SDM 2019 Top Systems Integrators Report: Security Projects Coming From All Market Sectors

Security integrators ranked on the 2019 Top Systems Integrators Report collectively grew at least 14 percent last year. Demand is abundant and stemming from every market sector.

Security integrators ranked on SDM’s 2019 Top Systems Integrators Report describe the 2018 market for integrated security systems as “strong,” “hot” and “accelerated” — all apt terms, given that the nation’s largest integrators grew their systems integration revenue by at least 14 percent last year. In their estimations, the market was driven by elevated visibility of the myriad benefits of physical security, and was made possible by excellent economic conditions.

“2018 was stronger across the board for security systems projects. The continued strong economy enabled strong customer spending,” according to GSI, ranked No. 14 with $37.3 million in systems integration revenue, a 16.7 percent increase over its prior-year financial performance.

Here is how MidCo Inc., ranked No. 25, describes the market: “Strong. Many leads coming to us for funded projects. Work coming from all markets.”

The market for integrated security systems was “stronger across the board,” notes Dallas Security Systems Inc. & DSS Fire Inc., ranked No. 26.

“The market was very strong. In fact, we consistently sold more than our capacity to install,” says No. 27, Mountain Alarm.

The 2019 Top Systems Integrators Report ranks security integrator companies by their North American systems integration revenue, which includes solutions such as design, project management, product, installation, programming, start-up, and training sold directly to an end-user customer or through a tier of contractors.

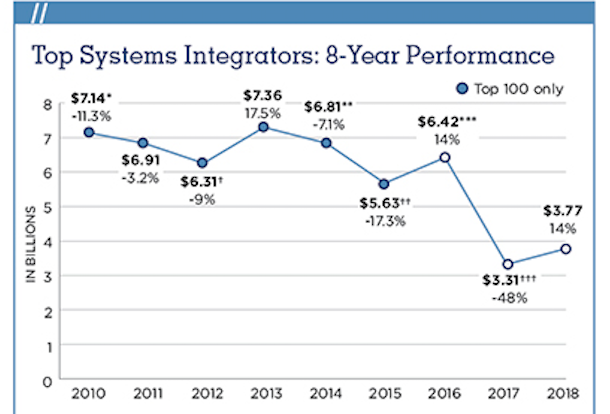

Total North American systems integration revenue — which is different from total annual revenue — for the 100 ranked companies reached $3.77 billion in 2018, a 14 percent increase over 2017. In addition, security integrators started 167,894 new projects in 2018, up from 104,788 in 2017. (See the chart, “Top Systems Integrators: Group Synopsis,”.)

While the 14 percent growth rate applies to financial results for all 100 ranked companies in 2019 compared with 2018, there is also another way to look at their performance. Among companies for which a year-to-year comparison could be made (comparing only those 80 companies ranked in both years), security systems integration revenue actually increased by as much as 34 percent.

“The market was very strong with all segments having tremendous growth in 2018. We had significant growth with Fortune 500 campuses, national multi-site retail, higher education, K-12 education, commercial property management and government,” remarks first-time ranked Star Asset Security, No. 28.

About the SDM Top Systems Integrators Report

The SDM 2019 Top Systems Integrators Report ranks North American companies by their security systems integration revenue. This ranking is based on data provided to or, in a few cases, estimated by SDM. Ranked companies were asked to submit either an audited or reviewed financial statement, or a copy of their income tax return showing total gross receipts for the stated period. The vast majority of the firms ranked are privately held.

The main table, ranks 100 companies by their North American revenue in 2018 from their security system integration projects. Integration includes solutions such as design, project management, product, installation, programming, start-up, training, and time-and-materials-based service sold directly to an end-user customer or through a tier of contractors. This includes revenue related to security, such as: access control, ID/badging, video surveillance/analytics, intrusion alarms, perimeter security, electronic gate entry, intercom/communications, fire protection, IT/networks, etc. It does not include recurring monthly revenue (RMR), as that is counted towards ranking on the SDM 100 Report.

