SDM 2019 Security Industry Forecast: Channeling Momentum Into Opportunities

Results of SDM’s 2019 Industry Forecast Study show that security integrators grew their total annual revenue by an average of 15 percent last year; they expect that momentum to bring them face-to-face with prosperous opportunities in 2019, as long as the economy stays strong.

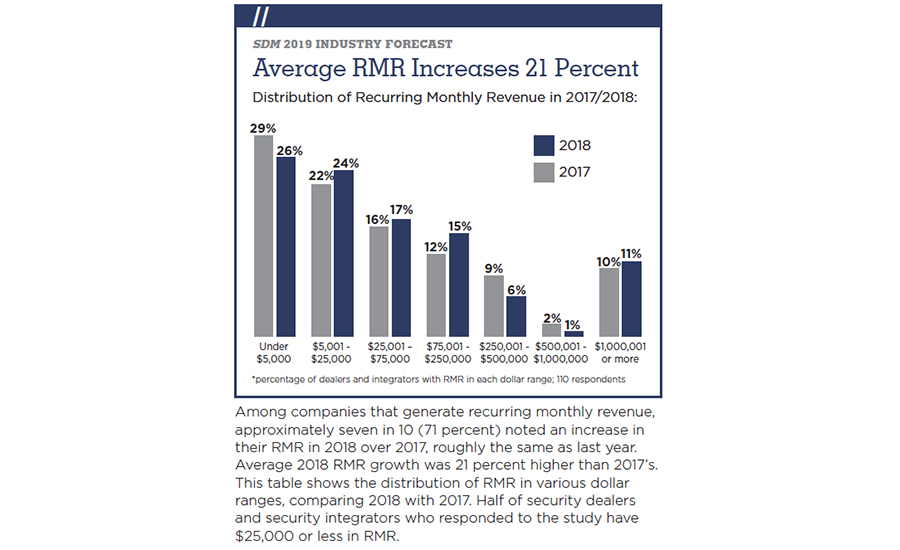

Security integrators expect their stellar 2018 performance to continue into 2019, according to results of SDM’s 2019 Industry Forecast Study, a report published annually by SDM since 1982. Last year saw double-digit growth in both total annual revenue and recurring monthly revenue (RMR) for integrators and dealers who participated in the study. Their total revenue increased by an average of 15 percent, while RMR grew by an average of 21 percent.

The Industry Forecast Panel: 2019

Brian Duffy is the chief operating officer for Per Mar Security Services, Davenport, Iowa, which in addition to electronic security also provides background investigation services and manned security services. Founded in 1953 by Brian’s grandparents, John and Eleanor Duffy, Brian and his brother Brad are now the third generation of Duffy family leadership, recently taking over from their father, Michael Duffy. Per Mar Security, a full-service security provider in the Midwest, serves more than 43,000 customers in seven states, and employs more than 2,500 people. Brian graduated from University of Notre Dame with a bachelor of arts in economics in 2009 and then began his career with Capital One Financial, before working at Per Mar as a general manager in the Cedar Rapids, Iowa, market.

Larry Simmons, CPP, PSP, is the vice president of corporate governance for Tech Systems Inc., Duluth, Ga., and is responsible for all legal and vender negotiations while assisting in the daily management of the company. He joined TSI in May 2008. He has 43 years of experience in the electronic security industry. Previously, Larry was president/owner of Distribution Associates South, Inc., Atlanta, and during that time he Audio Sentinel Monitoring. He also spent time working at Pinkerton Systems Integration and Securitas AB. Larry was a founding member of Security-Net in 1993 and continued to serve as an active member until selling his company. In 2017, he rejoined Security-Net as the representative for Tech Systems Inc.

JC Gonzalez is a co-founder and general manager of HomePro. Established in 1998, HomePro began as a traditional security company in Dallas, and has since grown to become a premier provider of home security, entertainment and control systems. HomePro works primarily in new residential construction for production and custom homebuilders in Dallas, Houston, Austin and San Antonio. In 2018 HomePro prewired more than 19,000 homes in the top Texas markets.

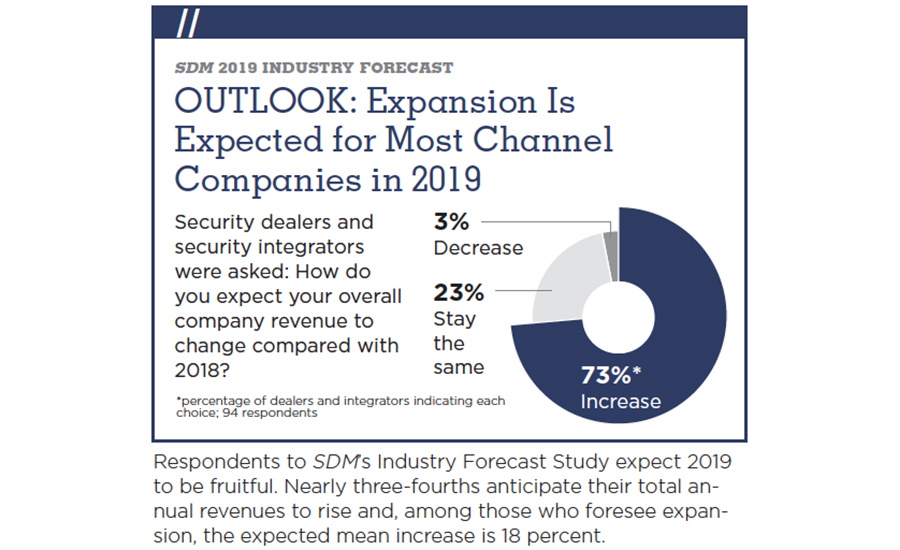

The security industry expects 2019 to be just as rewarding. Nearly three-fourths of integrators anticipate their total annual revenues will continue to grow and — among those who foresee expansion — the expected average increase is 18 percent.

