 | Advanced Cabling Systems North Little Rock, Ark. |

$27,579,999 | 280 | $2,150,000 | $1,000 | corp, education, financial | 174 | 6 |

| 23 | 30 | Integrated Security Technologies Herndon, Va. |

$25,445,604 | 595 | $3,117,285 | $2,500 | govt, health, education | 101 | 3 |

| 24 | 24 | Security Integrations Albany, N.Y. |

$24,757,219 | 497 | $5,000,000 | $25,000 | correctional, utilities, industrial | 43 | 3 |

| 25 | 35 | Per Mar Security Services Davenport, Iowa |

$23,680,700 | 6,114 | $545,000 | $100 | education, health, retail | 360 | 18 |

| 26 | 40 | Interface Security Systems Holdings Inc. Earth City, Mo. |

$23,528,149 | 3,693 | $6,700,000 | $0 | retail, hotel, corp | 1,264 | 13 |

| 27 | 29 | Advanced Electronic Solutions College Point, N.Y. |

$23,159,400 | 132 | $6,100,000 | $32,400 | corp, airport, financial | 84 | 3 |

| 28 | 31 | Mountain Alarm Ogden, Utah |

$21,304,384 | 2,438 | $2,000,000 | $99 | education, govt, financial | 270 | 11 |

| 29 | 32 | MidCo Inc. Burr Ridge, Ill. |

$21,000,000 | 1,520 | $1,650,000 | $8,400 | corp, govt, entertainment | 105 | 3 |

| 30 | 38 | Minuteman Security Technologies Inc. Andover, Mass. |

$20,324,814 | 1,084 | $863,000 | $1,000 | corp, education, health | 81 | 9 |

| 31 | 45 | ACT Clifton, N.J. |

$19,874,224 | 367 | $3,045,000 | $11,000 | health, education, financial | 34 | 1 |

| 32 | 48 | ADS Security L.P. Nashville, Tenn. |

$19,013,828 | 2,731 | $189,597 | $0 | retail, corp, industrial | 417 | 22 |

| 33 | 44 | Firstline Security Systems Inc. Anaheim, Calif. |

$18,124,000 | 240 | $1,240,000 | $2,300 | utilities, corp, financial | 61 | 2 |

| 34 | 34 | TRL Systems Inc. Rancho Cucamonga, Calif. |

$17,946,735 | 576 | $1,600,000 | $1,500 | industrial, corp, transport | 186 | 5 |

| 35 | 46 | American Alarm & Communications Arlington, Mass. |

$17,097,943 | 3,813 | $429,239 | $50 | property mgmt, health, corp | 237 | 6 |

| 36 | 37 | Access Systems Integration Eatontown, N.J. |

$17,095,000 | 830 | $1,150,000 | $2,000 | corp, industrial, utilities | 52 | 5 |

| 37 | 42 | Security Equipment Inc. Omaha, Neb. |

$16,898,420 | 619 | $264,972 | $99 | education, corp, retail | 174 | 5 |

| 38 | 41 | The Protection Bureau Exton, Pa. |

$16,068,190 | 771 | $1,238,014 | $99 | corp, education, financial | 92 | 4 |

| 39 | 47 | Dallas Security Systems Inc. & DSS Fire Inc. Dallas, Texas |

$14,165,823 | 1,000 | $500,000 | $299 | health, corp, education | 158 | 2 |

| 40 | 58 | DynaFire Inc. Casselberry, Fla. |

$14,005,629 | 350 | na | na | corp, education, entertainment | 190 | 5 |

| 41 | 43 | SIGNET Electronic Systems Inc. Norwell, Mass. |

14000000 | 250 | $2,000,000 | $5,000 | na | 139 | 3 |

| 42 | 53 | RedRock Security & Cabling Inc. Irvine, Calif. |

$13,750,000 | 500 | $1,750,000 | $5,000 | corp, hotel, education | 154 | 3 |

| 43 | 51 | Midstate Security Company Wyoming, Mich. |

$13,609,901 | 485 | na | na | na | 80 | 1 |

| 44 | 60 | Stone Security Salt Lake City, Utah |

$13,609,099 | 519 | $778,133 | $4,654 | corp, education, govt | 40 | 2 |

| 45 | 55 | FE Moran Security Solutions Champaign, Ill. |

$12,693,954 | 2,875 | $195,663 | $0 | retail, financial, health | 163 | 6 |

| 46 | 61 | Security By Design Wire Works Business Systems Inc. Westbury, N.Y. |

$11,300,000 | 500 | $3,747,000 | $300 | corp, health, education | 31 | 2 |

| 47 | Sonitrol SW Ohio Mason, Ohio |

$10,811,964 | 947 | $202,000 | $495 | industrial, corp, govt | 52 | 2 | |

| 48 | 64 | PASS Security Fairview Heights, Ill. |

$10,523,238 | 540 | $2,900,000 | $1,000 | utilities, education, health | 49 | 1 |