Note: an e following the figure indicates it is an SDM estimate.To find a company by name, use the alphabetical index.

The top three market segments that provided the most significant sources of revenue in 2018 were: commercial office space, education and healthcare (see list of top 10 market sectors here). The top three were unchanged from 2017. In addition, other sectors security integrators found to be productive were new construction, enterprise tenant space, state and local government, multi-family, national retail accounts, cannabis production and dispensaries, transportation, utilities, and financial — to name just some.

“2018 proved to be a big year for construction activity in and around the Boston area and therefore integrated system projects were definitely up compared to 2017. The market proved to be very strong. We saw major growth in the higher education, healthcare, and pharma market segments,” notes CGL Electronic Security Inc., No. 43. The company reported $11 million in security systems integration revenue, up 29.8 percent from the previous year.

“Market was strong. Our continued growth in healthcare and education/school security has been a very strong portion of our business and given the environment based on recent events it will likely continue to increase exponentially. Hosted/managed solutions is still a strong focus for us and we are seeing an increase in acceptance in these types of solutions in the marketplace,” describes No. 17-ranked Integrated Security Technologies.

Although the vast majority of integrators had a mutual experience of very high demand and above-average sales, several did not and they attributed it to competition and resultant pricing pressures. When asked if their net profit margin increased, decreased, or stayed the same last year, 53 percent of security integrators said it had increased; the average increase was 8 percent.

“The market was strong for business, particularly in the education sector. However, margin erosion occurred with increased competition and pricing pressure,” notes No. 23, A+ Technology & Security Solutions Inc.

Many of the security integrators cite an uptick in sales of cloud solutions to their clients. Although hosted/managed services, including cloud, currently account for only 3 percent of all sales revenue, integrators believe that will decidedly increase.

“2018 saw a marked rise in security systems and integrated systems sales, particularly in the IoT and cloud services sector. Manufacturers continued to respond with solid and secure cloud services as end users looked to reduce the need for large servers and the resultant IT requirements, as well as free up wall space traditionally utilized by security requirements. The largest growth was exhibited in cloud-based access systems, up 17 percent by some industry measurements; and while smaller systems (four to 12 doors) were a key growth area, especially in tenant spaces and storefronts, larger enterprise-class customers are beginning to look to this model, as well,” describes RFI Communications & Security Systems, No. 13.

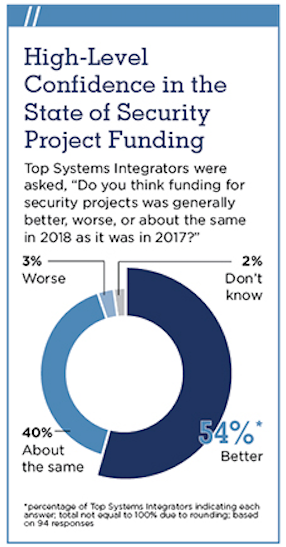

Cloud platforms often help end users secure funding more easily, perhaps a reason more than half (54 percent) of Top Systems Integrators think funding for security projects was generally better in 2018 than it was in 2017; 40 percent say it was about the same. There was “less growth in traditional hardware-based systems” and “more opportunities in cloud-based solutions,” concurs American Alarm & Communications, No. 35.

“In general, this is a function of a strong economy, and a continued heightened awareness of both security and the desire for deeper intelligence in facilities that incorporate automation, access control and an ever-growing demand for video surveillance that can both protect and monitor employees and visitors,” describes No. 24-ranked ADS Security of the funding environment.

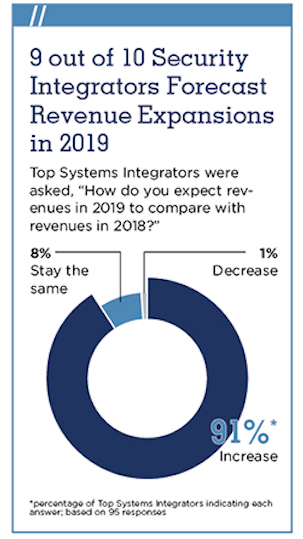

What’s in store for the remainder of this year? More than nine of 10 Top Systems Integrators (91 percent) expect their 2019 revenues to exceed 2018’s, which is just slightly less than the prior year’s 94 percent of integrators who thought the same.