“In 2018, we’ll have increased our total annual revenue by approximately 15 percent,” says JC Gonzalez, co-founder and general manager of Dallas-based HomePro, a company that specializes in home technologies for new residential construction in Texas. “And in 2019, we’re looking to grow by about 20 percent,” he emphasizes.

The Panel Speaks on Total Annual Revenue

SDM: How do you expect your company’s 2018 overall revenues will have changed compared with 2017? And how do you expect 2019 overall revenues will change compared with 2018?

Duffy: This year, we’ll do right around $120 million in revenue. We will grow approximately 7 percent this year over last year; and for next year we’re budgeting top line growth of 8 percent. I would say that’s about average. What we have found is that there is a lot of opportunity in the project space — access control and video surveillance. We have found quite a bit of opportunity there to grow. We’re a very service and recurring revenue-focused company, but I think we’ve found it a little bit easier in our markets to grow on the installation side.

Simmons: For 2018, it’s been a phenomenal year. In our industry traditionally, the fourth quarter is always the strongest quarter of the year. We’ve kind of been kidding ourselves this year by saying, “The fourth quarter never ended last year.” It’s been that way the whole year. We’ll finish with over 20 percent growth.

If we look ahead to 2019, we will try to roll back a little bit, but still, we anticipate it’ll be somewhere between 10 percent and 15 percent growth. The reason for that is twofold. One, we get a lot of referrals from existing customers. We have grown with our customers. That’s really how Tech Systems got started and we’re still doing that today. We expand with our customers. We also work closely with our manufacturers and get a lot of work with them on joint projects.

We also have expanded into Canada now, and that business is beginning to pick up. They’re ahead of their marks for a first full year.

Gonzalez: In 2018, we’ll have increased our total annual revenue by approximately 15 percent. And in 2019, we’re looking to grow by about 20 percent. Now, the reason we grew in 2018 is quite simply that we are a builder-related services company. We increased our presence and the amount of prewires that we’ve done from about 16,500 to about 19,000 homes in 2018. We’ve just seen more customers and we’ve expanded our offerings to those customers that we have seen.

We continue to expand our market penetration, but also we have brought in some new individuals to help us grow our RMR side.

“For 2018, it’s been a phenomenal year. We’ll finish with over 20 percent growth,” says Larry Simmons, vice president of corporate governance for Tech Systems Inc., an innovative security integrator based in Duluth, Ga. “If we look ahead to 2019 … we anticipate it’ll be somewhere between 10 percent and 15 percent growth,” Simmons forecasts.

“This year, we’ll do right around $120 million in revenue. We will grow approximately 7 percent this year over last year; and for next year we’re budgeting top line growth of 8 percent,” says Brian Duffy, chief operating officer for Per Mar Security Services, Davenport, Iowa, featured on this month’s front cover. Per Mar is a traditional security dealer with a central station, which serves a wide range of customer markets, but also has a manned security division and a background investigation division. (To read more about the experiences of each of these security professionals, see the sidebars throughout this story and online, “The Panel Speaks.”

The Panel Speaks on Factors Affecting Sales

SDM: What is the one factor you feel will most significantly affect sales of security systems by your company next year?

Duffy: I think factors within our control will be more important than factors outside of our control.

For us to grow next year and increase our speed of growth, the biggest factor is our ability to provide sales representatives in front of our customers that are truly being consultative — working hand-in-hand to develop a security program that we can be a part of, but oftentimes recommending things that we don’t even sell in order to provide value to our customers.

That’s what we’re working towards, especially given that we’re a full-service provider with the whole suite [of services].

Simmons: I’d say that’s the number one is economic conditions, because that dovetails right into capital spending by business. We’ve experienced several years of a great economy. The corporations we deal with have increased their capital spending, they’ve released money that they’d been holding to do projects — and that’s really helped fuel the growth of the last several years.

If our economy were to tank, I am concerned that people would be cautious again, and maybe not spend money that’s already budgeted for in 2019. That one, we have no control over, so that’s my biggest worry.

It’s just the uncertainty with all of the things going on in trade tariffs and what have you, and how [our customers’ management will react to that. It’s just the uncertainty in the market, which is why we’re seeing the stock market go crazy lately — and nobody likes uncertainty.

Gonzalez: We look at the residential building activity and economic conditions; more so the residential building activity, because we consider ourselves to be a true low-voltage integrator that specializes in the builder-related services area.

So while we’re optimistic, we continue to keep a close eye on the housing trends and what’s being built, especially here in Texas. So that’s probably our biggest driver is the number of new starts and houses that are being built in Dallas, Houston and Austin.

We work with about 53 different builders in those three markets. Some local, some national, some regional. We offer anything that we consider to be a home technology, from security, to home theater, to home automation, to distributed audio. We even touch on central vacuum systems.