| 49 | 63 | 3Sixty Integrated San Antonio, Texas |

$10,500,000 | 176 | $4,300,000 | $10,000 | education, govt, retail | 51 | 1 |

| 50 | 59 | SSD Alarm Anaheim, Calif. |

$10,123,900 | na | na | na | na | 221 | 11 |

| 51 | JSC Systems Inc. Jacksonville, Fla. |

$9,750,121 | 262 | $48,021 | $1,106 | na | 118 | 8 | |

| 52 | 67 | Guardian Protection Services Warrendale, Pa. |

$9,216,370 | 4,894 | $222,203 | $0 | industrial, corp, health | 1,116 | 13 |

| 53 | 65 | CGL Electronic Security Inc. Westwood, Mass. |

$8,500,000 | 200 | $465,000 | $2,500 | education, health, govt | 43 | 1 |

| 54 | 68 | APL Access & Security Inc. Gilbert, Ariz. |

$8,413,032 | 100 | $1,300,000 | $5,000 | corp, govt, industrial | 41 | 2 |

| 55 | Watchlight El Cajon, Calif. |

$8,000,000 | 136 | $200 | $40,000 | industrial, govt, retail | 79 | 3 | |

| 56 | 82 | Bates Security / Sonitrol of Lexington Lexington, Ky. |

$7,561,634 | 893 | $234,689 | $0 | corp, education, health | 70 | 2 |

| 57 | 88 | Will Electronics St. Louis, Mo. |

$7,129,491 | 325 | $186,155 | $350 | utilities, govt, health | 33 | 1 |

| 58 | 70 | Sentry Communications & Security Hicksville, N.Y. |

$7,000,000 | 20 | $875,000 | $100 | corp, health, transport | 71 | 2 |

| 59 | 72 | Vision Security Technologies Birmingham, Ala. |

$6,807,233 | 335 | $500,000 | $79 | education, govt, industrial | 42 | 2 |

| 60 | Ollivier Corporation Los Angeles, Calif. |

$6,711,076 | 100 | $659,098 | $560 | corp, health, education | 30 | 1 | |

| 61 | 86 | Strategic Security Solutions Raleigh, N.C. |

$6,604,811 | 793 | $199,000 | $500 | health, corp, education | 16 | 1 |

| 62 | 78 | Southeastern Security Professionals LLC Norcross, Ga. |

$6,521,282 | 90 | $244,293 | $170 | govt, education, health | 36 | 1 |

| 63 | 62 | Ackerman Security Systems Atlanta, Ga. |

$6,408,660 | 800 | na | na | retail, corp, education | 259 | 2 |

| 64 | 75 | Atlantic Coast Alarm Inc. Mays Landing, N.J. |

$6,352,344 | na | na | na | govt, health, education | 31 | 2 |

| 65 | 83 | Electronic Security Concepts LLC Scottsdale, Ariz. |

$5,971,234 | 310 | $830,000 | $450 | govt, education, correctional | 41 | 3 |

| 66 | 85 | Atronic Alarms Inc. Lenexa, Kan. |

$5,689,298 | 900 | $305,000 | $195 | corp, hotel, industrial | 83 | 2 |

| 67 | 77 | Custom Alarm Rochester, Minn. |

$5,624,806 | 705 | $249,226 | $99 | health, education, govt | 60 | 1 |

| 68 | 81 | Trinity Wiring & Security Solutions Manassas, Va. |

$5,600,000 | 69 | $40,000 | $0 | industrial, retail, education | 54 | 1 |

| 69 | Ener-Tel Services I LLC San Angelo, Texas |

$5,461,836 | 185 | $1,000,000 | $499 | education, health, law | 70 | 2 | |

| 70 | 84 | D/A Central Inc. Oak Park, Mich. |

$5,322,953 | 100 | $270,000 | $3,000 | industrial, utilities, govt | 44 | 3 |

| 71 | 69 | Scarsdale Security Systems Inc. Scarsdale, N.Y. |

$5,180,476 | 376 | $675,000 | $0 | retail, corp, airport | 101 | 2 |

| 72 | 87 | Rapid Security Solutions LLC Sarasota, Fla. |

$5,136,839 | 279 | $325,000 | $375 | gated communities, retail, corp | 47 | 2 |

| 73 | 73 | Engineered Security Systems Towaco, N.J. |

$5,038,703 | 250 | $1,260,000 | $325 | corp, health, education | 59 | 6 |

| 74 | 89 | Fleenor Security Systems Johnson City, Tenn. |

$4,977,996 | 621 | $88,716 | $250 | health, corp, industrial | 64 | 2 |

| 75 | 80 | Sonitrol of Sacramento & Orange County, Cybex Security Solutions Roseville, Calif. |

$4,877,769 | 1,141 | $110,150 | $199 | corp, govt, industrial | 48 | 3 |

| 76 | 76 | Peak Alarm Co. Inc. Salt Lake City, Utah |

$4,848,799 | 1,925 | $82,000 | $50 | govt, retail, health | 325 | 4 |

| 77 | Wilson Fire Houston, Texas |

$4,669,740 | 400 | $1,400,000 | $10,000 | corp, education, health | 120 | 1 | |

| 78 | Apex Integrated Security Solutions Inc. Garden City, Idaho |

$4,649,310 | 86 | $487,000 | $2,800 | health, govt, corp | 23 | 1 | |

| 79 | 94 | SCI Inc. Albuquerque, N.M. |

$4,634,991 | 250 | $560,000 | $25,000 | govt, utilities, education | 20 | 1 |

| 80 | T&R Alarm Systems Inc. Clifton, N.J. |

$4,530,793 | 90 | $280,000 | $1,500 | na | 28 | 1 | |

| 81 | 96 | Kimberlite Corp. Fresno, Calif. |

$4,496,394 | 155 | $86,000 | $900 | education, govt, transport | 119 | 8 |

| 82 | 66 | Sonitrol New England Rocky Hill, Conn. |

$4,425,281 | 1,282 | $374,138 | $500 | education, corp, industrial | 204 | 5 |

| 83 | 98 | EMC Security Suwanee, Ga. |

$4,377,873 | 620 | $340,000 | $99 | multifamily, education, industrial | 140 | 1 |