“The economy remained strong in 2018 and security had ever-increasing importance and visibility,” says Rapid Security Solutions LLC, No. 71.

“Consumer confidence should remain solid, at least until the next election cycle. Commercial customers are willing to invest to update aging systems, renovate and expand facilities. Recent events at schools and workplaces are driving awareness of the need to provide additional security protection,” says No. 75, EMC Security.

Awareness of the effectiveness of security, the greater affordability of solutions, and a thriving economy are the central elements of last year’s success among Top Systems Integrators — and key to keeping the work coming in from all market sectors in 2019.

The 2019 Top Systems Integrators Report

24th Annual Report

View/Download this table as a PDF

| 2019 Rank |

2018 Rank |

Company & Headquarters Location | North American Systems Integration Revenue, 2018 | Number of New Projects, 2018 | Largest Project Size | Smallest Project Size | Top 3 Markets Contributing to Revenue | Full-time Employees | Business Locations |

| 1 | 1 | Convergint Technologies Schaumburg, Ill. |

$1,068,385,542 | 18,550 | $14,710,000 | $2,500 | office, financial, govt | 3,689 | 113 |

| 2 | 2 | ADT Boca Raton, Fla. |

$471,734,000e | na | na | na | na | 19,000 | 200 |

| 3 | 3 | Securitas Electronic Security Uniontown, Ohio |

$359,000,000 | na | na | na | na | 1,400 | 30 |

| 4 | 6 | Vector Security Inc. Warrendale, Pa. |

$252,214,889 | 6,400 | $500,000 | $99 | office, retail, health | 1,172 | 33 |

| 5 | 7 | G4S Secure Integration LLC Omaha, Neb. |

$172,694,270 | 2,041 | $5,566,730 | $600 | na | 634 | 20 |

| 6 | 11 | Allied Universal Technology Services Santa Ana, Calif. |

$121,000,000 | 1,768 | $3,400,000 | $1,000 | industrial, education, utilities | 519 | 27 |

| 7 | 5 | Kastle Systems International Falls Church, Va. |

$107,000,000 | na | $1,400,000 | na | office, financial, govt | 545 | 13 |

| 8 | 9 | Tech Systems Inc. Duluth, Ga. |

$66,927,200 | 1,400 | $1,144,280 | $30,000 | office, health, financial | 350 | 2 |

| 9 | 10 | Unlimited Technology Inc. Chester Springs, Pa. |

$55,950,570 | 561 | $5,764,138 | $1,035 | utilities, industrial, health | 134 | 6 |

| 10 | Surveillance Systems Inc. Rocklin, Calif. |

$50,740,199 | 81 | $15,000,000 | $3,500 | gaming, education, industrial | 51 | 7 | |

| 11 | 12 | A3 Communications Inc. Irmo, S.C. |

$45,326,049 | 1,212 | $950,175 | $102 | education, govt, financial | 142 | 6 |

| 12 | 15 | AFA Protective Systems Inc. Syosset, N.Y. |

$45,013,000 | 7,788 | $1,100,000 | $500 | retail, airports, office | 372 | 16 |

| 13 | 13 | RFI Communications & Security Systems San Jose, Calif. |

$41,300,000 | 1,923 | $1,300,000 | $2,300 | na | 176 | 4 |

| 14 | 19 | GSI Troy, Mich. |

$37,300,053 | 889 | $2,097,400 | $250 | industrial, utilities, office | 117 | 4 |

| 15 | NextGen Security LLC Exton, Pa. |

$36,400,000 | 1,369 | $6,200,000 | $12,350 | industrial, utilities, health | 116 | 2 | |

| 16 | 18 | Entech Sales and Service LLC Dallas, Texas |

$33,170,000 | na | $2,357,825 | $1,000 | health, education, telecom/data center | 287 | 6 |