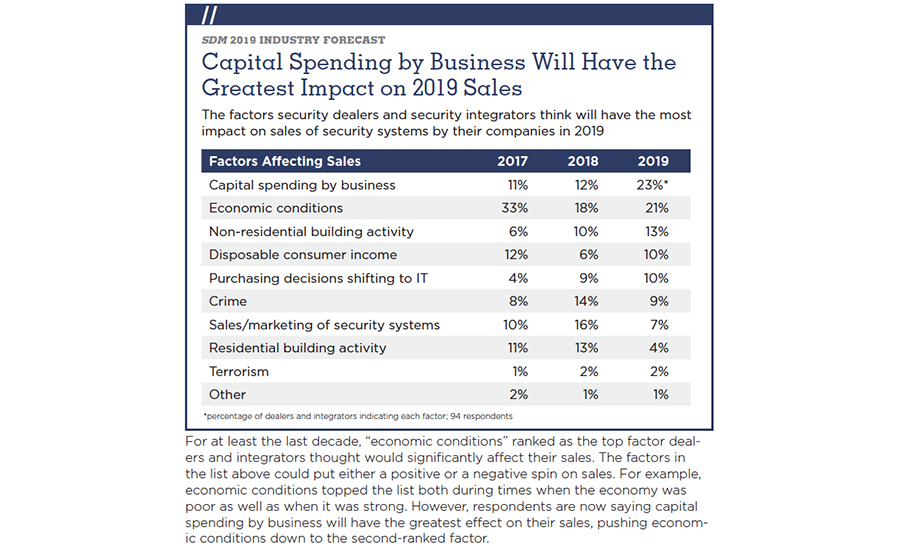

Expectations may be tempered by reality, however. The economy and capital spending by business are the top two factors security dealers and security integrators think will have the greatest impact on sales of security systems by their companies in 2019, according to SDM’s study, and some economic forecasts expect growth to slow slightly this year. Gross domestic product (GDP), which measures the value of goods and services produced, is a reliable measure of economic performance. According to a GDP economic forecast by Kiplinger, we can “expect 2019 growth to slow to 2.7 percent from 2.9 percent. Although Americans will keep spending at a healthy clip because of higher wages and low unemployment, the tight labor market will make it difficult for businesses to expand.”

Indeed, the security industry has not escaped the shortage of labor that plagues nearly every business in America. According to Kiplinger, “the short-term unemployment rate (those unemployed for less than six months) is at its lowest level since the Korean War in 1953.” Further, “there are now 1 million more vacancies than there are unemployed Americans.”

The Panel Speaks on Recurring Monthly Revenue

SDM: How do you expect your company’s 2018 recurring monthly revenue (RMR) will have changed compared with 2018? And how do you expect 2019 revenue will change compared with 2018?

Duffy: By the end of 2018, I expect we will have increased our recurring revenue by about 10 percent. I think at the beginning of this year, we were just a little bit over $2.2 million, and we’ll finish up just over $2.4 million at the end of this year. That’s a combination of an acquisition and also organic growth this year.

And next year, I’d expect the number to be anywhere between 5 percent and 10 percent.

The biggest variable for us is our ability to find the right companies to acquire … where they’re at the right stage where they’re either ready to transition and work with us, or the owner is retiring and we feel like the customers have been well taken care of and are prepared to work with someone like Per Mar.

Right now, Per Mar has very close to 40,000 subscribers.

For the organic recurring growth, certainly new size is part of that, but we see even more opportunity in increasing the level of service provided with video and access control — and making those the types of services that customers are willing to subscribe to. So we’re trying to provide the network on an access control system where the customer doesn’t need to provide that or really make the video very interactive where there’s a lot of value in it.

Simmons: In 2018, we will end up with 8 percent increase in recurring revenue over 2017. As we look ahead for 2019, we anticipate a 14 percent increase in recurring revenue. We’ve done a number of things through our Fusion Focus Center to prepare it for managed services, and that’s really feeding the growth.

Gonzalez: In 2018, we will have grown our RMR by about 25 percent. There is a direct correlation between the number of homes that we touch and the number of new customers that we bring on board.

In 2019, we’re hoping to grow by 35 percent. We recently hired what I consider to be just in a titan in our industry in Joe Colosimo, [former president of Guardian Protection Services]. He joined our team for several different reasons, but one of the biggest factors was that he saw the potential in greatly increasing our RMR. He’s helping us look at bringing on new customers in a different way than we were accustomed to — specifically, looking at introducing a mass-market play where not only are we touching the customers that we have helped build their homes, but going after a mass-market security play. We are certainly excited and he is as promised — he’s fantastic.

We will touch about 19,000 homes this year, and we have the opportunity to meet with the homebuyer when they’re building their homes. If we see them in our showroom, we have a significantly higher percentage closing on the RMR side. For the rest of the customers, where builders build spec homes, we have an outside sales team that will meet with the customers as they’re moving into their homes.