| 84 | Moon Security Services Inc. Pasco, Wash. |

$4,200,000 | 300 | $220,000 | $99 | na | 109 | 3 | |

| 85 | Allstate Security Ind. Amarillo, Texas |

$4,178,000 | 1,054 | $88,000 | $0 | corp, education, financial | 87 | 1 | |

| 86 | Titan Alarm Inc. Phoenix, Ariz. |

$4,118,000 | 279 | $430,000 | $0 | corp, industrial, retail | 43 | 2 | |

| 87 | 92 | Sonitrol of Buffalo, Rochester, Toronto Buffalo, N.Y. |

$3,880,000 | 245 | $1,200,000 | $2,500 | retail, corp, industrial | 86 | 3 |

| 88 | 95 | Redwire LLC Tallahassee, Fla. |

$3,849,512 | na | na | na | na | 63 | 3 |

| 89 | 99 | New York Security Solutions Brooklyn, N.Y. |

$3,760,505 | 315 | $421,000 | $1,194 | govt, corp | 41 | 3 |

| 90 | 91 | Sonitrol Great Lakes Grand Blanc, Mich. |

$3,720,588 | 1,301 | $51,000 | $1,000 | education, health, corp | 63 | 3 |

| 91 | 100 | Sonitrol Pacific Portland, Ore. |

$3,394,884 | 420 | $125,964 | $250 | commercial office, education, corp | 98 | 5 |

| 92 | 97 | Post Alarm Systems Arcadia, Calif. |

$3,367,166 | 575 | $175,000 | $299 | corp, education, industrial | 136 | 2 |

| 93 | 49 | Life Safety Engineered Systems Inc. Buffalo, N.Y. |

$3,000,000 | 69 | $450,000 | $1,000 | retail, health, education | 64 | 5 |

| 94 | Acadiana Security Plus Broussard, La. |

$2,727,302 | 261 | $160,000 | $99 | na | 76 | 2 | |

| 95 | Sonitrol Security Services Inc. Charlotte, N.C. |

$2,534,528 | 111 | $72,365 | $399 | corp, industrial, govt | 49 | 2 | |

| 96 | Habitec Security Toledo, Ohio |

$2,418,000 | 1,000 | $300,000 | $1,000 | industrial, govt, retail | 76 | 3 | |

| 97 | Secure Pacific Corporation Portland, Ore. |

$1,705,308 | 375 | $79,500 | $250 | construction, govt, property mgmt | 33 | 6 | |

| 98 | Valley Alarm Sun Valley, Calif. |

$1,504,633 | 426 | $173,557 | $100 | industrial, health, corp | 34 | 1 | |

| 99 | General Security Inc. Plainview, N.Y. |

$1,500,000 | na | $299,900 | $99 | retail, corp, financial | 151 | 7 | |

| 100 | GHS Interactive Security LLC Woodland Hills, Calif. |

$1,375,300 | 390 | $3,250 | $99 | corp, retail, entertainment | 178 | 12 |

e = SDM estimate.

na = not available.

Abbreviations to markets:

airport = airports;

corp = corporate office space;

correctional = correctional;

education = education/campuses;

entertainment = entertainment/sports venues;

financial = financial/banking;

gaming = casinos/gaming;

govt = government;

health = healthcare;

hotel = hotels/hospitality;

industrial = industrial;

law = law enforcement;

retail = retail/restaurants;

transport = transportation/distribution;

utilities = utilities/critical infrastructure.

No. 1 – Integrated and assimilated seven unique acquisitions in 2017. SDM’s 2007 and 2012 Systems Integrator of the Year.

No. 3 – Held ribbon-cutting ceremony and open house in April 2017, for new headquarters in Uniontown, Ohio, which houses company’s monitoring and business operations center. SDM’s 2011 Systems Integrator of the Year as Diebold Security, acquired later by Securitas ES.

No. 4 – Acquired ATCi in Florida, DPSI in California, and TTM in Maryland. These acquisitions are part of company’s four-part corporate strategy of organic growth, mergers and acquisitions, national accounts, and upsell/cross-sells.

No. 5 – Acquired Urban Alarm to expand into high-end residential security; hit highest level of RMR to date. SDM’s 2015 Systems Integrator of the Year.

No. 6 – Integrated National Accounts Division with Industry Retail Group, company’s acquired managed services business, under one brand.

No. 7 – SDM’s 2013 Systems Integrator of the Year (and 2008 as Adesta LLC).

No. 8 – SDM’s 2016 Systems Integrator of the Year.

No. 9 – SDM’s 2004 Systems Integrator of the Year.