| 17 | 23 | Integrated Security Technologies Herndon, Va. |

$27,000,823 | 507 | $3,479,756 | $2,500 | govt, education, health | 112 | 3 |

| 18 | 25 | Per Mar Security Services Davenport, Iowa |

$26,306,167 | 1,703 | $250,000 | $0 | retail, industrial, office | 330 | 18 |

| 19 | 20 | Security Corporation Novi, Mich. |

$25,305,862 | 1,248 | na | na | utilities, financial, office | 113 | 2 |

| 20 | 40 | DynaFire Inc. Casselberry, Fla. |

$24,994,311 | 925 | $2,200,000 | $195 | hotel, entertainment, education | 253 | 6 |

| 21 | 27 | Advanced Electronic Solutions College Point, N.Y. |

$24,750,200 | 312 | $7,200,000 | $28,650 | office, health, airports | 88 | 3 |

| 22 | 26 | Interface Security Systems Holdings Inc. Earth City, Mo. |

$23,528,149 | 36,549 | $850,000 | $0 | retail, hotel, office | 617 | 12 |

| 23 | A+ Technology & Security Solutions Inc. Bay Shore, N.Y. |

$23,400,000 | 163 | $2,700,000 | $1,029 | education, govt, law | 96 | 2 | |

| 24 | 32 | ADS Security L.P. Nashville, Tenn. |

$22,384,497 | 33,338 | $417,361 | $0 | retail, office, industrial | 480 | 25 |

| 25 | 29 | MidCo Inc. Burr Ridge, Ill. |

$22,290,100 | 1,550 | $1,477,000 | $4,500 | office, industrial, education | 98 | 3 |

| 26 | 39 | Dallas Security Systems Inc. & DSS Fire Inc. Dallas, Texas |

$22,219,959 | 1,250 | $365,000 | $299 | health, office, education | 153 | 2 |

| 27 | 28 | Mountain Alarm Ogden, Utah |

$21,937,580 | 500 | $200,000 | $99 | education, govt, utilities | 244 | 11 |

| 28 | Star Asset Security Orlando, Fla. |

$21,350,000 | 2,409 | $600,000 | $1,000 | retail, govt, health | 158 | 10 | |

| 29 | 30 | Minuteman Security Technologies Inc. Andover, Mass. |

$19,442,913 | 1,035 | $4,515,680 | $1,000 | transport, health, education | 70 | 10 |

| 30 | Sound Inc. Naperville, Ill. |

$19,000,000 | na | $4,500,000 | $1,850 | office, health, education | 112 | 1 | |

| 32 | 34 | TRL Systems Inc. Rancho Cucamonga, Calif. |

$18,000,000 | 1,515 | $500 | $1,000 | office, health, education | 49 | 5 |

| 31 | 42 | RedRock Security & Cabling Inc. Irvine, Calif. |

$18,000,000 | 300 | $3,000,000 | $30,000 | office, industrial, education | 220 | 3 |

| 33 | 44 | Stone Security Salt Lake City, Utah |

$17,669,670 | 669 | $1,270,122 | $225 | education, office, govt | 60 | 2 |

| 34 | 38 | The Protection Bureau Exton, Pa. |

$17,595,869 | 784 | $1,700,000 | $99 | office, education, financial | 88 | 4 |

| 35 | 35 | American Alarm & Communications Arlington, Mass. |

$16,167,798 | 4,001 | $374,868 | $50 | property mgmt, health, office | 237 | 6 |

| 36 | 49 | 3Sixty Integrated San Antonio, Texas |

$15,873,367 | 300 | $1,498,000 | $10,000 | retail, education, govt | 53 | 1 |

| 37 | 43 | Midstate Security Company Wyoming, Mich. |

$15,846,090 | 520 | $6,000,000 | $450 | correctional, education, health | 79 | 1 |