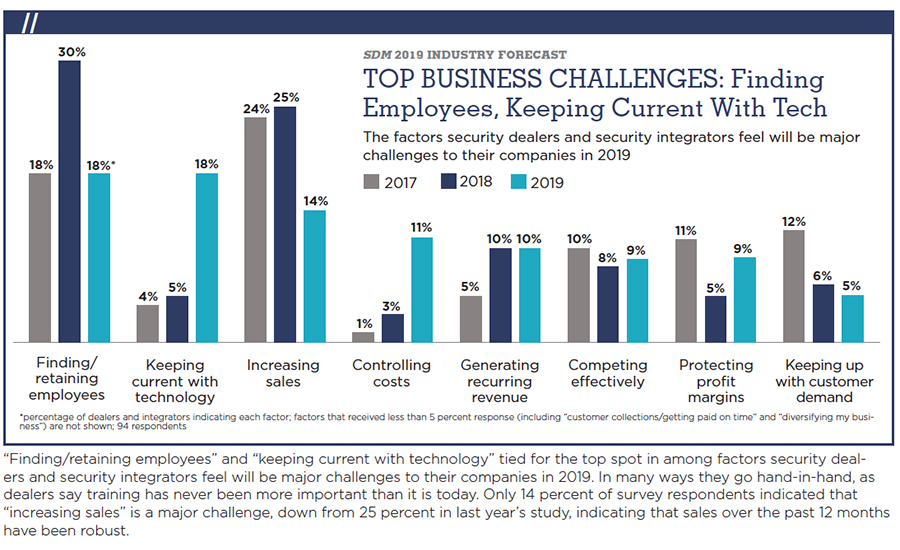

Finding/retaining employees and keeping current with technology, tied as the top factors in SDM’s study that dealers and integrators feel will be major challenges to their companies this year. The Industry Forecast panel concurs that there is a direct correlation between the right employees and sales growth.

“When we do well, it’s because we have great employees and especially great employees that the customers know. When we struggle, it’s because we don’t have great people in front of the customers that they appreciate. It’s really that simple,” Duffy describes.

The Panel Speaks on Competition

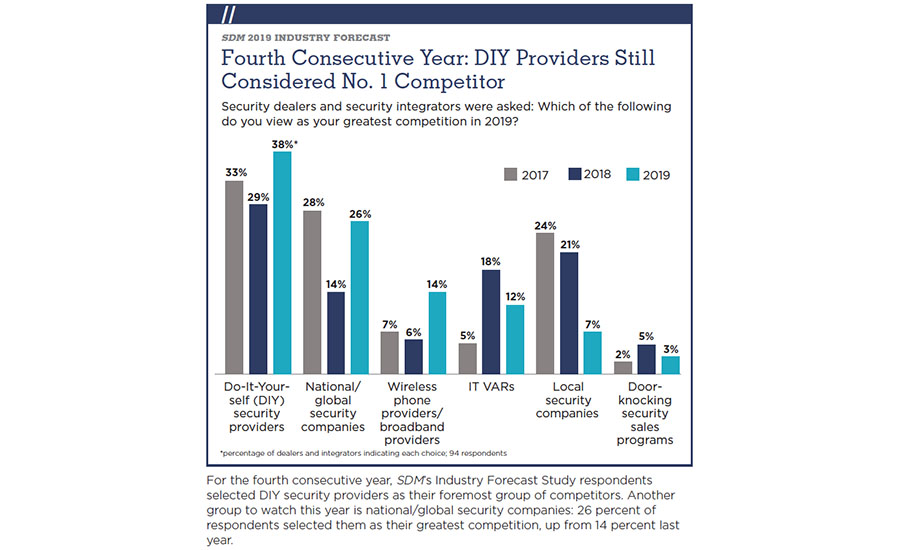

SDM: Which type of company do you view as your greatest competition in 2019 and why?

Duffy: For us, it really is our local competitors. We are striving all the time to try to replicate the personal touch that they are able to provide to their customers as we scale up. When I’m out talking to our sales reps, they much more often are having problems competing with our local competitors than they are with the nationals. So given the way that we go to market, those are our greatest competitors.

Our electronic security services and our fire alarm services are primarily provided in secondary and tertiary markets. So not only are we in the Midwest, but we’re not in the big cities in the Midwest selling those things. In those markets, there’s just not as much of a focus for someone who’s trying to sell across the whole country. We have local offices there, and we are really trying to be as local as we possibly can, even as we grow.

There was a time when my parents knew every salesperson, installer, and security officer — and that is just very hard for us to have personal relationships with a huge number of our employees at this point. So we really try to place a lot of trust in the people in between the family and the front line in order to decide what’s right for the customer.

We have about 2,500 employees; without the security officer division, it is right around 375.

Simmons: I think the local integrators are always the best competition. They usually are close to the clients and do a really good job. That’s been true for many years and I think it’ll remain true because of that local touch.

The national/global companies actually probably give us more opportunities than anybody. Generally, when they make an acquisition, within a year the customer base is upset [and] we get phone calls from those customers. But we don’t view them as the competition as we do the local integrators, which we have a lot of respect for.

[Tech Systems] really hasn’t changed at all. We have grown, but Darryl Keeler, the founder of Tech Systems, still has that same philosophy and focus in both the product and the culture, and it stands for our customers’ ultimate satisfaction.

It’s a tough thing to do, but we try to keep it like a family-owned business. We’re an ESOP company, an employee-owned company. Darryl is doing a great job of taking that focus and mentality and pushing it down to the employees and saying “This is your company now. What are you going to do with it?”

That’s the driver for Tech Systems — shifting the ownership from Darryl to the employees. It’s a journey and it takes a little while to get there, but then they realize they own part of it. Each year you see more and more buy in [to] becoming part of the ownership of the company.