No. 10 – Deployed Exero, a cloud- based security device management and health management software, in order to provide predictive analytics to company’s new and existing customers. SDM’s 2014 Systems Integrator of the Year.

No. 12 – In 2017, hit highest revenue in company history.

No. 13 – Increased service and project delivery experience through increased staffing and leveraging mobile platform.

No. 14 – Rebranded, including a name change, to allow company to bring all offices and disciplines under one brand name.

No. 16 – Received the Axis Communications Federal VAR of the Year and Milestone Integration of the Year.

No. 17 – Company introduced another layer of management within its sales and service functions to ensure it provides the best service and solutions to customers. Continued to invest in training, including sending three managers to an executive development program.

No. 22 – Opened a Ft. Smith, Ark., office (company’s sixth location) and completed a software conversion within accounting department.

No. 23 – Over 23 percent growth in revenues; broke the 100-employee mark.

No. 24 – 2017 marked company’s 25th anniversary and a record year fueled by customer loyalty and staff performance.

No. 26 – Completed a recapitalization in 2017, raising substantial growth capital. Completed a major expansion of company’s Special Purpose Interactive Video Monitoring Center in Plano, Texas, more than tripling customer capacity and integrating new video and two-way audio capabilities.

No. 28 – Grew over $100,000 of RMR organically.

No. 29 – Major retrofit and upgrade for an 86-story office building in Chicago and a major security installation for a professional sports team in Chicago.

No. 30 – Expanded into five new states, opened three new branch offices, acquired one company, and developed a wireless video surveillance product for the transportation industry.

No. 31 – Renewed all large-scale maintenance agreements for multiple years.

No. 32 – Focus on commercial market led to subsequent growth, some of which was driven by company’s expansion into engineered fire systems.

No. 34 – Developed, designed, implemented and deployed company’s own trademarked cloud-based service offering for network health monitoring: TRL Systems AlertPro real-time health monitoring service.

No. 36 – Increased energy sector presence and improved project management processes to drive efficiency and profitability.

No. 43 – Became ISO9002 certified.

No. 44 – Received the 2017 Axis Communications Transportation Partner of the Year award.

No. 45 – Developed a sales CRM platform that is tightly integrated in company’s business operating systems.

No. 46 – Awarded the Time Warner project at 55 Hudson Yards, New York – $3.8 million.

No. 49 – Direct, multi-million dollar contract of security design for K-12 school district.

No. 51 – Company was a crucial part of the design of low-voltage systems in the Historic District Hotels of Savannah, Ga., along with the design of low-voltage systems of Pruitt Health.

No. 56 – Acquired ABCO Security; implemented the Sonitrol Standard, an operational paradigm shift to implement and improve efficiencies and profitability of the operations of the entire company.

No. 57 – Completed the O’Fallon Justice Center project.

No. 59 – Launched new digital marketing campaign.

No. 60 – Established Managed Services Division.

No. 61 – Ownership change: Jay Slaughterbeck purchased Strategic Security Solutions outright from parent company.

No. 62 – Improved national account program, resulted in significant increase in sales revenue.

No. 65 – Opened Las Vegas office.

No. 66 – Opened first branch office in Omaha, Neb.

No. 67 – Able to navigate the year with consistent revenues and profits, due to a new operating system called EOS/TractionSome, some components of which concerned data and accountability. Exceeded profit margin budget and rewarded all staff with profit-sharing bonuses in 2017.

No. 69 – With new leadership at the helm, Ener-Tel Services increased footprint in other markets; in addition to diving deeper into Abilene, Texas, market, company also expanded into the Brownwood area.

No. 70 – Engineering expertise and service orientation helped land another global manufacturer.

No. 73 – 2-million-sq.-ft. building with a full fire alarm replacement, 200 cameras, 220 card readers, optical turnstiles, and command center was one of many projects in 2017.

No. 74 – Recruited talented team members and grew new branch location in Knoxville, Tenn.

No. 75 – Secured a contract with local county law enforcement agency to upgrade all of the cameras through multiple phases to a network-based system, all 1080p and higher with three years of video retention. Helped the county establish video standards.

No. 77 – First security integration project over $1 million in company’s history.

No. 80 – Completed very large project for the Army Corps of Engineers; aside from general electrical it was build for fire, CCTV, and voice evac along with voice intelligibility, testing and certification.

No. 83 – Activated new online employee payroll and benefits portal for employees. Cloud-based systems allow employees to log work time by work type, allowing for much better tracking of expense and management of overtime. Expanded customer financing options for new activations. Completed negotiations with two new electric service cooperative partners that will launch in 2018.

No. 85 – Gutted existing monitoring station and replaced everything with state-of-the-art equipment and technology. Project took close to four months to complete, totaling approximately $300,000.

No. 86 – Acquired a branch in Tucson, Ariz.

No. 89 – Obtained a city and state contract with the largest health and hospital facilities in New York City, as a vendor for all security-related service and installation for many of their locations.

No. 98 – Completed three significant acquisitions and increased RMR 12 percent.