| 38 | 37 | Security Equipment Inc. Omaha, Neb. |

$15,127,290 | 385 | $255,180 | $99 | education, utilities, transport | 165 | 5 |

| 39 | 51 | JSC Systems Inc. Jacksonville, Fla. |

$14,570,116 | 216 | $625,638 | $800 | health, education, govt | 126 | 8 |

| 40 | 45 | FE Moran Security Solutions Champaign, Ill. |

$12,963,510 | 3,075 | $289,126 | $0 | retail, financial, office | 153 | 6 |

| 41 | Ojo Technology Fremont, Calif. |

$12,372,549 | 217 | $2,000,000 | $25,000 | education, transport, govt | 36 | 3 | |

| 42 | 48 | PASS Security Fairview Heights, Ill. |

$11,866,835 | 600 | $2,425,000 | $1,000 | utilities, education, health | 51 | 1 |

| 43 | 53 | CGL Electronic Security Inc. Westwood, Mass. |

$11,033,433 | 622 | $1,766,000 | $2,500 | education, health, industrial | 44 | na |

| 44 | 50 | SSD Alarm Anaheim, Calif. |

$10,814,496 | na | na | na | na | 220 | 10 |

| 45 | Koorsen Fire & Security Indianapolis, Ind. |

$10,359,400 | 1,322 | $185,000 | $350 | industrial, education, financial | 1,016 | 24 | |

| 46 | 56 | Bates Security / Sonitrol of Lexington Lexington, Ky. |

$10,141,152 | 948 | $158,870 | $0 | education, office, retail | 85 | 3 |

| 47 | 57 | Will Electronics St. Louis, Mo. |

$9,617,340 | 426 | $513,962 | $895 | utilities, health, office | 31 | 1 |

| 48 | 58 | Sentry Communications & Security Hicksville, N.Y. |

$9,100,000 | 20 | $850,000 | $1,000 | office, transport, health | 65 | 4 |

| 49 | 59 | Vision Security Technologies Birmingham, Ala. |

$8,999,018 | 350 | $900,000 | $1,500 | education, govt, industrial | 41 | 3 |

| 50 | 63 | Ackerman Security Systems Norcross, Ga. |

$8,681,392 | 899 | $950,000 | $99 | education, retail, transport | 245 | 5 |

| 51 | 66 | Atronic Alarms Inc. Lenexa, Kansas |

$8,391,992 | 852 | na | na | na | 94 | 3 |

| 52 | 54 | APL Access & Security Inc. Gilbert, Ariz. |

$8,034,477 | 100 | $750,000 | $5,000 | office, govt, industrial | 43 | 2 |

| 53 | 52 | Guardian Protection Services Warrendale, Pa. |

$7,741,024 | 3,198 | $536,271 | $0 | industrial, office, health | 1,035 | 16 |

| 54 | 60 | Ollivier Corporation Los Angeles, Calif. |

$7,625,800 | na | $948,205 | $1,110 | na | 30 | 1 |

| 55 | 70 | D/A Central Inc. Oak Park, Mich. |

$7,000,995 | 82 | $453,000 | $5,000 | utilities, industrial, financial | 42 | 3 |

| 56 | 71 | Scarsdale Security Systems Inc. Scarsdale, N.Y. |

$6,970,952 | 2,301 | $350,000 | $0 | retail, airports, office | 93 | 2 |

| 57 | 82 | Sonitrol New England Rocky Hill, Conn. |

$6,576,845 | 1,103 | $181,255 | $500 | education, office, industrial | 108 | 6 |

| 58 | 61 | Strategic Security Solutions Raleigh, N.C. |

$6,464,927 | 500 | $350,000 | $500 | office, health, education | 16 | 1 |

| 59 | 76 | Peak Alarm Co. Inc. Salt Lake City, Utah |

$6,391,588 | 1,946 | $775,000 | $0 | office, education, industrial | 98 | 5 |

| 60 | 75 | Sonitrol of Sacramento & Orange County, Cybex Security Solutions Roseville, Calif. |