Gonzalez: We feel that our biggest competition are the low-cost, no-contact local security companies in our markets. We certainly will monitor and try to understand what the Googles, and the Nests, and the Apples are trying to do. But we believe that they are contributing to getting the message out there about the possibilities and the potential of what you can do from a home technology perspective. We feel like they’re helping us educate the customers on what’s available.

But our biggest competition are the local integrators and local security companies that are offering lower-cost and no

“Finding talented people in this stressed labor market presents some challenges for us,” Gonzalez says. “You’re only as good as the folks that are representing you in front of the customer to try to get that ultimate sale and finding that person can sometimes be challenging.”

Although the labor market may make it difficult for security companies to grow their sales, one factor that may help is the expectation for businesses to increase their spending this year. “Despite the unease over trade, the U.S. economy is quite strong. We look for a 7 percent increase in business spending this year, partly to cope with growing worker shortages,” according to the Kiplinger economic reports, adding that the slower GDP pace “will result partly from a waning in the fiscal stimulus applied [in 2018] – the $1.5 trillion tax cut. The tax bill included incentives to increase business equipment spending, leading to a significant pickup in 2018 spending. Business organizations now worry that tariffs and a more acrimonious trade war with China will undo those gains.”

The Panel Speaks on What Keeps Them up at Night

SDM: What is the one factor you think will present the biggest challenge to your company in 2019?

Duffy: Finding and retaining employees. I would say, especially given the number of businesses and markets that we operate in, I’ve been able to see it really at work. We’ve got a lot more successes than failures, or we wouldn’t be where we’re at. But when we do well, it’s because we have great employees and especially great employees that the customers know. When we struggle, it’s because we don’t have great people in front of the customers that they appreciate. It’s really that simple.

We have increased our recruiting staff; we had one recruiter and we now have two, so we’re trying to make sure that we are constantly recruiting so that we can be as selective as possible when we’re finding people. And inside the alarm division, focusing on sales and technical staff, which tend to be the primary positions that we hire — we do our absolute best in order to give them control over what they’re able to sell or what they’re able to install, and not capping their ability to improve and be rewarded for that.

We don’t view it like we’re looking for people that need hand-holding in order to get to the top. We want to find people that we can provide with opportunity, that are self-directed learners, and then reward them for doing that inside of our company.

Gonzalez: I wish I could provide you with a different answer, but it’s going to be a resounding consensus across the board: finding, hiring and retaining employees. Thankfully, unemployment figures are low, especially in Texas. As a result, finding talented people in this stressed labor market presents some challenges for us. You’re only as good as the folks that are representing you in front of the customer to try to get that ultimate sale and finding that person can sometimes be challenging.

There’s a direct correlation between the number of security accounts, based on the number of folks out there that you have in the field selling your products. That is a huge focus to continue to make sure that we keep a full sales staff out there. Technicians are just as important.

Let’s not forget that training is also critical for our industry in the ever-changing and ever-evolving home technology space. Our technicians are always learning and taking classes from our manufacturers and from some in-house training that we do, as well.

Simmons: I’ll have to go along with what was just said: finding and retaining employees. Yeah, we had pretty strong growth and have grown geographically. To keep that focused culture, it’s hard to find that employee. Generally, you wash out pretty fast at Tech Systems if you don’t have it. Our challenge is saying to people “Believe in it. Really, do whatever it takes to take care of the client.”

Just like what was just stated, it’s who you have in front of the customer. Where we have successes it is somebody that’s in front of the customer that really cares and takes ownership in that. People are the key to the business.

We spend hundreds of thousands of dollars in training every year, plus we’ve [developed] a lot of things in-house. Once we bring somebody on, we make quite an investment in them the rest of their career, because it doesn’t stop the first year. There are lots of certifications you have to have in our market. Whether it be Cisco, Microsoft, and obviously the manufacturer certifications, there’s a lot of money you have to spend to get an employee up to speed in our business and keep around. The technology is changing so quickly, you have to keep reinvesting in the employees.

SDM: Do you have any advice for a smaller integrator who doesn’t have a dedicated staff for training?

Simmons: First, understand your market and make a list of what training is important for the industry you’re in — for the market that you’re serving, what’s important. Then, try to work with the manufacturers to get as much free training as you can. Then bring it in-house. Sometimes it’s very simple things that you can do. There are things that manufacturers don’t teach that you want to make sure your people know, and that gives you the edge over the competition who doesn’t do that.

So, it’s putting down the things that are important to your market, finding out what you can do free and then, what you need to do in-house.

Simmons at Tech Systems is keeping economic conditions in sight, because of the link with capital spending by businesses.

“We’ve experienced several years of a great economy. The corporations we deal with have increased their capital spending; they have released money that they’d been holding to do projects — and that has really helped fuel the growth of the last several years.

“If our economy were to tank, I am concerned that people would be cautious again, and maybe not spend money that’s already budgeted for in 2019. It’s just the uncertainty with all of the things going on with trade tariffs and what have you, and how their management will react to that. It’s just the uncertainty in the market, which is why we’re seeing the stock market go crazy lately. And nobody likes uncertainty,” Simmons says.

The Panel Speaks on Productive Market Sectors

SDM: What market sectors do you expect to have the most success with in 2019? Where do you see the growth coming from?

Duffy: This answer is a little bit different in every market. We’re not organized around verticals; we’re more organized around geographies where in a specific market, we’ll find one niche and expand it inside that market.