Ranked by Project Size

View/Download this table as a PDF

CONVERGINT TECHNOLOGIES’ $8.7 M PROJECT

In 2017, Convergint Technologies executed the first year of a multi-year agreement in which it provided comprehensive operations and maintenance services for a large producer in the Canadian oil sands. Convergint provides day-today operation of facility management systems, scheduled and break-in maintenance, and 24/7 support and response services. Dedicated specialists execute new construction as well as upgrades and project support, providing a full range of services that sustain the client’s security and building automation systems. Convergint’s innovative solutions reduce operating costs, enhance environmental responsiveness, increase operational efficiencies, and positively impact this client’s business on a daily basis.

| Rank by Project Size | Company | Value of Largest Project | 2018 Rank |

| 1 | Convergint Technologies | $8,700,000 | 1 |

| 2 | Interface Security Systems Holdings Inc. | $6,700,000 | 26 |

| 3 | Unlimited Technology Inc. | $6,500,000 | 10 |

| 4 | Advanced Electronic Solutions | $6,100,000 | 27 |

| 5 | Security Integrations | $5,000,000 | 24 |

| 6 | 3Sixty Integrated | $4,300,000 | 49 |

| 7 | Security By Design Wire Works Business Systems Inc. | $3,747,000 | 46 |

| 8 | Securityhunter Inc. | $3,137,026 | 16 |

| 9 | Integrated Security Technologies | $3,117,285 | 23 |

| 10 | ACT | $3,045,000 | 31 |

| 11 | PASS Security | $2,900,000 | 48 |

| 12 | GSI | $2,878,000 | 19 |

| 13 | Allied Universal Security Systems | $2,600,000 | 11 |

| 14 | Red Hawk Fire & Security | $2,200,000 | 4 |

| 15 | Advanced Cabling Systems | $2,150,000 | 22 |

| 16 | Tech Systems Inc. | $2,000,000 | 9 |

| 17 | Mountain Alarm | $2,000,000 | 28 |

| 18 | SIGNET Electronic Systems Inc. | $2,000,000 | 41 |

| 19 | RedRock Security & Cabling Inc. | $1,750,000 | 42 |

| 20 | MidCo Inc. | $1,650,000 | 29 |

| 21 | TRL Systems Inc. | $1,600,000 | 34 |

| 22 | Entech Sales and Service LLC | $1,547,320 | 18 |

| 23 | LVC Companies Inc. | $1,485,000 | 14 |

| 24 | Wilson Fire | $1,400,000 | 77 |

| 25 | RFI Communications & Security Systems | $1,300,000 | 13 |

| 26 | APL Access & Security Inc. | $1,300,000 | 54 |

| 27 | Engineered Security Systems | $1,260,000 | 73 |

| 28 | Firstline Security Systems Inc. | $1,240,000 | 33 |

| 29 | The Protection Bureau | $1,238,014 | 38 |

| 30 | Sonitrol of Buffalo, Rochester, Toronto | $1,200,000 | 87 |

| 31 | A3 Communications Inc. | $1,181,326 | 12 |

| 32 | Access Systems Integration | $1,150,000 | 36 |

| 33 | Ener-Tel Services I, LLC | $1,000,000 | 69 |

| 34 | AFA Protective Systems Inc. | $900,000 | 15 |

| 35 | Sentry Communications & Security | $875,000 | 58 |

| 36 | Minuteman Security Technologies Inc. | $863,000 | 30 |

| 37 | Electronic Security Concepts LLC | $830,000 | 65 |

| 38 | Stone Security | $778,133 | 44 |

| 39 | Intertech Ci | $723,441 | 21 |

| 40 | Scarsdale Security Systems Inc. | $675,000 | 71 |

| 41 | Ollivier Corporation | $659,098 | 60 |

| 42 | Vector Security Inc. | $577,000 | 6 |

| 43 | SCI Inc. | $560,000 | 79 |

| 44 | Per Mar Security Services | $545,000 | 25 |

| 45 | Dallas Security Systems Inc. & DSS Fire Inc. | $500,000 | 39 |

| 46 | Vision Security Technologies | $500,000 | 59 |

| 47 | Apex Integrated Security Solutions, Inc. | $487,000 | 78 |

| 48 | CGL Electronic Security Inc. | $465,000 | 53 |

| 49 | Life Safety Engineered Systems Inc. | $450,000 | 93 |

| 50 | Titan Alarm Inc. | $430,000 | 86 |

| 51 | American Alarm & Communications | $429,239 | 35 |

| 52 | New York Security Solutions | $421,000 | 89 |

| 53 | Sonitrol New England | $374,138 | 82 |

| 54 | EMC Security | $340,000 | 83 |

| 55 | Rapid Security Solutions LLC | $325,000 | 72 |

| 56 | Atronic Alarms Inc. | $305,000 | 66 |

| 57 | Habitec Security | $300,000 | 96 |

| 58 | General Security Inc. | $299,900 | 99 |

| 59 | T&R Alarm Systems Inc. | $280,000 | 80 |

| 60 | D/A Central Inc. | $270,000 | 70 |

| 61 | Security Equipment Inc. | $264,972 | 37 |

| 62 | Custom Alarm | $249,226 | 67 |

| 63 | Southeastern Security Professionals LLC | $244,293 | 62 |

| 64 | Bates Security / Sonitrol of Lexington | $234,689 | 56 |

| 65 | Guardian Protection Services | $222,203 | 52 |

| 66 | Moon Security Services Inc. | $220,000 | 84 |

| 67 | Sonitrol SW Ohio | $202,000 | 47 |

| 68 | Strategic Security Solutions | $199,000 | 61 |

| 69 | FE Moran Security Solutions | $195,663 | 45 |

| 70 | ADS Security L.P. | $189,597 | 32 |

| 71 | Will Electronics | $186,155 | 57 |

| 72 | Post Alarm Systems | $175,000 | 92 |

| 73 | Valley Alarm | $173,557 | 98 |

| 74 | Acadiana Security Plus | $160,000 | 94 |

| 75 | Sonitrol Pacific | $125,964 | 91 |

| 76 | Sonitrol of Sacramento & Orange County, Cybex Security Solutions | $110,150 | 75 |