$6,368,854 | 973 | $398,715 | $80 | office, govt, industrial | 49 | 2 |

| 61 | 64 | Atlantic Coast Alarm Inc. Mays Landing, N.J. |

$6,207,535 | na | na | na | govt, health, education | 31 | 2 |

| 62 | 73 | Engineered Security Systems Towaco, N.J. |

$6,064,131 | na | $2,000,000 | $1,200 | office, health, education | 58 | na |

| 63 | 68 | Trinity Wiring & Security Solutions Manassas, Va. |

$6,006,000 | 145 | na | na | office, education, industrial | 61 | 1 |

| 64 | 67 | Custom Alarm Rochester, Minn. |

$5,787,980 | 749 | $257,860 | $99 | health, education, multi-family | 65 | 1 |

| 65 | Briscoe Protective Garden City, N.Y. |

$5,721,569 | 210 | $171,000 | $1,000 | education, hotel, industrial | 133 | 4 | |

| 66 | 86 | Titan Alarm Inc. Phoenix, Ariz. |

$5,610,184 | 912 | $95,000 | $0 | na | 48 | 2 |

| 67 | Detection Systems and Engineering Company Troy, Mich. |

$5,479,139 | 60 | $1,000,000 | $2,500 | financial, govt, industrial | 31 | 1 | |

| 68 | 78 | Apex Integrated Security Solutions Inc. Garden City, Idaho |

$5,451,371 | na | $1,373,000 | $2,800 | health, govt, industrial | 29 | 1 |

| 69 | 65 | Electronic Security Concepts LLC Scottsdale, Ariz. |

$5,443,188 | 350 | $698,000 | $450 | na | 37 | 3 |

| 70 | 74 | Fleenor Security Systems Johnson City, Tenn. |

$5,314,146 | 991 | $391,292 | $150 | office, industrial, health | 67 | 2 |

| 71 | 72 | Rapid Security Solutions LLC Sarasota, Fla. |

$5,029,923 | 191 | $225,886 | $850 | gated community/HOA/condo, retail, education | 36 | 2 |

| 72 | 89 | New York Security Solutions Brooklyn, N.Y. |

$4,814,383 | 350 | $560,000 | $1,000 | correctional, financial, govt | 48 | 3 |

| 73 | 77 | Wilson Fire Houston, Texas |

$4,775,400 | 90 | $540,000 | $10,000 | office, education, industrial | 125 | na |

| 74 | 87 | Sonitrol of Buffalo, Rochester, Toronto Buffalo, N.Y. |

$4,639,187 | 515 | $900,000 | $2,500 | office, industrial, retail | 81 | 3 |

| 75 | 83 | EMC Security Suwanee, Ga. |

$4,500,472 | 682 | $581,866 | $99 | office, education, industrial | 116 | 1 |

| 76 | 47 | Sonitrol SW Ohio Mason, Ohio |

$4,259,058 | 544 | $106,558 | $199 | retail, office, education | 63 | 2 |

| 77 | 84 | Moon Security Services Inc. Pasco, Wash. |

$4,250,000 | 250 | $279,000 | $0 | na | 89 | 3 |

| 78 | 91 | Sonitrol Pacific Portland, Ore. |

$4,197,539 | 475 | $114,593 | $250 | office, education, retail | 103 | 5 |

| 79 | 81 | Kimberlite Corp. Fresno, Calif. |

$3,859,182 | 31 | $87,000 | $499 | education, govt, industrial | 111 | 8 |

| 80 | 79 | SCI Inc. Albuquerque, N.M. |

$3,792,997 | 242 | $540,000 | $25,000 | utilities, education, govt | 18 | 1 |

| 81 | 88 | Redwire LLC Tallahassee, Fla. |

$3,671,285 | na | na | na | govt, health, education | 69 | 5 |

| 82 | Richmond Alarm Company Midlothian, Va. |

$3,550,000 | 550 | na | na | na | 85 | 3 | |

| 83 | 99 | General Security Inc. Plainview, N.Y. |

$2,874,000 | 600 | $310,000 | $99 | education, office, retail | 146 | 8 |

| 84 | 96 | Habitec Security Holland, Ohio |

$2,680,000 | 1,000 | $150,000 | $100 | govt, education, office | 80 | 3 |

| 85 | LOUD Security Systems Inc. Kennesaw, Ga. |

$2,609,366 | 302 | $117,635 | $0 | office, industrial, entertainment | 46 | 1 | |