In general, we’ve had good success as far as larger commercial goes and healthcare, and then in critical infrastructure. We’ve had good growth this year. I’d expect that to continue across our footprint.

As far as geography, Des Moines, Iowa, is a market that has really grown quite a bit. Madison, Wis., is a market that’s done well. We continue to be happy with our strategy of not going full-in on the huge markets.

Simmons: Our sweet spot is the enterprise market. About 40 percent of our business comes from that vertical. A lot of large corporations we work with, we do everything in the United States and, in some cases, around the world and link all the buildings together.

Financial institutions probably make up about 30 percent. Financial institutions [meaning] the large credit card processing companies and things of that nature that need a high-security presence and are willing to pay for it.

Hospitals/healthcare is a huge market for us, at about 20 percent, and expanding today. It is one of our fastest-growing verticals. As they consolidate, we seem to have some pretty good answers for them.

Then I’d say 10 percent in all other markets.

We’ve got a group of professional services guys that are scary smart; I call them the “propeller heads.” They can write all kinds of interfaces between the HR databases and the card access databases. The product we sell is being able to interface things that just don’t come off the shelf.

For the hospitals, we do infant protection in addition to the other things, and being able to interface the infant protection into the card access and CCTV is a differentiator because we can do all of it. Sometimes, you have a company that can do one or two, but not the whole package.

Gonzalez: We expect to have the most success in our core industry, which is the residential new construction market. We’ve built our business around the residential security customer, and in 2019, there’s going to be a continued focus to grow in this area, both by increasing our market penetration in Dallas, Houston and Austin, but also by geographic growth — by stretching out into San Antonio and the surrounding communities.

Gonzalez keeps a close eye on the residential building business, due to HomePro’s niche. According to the National Association of Homebuilders, total housing starts are expected to increase slightly to 1.268 million in 2019 from 1.258 million in 2018.

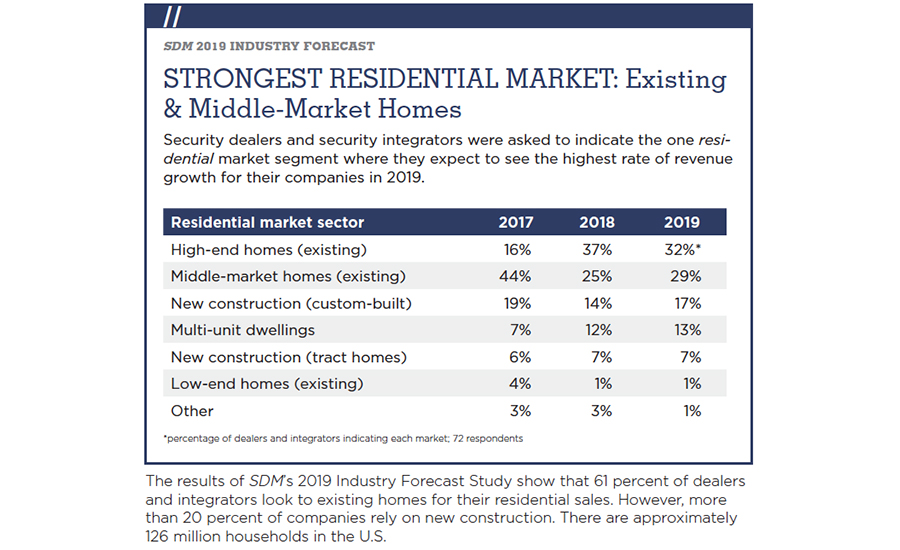

Among security dealers and security integrators responding to the SDM Industry Forecast Study, 78 percent had residential security system sales in the past 12 months. Among this group, 61 percent will look to existing high-end and mid-market homes for their residential sales this year. However, more than 20 percent of companies relies on new construction. There are approximately 126 million households in the U.S.

Consumer confidence could produce a positive effect on security spending. “Despite a small decline in November, Consumer Confidence remains at historically strong levels,” said Lynn Franco, senior director of economic indicators at The Conference Board, adding that if expectations continue to soften in the near term, the pace of growth would likely change.

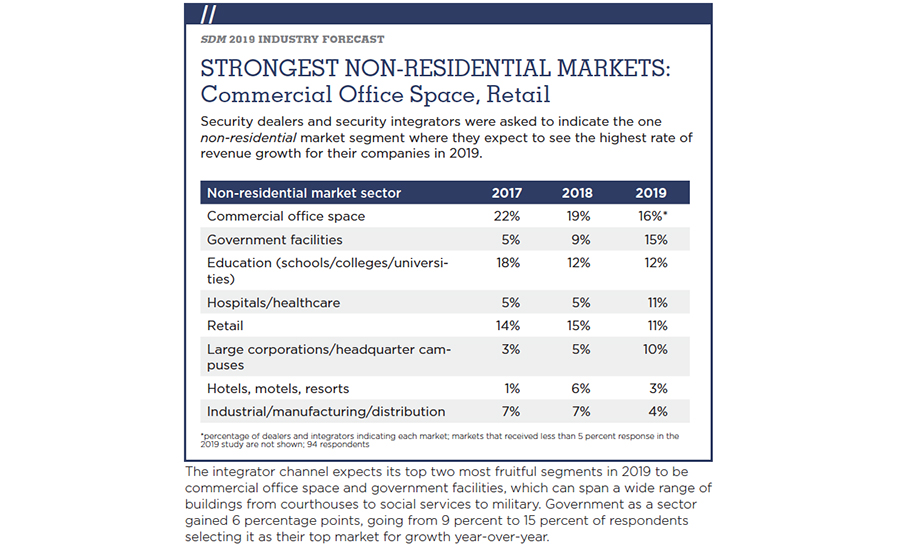

The integrator channel expects its top two most prolific non-residential segments in 2019 to be commercial office space and government facilities, which can span a wide range of buildings from courthouses to social services to military. Government as a sector gained 6 percentage points, going from 9 percent to 15 percent of respondents selecting it as their top market for growth year-over-year.