These 76 security systems integrators reported having the highest-value security projects started in 2017. Note: Five of the top 10 companies did not report their largest project size, as requested by SDM. Projects below $100,000 are not ranked here.

Source: SDM Top Systems Integrators Report, July 2018

View/Download this table as a PDF

| Company | 2018 Rank |

| 3Sixty Integrated | 49 |

| A3 Communications Inc. | 12 |

| Acadiana Security Plus | 94 |

| Access Systems Integration | 36 |

| Ackerman Security Systems | 63 |

| ACT | 31 |

| ADS Security L.P. | 32 |

| ADT | 2 |

| Advanced Cabling Systems | 22 |

| Advanced Electronic Solutions | 27 |

| AFA Protective Systems Inc. | 15 |

| Allied Universal Security Systems | 11 |

| Allstate Security Ind. | 85 |

| American Alarm & Communications | 35 |

| Apex Integrated Security Solutions Inc. | 78 |

| APL Access & Security Inc. | 54 |

| Atlantic Coast Alarm Inc. | 64 |

| Atronic Alarms Inc. | 66 |

| Bates Security / Sonitrol of Lexington | 56 |

| CGL Electronic Security Inc. | 53 |

| Convergint Technologies | 1 |

| Custom Alarm | 67 |

| D/A Central Inc. | 70 |

| Dallas Security Systems Inc. & DSS Fire Inc. | 39 |

| DynaFire Inc. | 40 |

| Electric Guard Dog | 17 |

| Electronic Security Concepts LLC | 65 |

| EMC Security | 83 |

| Ener-Tel Services I LLC | 69 |

| Engineered Security Systems | 73 |

| Entech Sales and Service LLC | 18 |

| FE Moran Security Solutions | 45 |

| Firstline Security Systems Inc. | 33 |

| Fleenor Security Systems | 74 |

| G4S Secure Integration | 7 |

| General Security Inc. | 99 |

| GHS Interactive Security LLC | 100 |

| GSI | 19 |

| Guardian Protection Services | 52 |

| Habitec Security | 96 |

| Integrated Security Technologies | 23 |

| Interface Security Systems Holdings Inc. | 26 |

| Intertech Ci | 21 |

| JSC Systems Inc. | 51 |

| Kastle Systems International | 5 |

| Kimberlite Corp. | 81 |

| Life Safety Engineered Systems Inc. | 93 |

| LVC Companies Inc. | 14 |

| MidCo Inc. | 29 |

| Midstate Security Company | 43 |

| Minuteman Security Technologies Inc. | 30 |

| Moon Security Services Inc. | 84 |

| Mountain Alarm | 28 |

| New York Security Solutions | 89 |

| Ollivier Corporation | 60 |

| PASS Security | 48 |

| Peak Alarm Co. Inc. | 76 |

| Per Mar Security Services | 25 |

| Post Alarm Systems | 92 |

| Rapid Security Solutions LLC | 72 |

| Red Hawk Fire & Security | 4 |

| RedRock Security & Cabling Inc. | 42 |

| Redwire LLC | 88 |

| RFI Communications & Security Systems | 13 |

| Scarsdale Security Systems Inc. | 71 |

| SCI Inc. | 79 |

| Securadyne Systems LLC | 8 |

| Secure Pacific Corporation | 97 |

| Securitas Electronic Security | 3 |

| Security By Design Wire Works Business Systems Inc. | 46 |

| Security Corporation | 20 |

| Security Equipment Inc. | 37 |

| Security Integrations | 24 |

| Securityhunter Inc. | 16 |

| Sentry Communications & Security | 58 |

| SIGNET Electronic Systems Inc. | 41 |

| Sonitrol Great Lakes | 90 |

| Sonitrol New England | 82 |

| Sonitrol of Buffalo, Rochester, Toronto | 87 |

| Sonitrol of Sacramento & Orange County, Cybex Security Solutions | 75 |

| Sonitrol Pacific | 91 |

| Sonitrol Security Services Inc. | 95 |

| Sonitrol SW Ohio | 47 |

| Southeastern Security Professionals LLC | 62 |

| SSD Alarm | 50 |

| Stone Security | 44 |

| Strategic Security Solutions | 61 |

| T&R Alarm Systems Inc. | 80 |

| Tech Systems Inc. | 9 |

| The Protection Bureau | 38 |

| Titan Alarm Inc. | 86 |

| Trinity Wiring & Security Solutions | 68 |

| TRL Systems Inc. | 34 |

| Unlimited Technology Inc. | 10 |

| Valley Alarm | 98 |

| Vector Security Inc. | 6 |