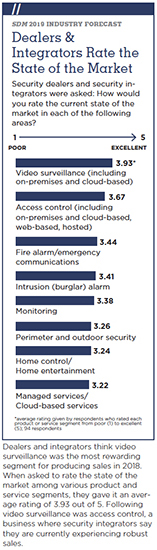

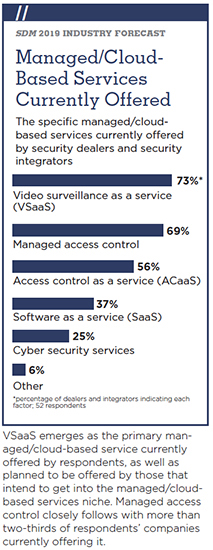

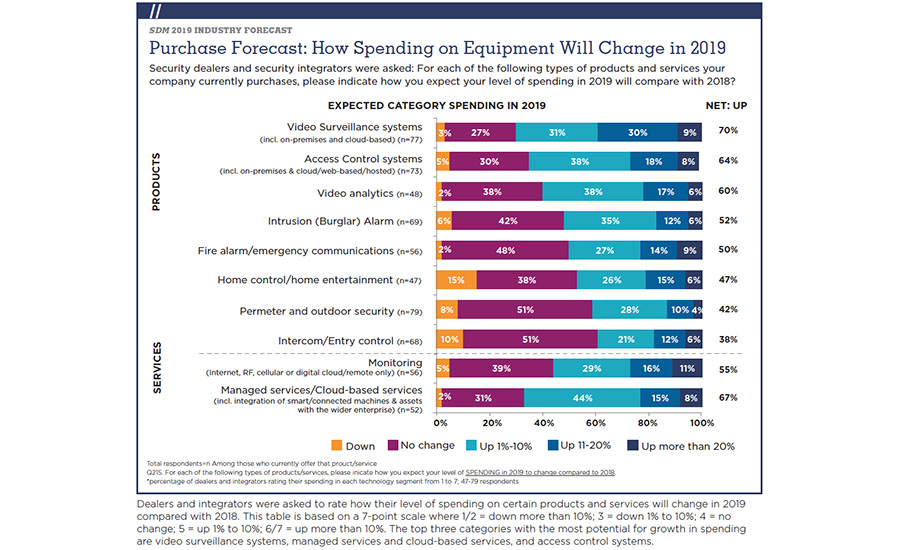

Based on their expected spending levels in various product and service categories, growth will come from the top three categories of video surveillance systems, managed services/cloud-based services, and access control systems, according to the survey respondents.

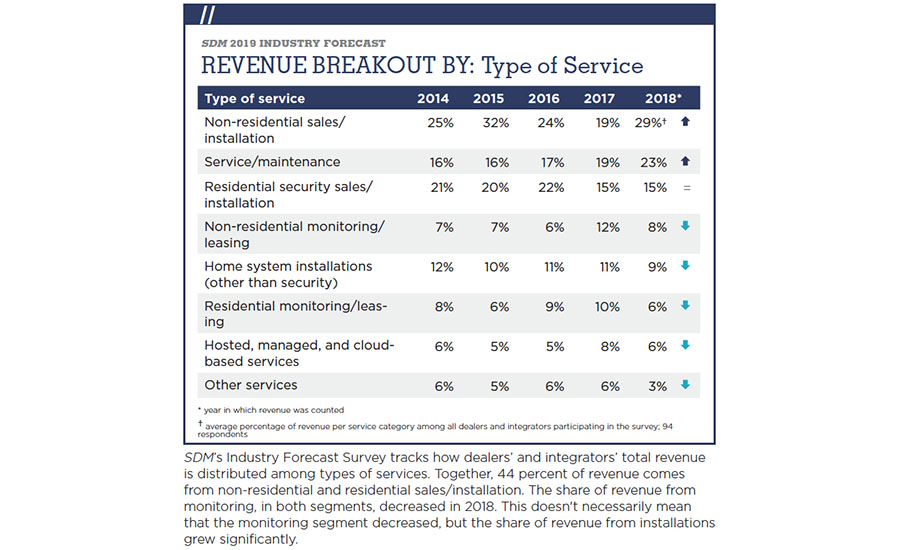

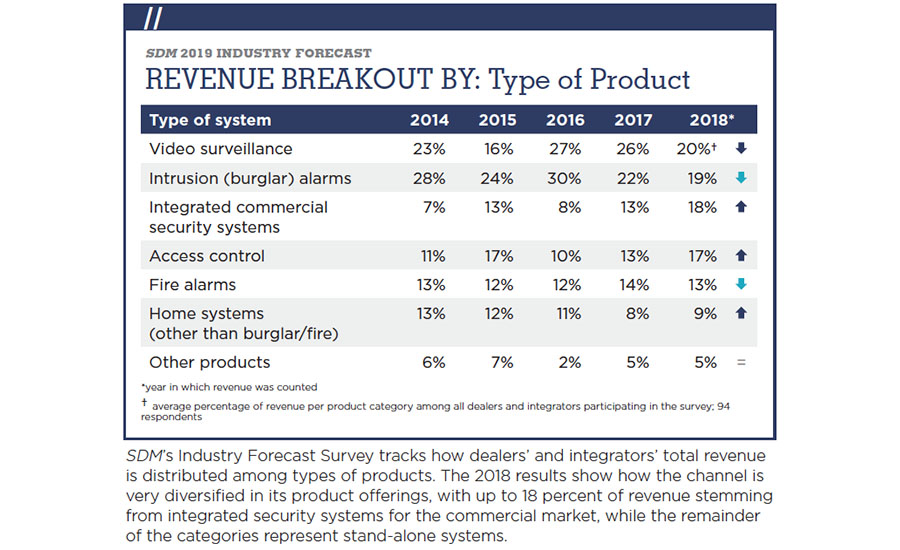

SDM’s Industry Forecast Survey tracks how dealers’ and integrators’ total revenue is distributed among types of services. Together, 44 percent of revenue comes from non-residential and residential sales/installation. The share of revenue from monitoring, in both segments, decreased in 2018. This doesn’t necessarily mean that revenue from the monitoring segment declined, but that its share fell correspondingly in relation to the share of revenue from installations, which grew significantly.

“What we have found is that there is a lot of opportunity in the project space — access control and video surveillance. We have found quite a bit of opportunity there to grow. We’re a very service and recurring revenue-focused company, but I think we’ve found it a little bit easier in our markets to grow on the installation side,” Duffy described.

The Panel Speaks on New Products & Services

SDM: What, if any, new revenue-generating services or products did your company add in 2018?

Duffy: A lot of this at Per Mar stems from our ability to deploy technology better. What we’ve tried to do whenever possible is utilize it to add more value to our existing services, as opposed to charge for it. For example, texting alarm signals is something that we’re embracing and transmitting a lot of those by either text or by e-mail for the lower-priority signals; and even though there is a minor cost associated with that, there’s no reason to charge our customers what they’re [getting] relative to the service that we’re already providing. We’ve also deployed notifications when we’re sending a technician — when we’re scheduling, when we’re en route, when we’re finished. Customers get all those things over e-mail, such as a picture of the technician. Those add value to our service.

One thing I mentioned before is related to video — monitoring the health of our video systems and having our central station or our monitoring center be a part of that in order to fulfill for the customer around-the-clock is one additional way that we’re adding value.

Simmons: About three-and-a-half years ago, we purchased a building with an intent of hosting managed services. We’ve come along, and this year we achieved a lot of milestones. We received our UL/UUFX certification in the beginning of 2018. It provides guidelines and requirements around the facility and staffing, so for credibility we felt like that was important.

Another thing that we achieved at the end of 2017 is ISO-27001, the information security policy. In the markets we’re in, our customer often is the IT guy. For instant credibility, they want to know if you understand what you’re doing. We were already 9001, which is quality management. So to become a 27001, which is information security management, we have some instant credibility, because they know that we have good “cyber hygiene,” as I like to call it.

The managed services piece for us is really beginning to take off, that’s where we see our greatest growth. We put in Bold Manitou alarm monitoring software this year. We also put in SureView Immix. So we have the platforms that’ll let us scale with our clients. Unlike the traditional central station, we’re going after more of the managed services.

I haven’t seen anybody else invest the money that we’ve invested in this to get to that level. We’ve spent three years preparing for it, spending money in training, getting certifications — and the pay back is just beginning to come. It’s been a journey, but the fact that we became ISO certified — there are three contracts we won this year solely because nobody else can compete because that was a requirement. These are high-level, enterprise-type clients. I expect that number will triple this year.

Our industry is going that way. I think that the industry as a whole has not reacted to it, so we have tried to get ahead of the curve of what our clients will expect.

Gonzalez: My answer to this question is home automation. Although home automation has been a cornerstone for HomePro for a few years now, we’ve really seen an explosion in 2018 from our builders. More and more builders now understand the importance of home technology, and there’s a demand for it. So from the builders’ perspective, their homebuyers are now asking the builders for these types of things in their homes.

It’s up to us as integrators to find the right solution for their buyers. We’ve seen some national programs roll out from builders installing some of these home automation systems as standard. We’ve fielded many questions and we’ve provided solutions to some of our partners, as well. Not only is that great on the front end, but we’re seeing higher attachment rates, we’re seeing lower attrition when these homebuyers are more engaged with these home automation systems.

Editor’s Note: This article is based primarily on a report produced by Clear Seas Research, “2018 Security Systems Usage: SDM Industry Forecast,” Nov. 2018. To learn more about the report or to purchase, visit https://clearseasresearch.com/product/2018-state-of-the-industry-sdm-security-systems/?r=9

Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

More Online

Are you using SDM’s Industry Forecast Study data for 2019 business planning? More than a dozen tables and graphs from the 2019 Industry Forecast Study are available online at www.SDMmag.com/annual-security-industry-forecast.