| Vision Security Technologies | 59 |

| Watchlight | 55 |

| Will Electronics | 57 |

| Wilson Fire | 77 |

| Company | Total Revenue |

| ADT | $4,315,502,000 |

| Convergint Technologies | $842,460,787 |

| Securitas Electronic Security | $375,000,000 |

| Vector Security Inc. | $296,262,172 |

| Red Hawk Fire & Security | $264,000,000 |

| Guardian Protection Services | $213,319,598 |

| Interface Security Systems Holdings Inc. | $164,978,340 |

| G4S Secure Integration | $158,721,000e |

| Entech Sales and Service LLC | $105,495,381 |

| Kastle Systems International | $100,000,000 |

Among companies ranked on the Top Systems Integrators Report, these businesses reported (or were estimated by SDM) the highest total revenue in 2017: ADT, Convergint Technologies, and Securitas Electronic Security are the top three. (Note: Revenue for G4S Secure Integration is estimated by SDM.)

| 2016 | 2017 | |

| Total North American systems integration revenue | $6.42 billion | $3.31 billion |

| New systems started | 120,099 | 104,788 |

| Total full-time employed | 52,957 | 38,322 |

| Business locations operated | 1,688 | 1,145 |

Total North American revenue from systems integration for the 100 largest integrators reached $3.31 billion in 2017 from solutions such as design, project management, product, installation, programming, start-up, and training sold directly to an end-user customer or through a tier of contractors. It does not include recurring revenue from services and monitoring, as integrators were asked to report that amount separately in order to be ranked on the SDM 100, a report based on RMR in the security industry. A comparison between the top 100 companies ranked this year and the top 100 ranked in 2017 shows a 48 percent decrease in systems integration revenue. This is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in 2017 are not ranked in 2018, including Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), VTI Security (declined to participate), NextGen Security LLC (declined to participate), and Genesis Security Systems LLC (acquired by Convergint Technologies). Among companies for which a year-to-year comparison could be made, security system integration revenue actually increased 10.9 percent.

| 2016 | 2017 |

| 1. Corporate office space | 1. Corporate office space |

| 2. Education/ campus | 2. Education/ campus |

| 3. Healthcare | 3. Healthcare |

| 4. Government | 4. Government |

| 5. Industrial | 5. Industrial |

| 6. Retail/restaurant | 6. Retail/restaurant |

| 7. Utilities/critical infrastructure | 7. Financial/banking |

| 8. Financial/banking | 8. Utilities/critical infrastructure |

| 9. Hotel/hospitality | 9. Hotel/hospitality |

| 10. Transportation/distribution | 10. Transportation/distribution |

These top 10 market sectors provided the most significant portion of revenues to security systems integrators in 2017 — and the top 10 list is nearly the same year-over-year. For the past several years, corporate/property management, education, and healthcare have steadfastly been among the top market sectors for integrators.

Charts

Source: SDM Top Systems Integrators Report, July 2018

More than nine of 10 Top Systems Integrators (94 percent) expect their 2018 revenues to exceed 2017’s, which is even higher than the prior year’s 86 percent of integrators who thought the same.

Source: SDM Top Systems Integrators Report, July 2018

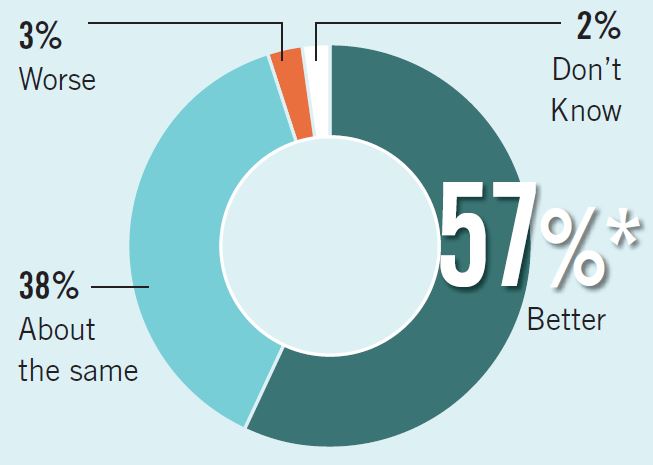

Top Systems Integrators have a very positive outlook on the state of funding for their clients’ security projects, with 57 percent of integrators stating funding was better in 2017 compared with 2016 — up from 51 percent the prior year.

Source: SDM Top Systems Integrators Report, July 2018

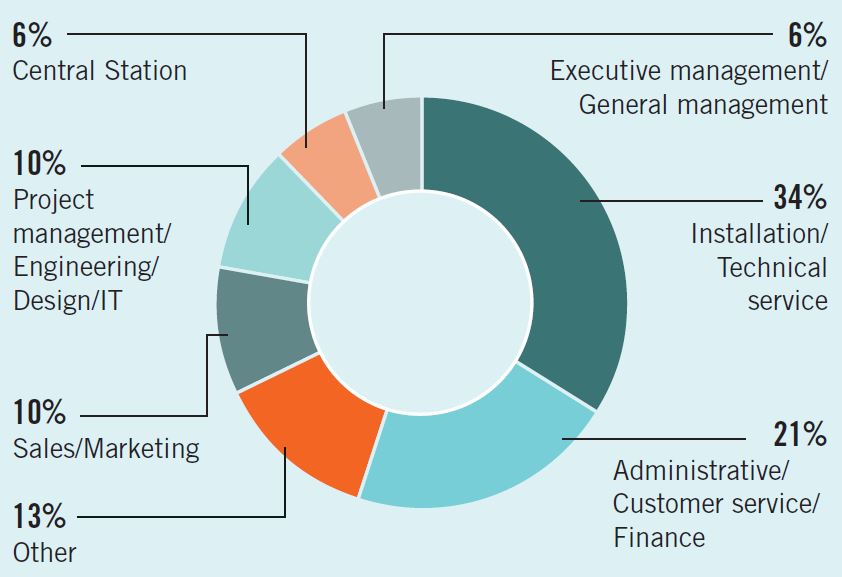

This chart, which you can use to compare job titles in your own company with industry averages, shows the average percentage distribution of job titles among Top Systems Integrator companies. Approximately one-third of jobs (34 percent) are comprised of installation and technical service positions.

Source: SDM Top Systems Integrators Report, July 2018

Top Systems Integrators were asked to break out their 2017 sales revenue by type of product. The single largest category of revenue from products is from “integrated non-residential systems” that combine two or more different technology solutions, comprising 34 percent of total sales revenue. This is followed by video surveillance, at 19 percent, and access control, at 14 percent of sales revenue.

Source: SDM Top Systems Integrators Report, July 2018

Top Systems Integrators were asked to break out their 2017 revenue by type of service. The single largest category of revenue is from “system sales and installation,” comprising 54 percent of total revenue, followed by monitoring, at 21 percent, and then service contracts, at 11 percent.

North American systems integration revenue (as reported to or estimated by SDM) reached $3.31 billion in 2017, based on reporting from 100 Top Systems Integrators. This amount registers a 48 percent decrease, which is attributed to the elimination of several large integrators on the report (see footnotes below). For integrators whose revenue could be compared year-over-year, total systems integration revenue actually increased 10.9 percent.

*In the 2010 report, several notable companies did not participate, including SAIC, Red Hawk Security, North American Video, and National Security Systems Inc., which skewed the results. Among systems integrators for which a year-to-year comparison could be made, there was actually only a 4.4 percent decrease in performance between 2009 and 2010.

†Two major factors contributed to the decrease in systems integration revenue; ADT was not ranked, and Siemens Industry Inc. systems integration revenue was adjusted downward by an SDM estimate.

**Siemens Industry Inc., which had been ranked in 2014 using estimated systems integration revenue, was not ranked in 2015. On the surface, it appears that Top Systems Integrators revenue declined 7.1 percent in 2014. When Siemens is removed from this calculation for comparison purposes, however, systems integration revenue for the top 100 companies grew very slightly, at 0.35 percent year-over-year.

††A 17.34 percent decrease in systems integration revenue is attributable to the fact that several of the largest systems integrators either did not reply to SDM’s requests for information, could not comply due to restrictions of being publicly held, or were omitted due to acquisition (includes Diebold Security – will report in 2017 as Securitas Electronic Security Inc.; Stanley Convergent Security Solutions; Protection 1; Schneider Electric; SDI; DTT; and Dakota Security Systems, among the top 25).

***The 14 percent increase in systems integration revenue is attributed to the fact that several of the largest systems integrators that did not participate in 2016 are now ranked in 2017, including ADT, Securitas Electronic Security, and the combined entity of Johnson Controls/Tyco Integrated Security.

†††The 48 percent decrease in systems integration revenue is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in 2017 are not ranked in 2018, including Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), VTI Security (declined to participate), NextGen Security LLC (declined to participate), and Genesis Security Systems LLC (acquired by Convergint Technologies).

About the SDM Top Systems Integrators Report

The SDM 2018 Top Systems Integrators Report ranks North American companies by their security systems integration revenue. This ranking is based on data provided to or, in a few cases, estimated by SDM. Ranked companies were asked to submit either an audited or reviewed financial statement, or a copy of their income tax return showing total gross receipts for the stated period. The vast majority of the firms ranked are privately held.

The main table ranks 100 companies by their North American revenue in 2017 from their security system integration projects. Integration includes solutions such as design, project management, product, installation, programming, start-up, training, and time-and-materials-based service sold directly to an end-user customer or through a tier of contractors. This includes revenue related to security, such as: access control, ID/badging, video surveillance/analytics, intrusion alarms, perimeter security, electronic gate entry, intercom/communications, fire protection, IT/networks, etc. It does not include recurring monthly revenue (RMR), as that is counted toward ranking on the SDM 100 (www.SDMmag. com/SDM100Report).

Note: an e following the figure indicates it is an SDM estimate. To find a company by name, use the alphabetical index.

More From the Report

To gain additional information beyond that published in this issue and online, the complete SDM Top Systems Integrators Report and Database is available in Excel format. Included are mailing addresses, telephone numbers, website URLs, targeted vertical markets, branch office locations, and much more. SDM’s Top Systems Integrators Report and Database contains the information needed to target products and services to the systems integration market.

The cost of the report is $595. It may be ordered by contacting Heidi Fusaro at 630-518-5470 or by emailing fusaroh@bnpmedia.com.