| 86 | 95 | Sonitrol Security Services Inc. Charlotte, N.C. |

$2,563,969 | 489 | $145,668 | $150 | office, industrial, govt | 54 | 2 |

| 87 | 94 | Acadiana Security Plus Broussard, La. |

$2,551,001 | 372 | $200,390 | $99 | financial, industrial, retail | 75 | 1 |

| 88 | Advanced Security Systems Eureka, Calif. |

$2,229,066 | 901 | $149,000 | $1,200 | education, health, office | 48 | 3 | |

| 89 | Sonitrol Security Systems of the Triangle Raleigh, N.C. |

$2,005,051 | 450 | $125,000 | $200 | office, industrial, retail | 31 | 2 | |

| 90 | Skynet Integrations LLC Tampa, Fla. |

$2,004,824 | na | $480,000 | $1,000 | na | 7 | 1 | |

| 91 | 92 | Post Alarm Systems Arcadia, Calif. |

$1,833,767 | 560 | $200,000 | $299 | na | 148 | 2 |

| 92 | 98 | Valley Alarm Sun Valley, Calif. |

$1,798,438 | 379 | $172,873 | $100 | office, health, govt | 34 | 2 |

| 93 | Alert Protective Services Chicago, Ill. |

$1,710,350 | 351 | $35,400 | $299 | retail, industrial, entertainment | 29 | 1 | |

| 94 | Key Security Designs Corporation Orinda, Calif. |

$1,677,057 | 29 | $340,000 | $7,000 | office, industrial, health | 5 | 2 | |

| 95 | 97 | Secure Pacific Corporation Portland, Ore. |

$1,593,341 | 350 | $81,607 | $250 | construction sites, govt, property mgmt | 34 | 6 |

| 96 | 100 | GHS Interactive Security LLC Woodland Hills, Calif. |

$1,581,000 | 225 | na | na | office, retail, entertainment | 97 | 6 |

| 97 | Fortress Security Arlington, Texas |

$1,388,622 | 488 | $135,000 | $99 | industrial, office, retail | 43 | 2 | |

| 98 | Sonitrol of Evansville Inc. Evansville, Ind. |

$1,352,534 | 235 | $76,800 | $100 | education, office, industrial | 34 | 1 | |

| 99 | Marquee Security Morris Plains, N.J. |

$1,246,997 | 37 | $270,000 | $5,000 | office, health, financial | 19 | 1 | |

| 100 | NVMC Solutions Marietta, Ga. |

$1,188,286 | 94 | $320,380 | $650 | transport, real estate, industrial | 36 | 3 |

e = SDM estimate.

na = not available.

Abbreviations to markets:

airport = airports;

corp = corporate office space;

correctional = correctional;

education = education/campuses;

entertainment = entertainment/sports venues;

financial = financial/banking;

gaming = casinos/gaming;

govt = government;

health = healthcare;

hotel = hotels/hospitality;

industrial = industrial;

law = law enforcement;

retail = retail/restaurants;

transport = transportation/distribution;

utilities = utilities/critical infrastructure.

No. 1 – Convergint completed 10 acquisitions of various sizes and locations across the globe in 2018. Convergint achieved $1 billion in revenue for the first time in the company’s history. SDM’s 2007 and 2012 Systems Integrator of the Year.

No. 3 – SDM’s 2011 Systems Integrator of the Year (as Diebold).

No. 4 – Launching new retail storefronts in Canfield, Ohio, and Ft. Mitchell, Ky. Ongoing leadership in the Automated Secure Alarm Protocol (ASAP).

No. 5 – Company launched a formal Energy vertical, capitalizing on its deep regulated industry expertise. Separately, closed largest long-term service and installation contract for $40 million plus, over a five-year term. SDM’s 2013 Systems Integrator of the Year.

No. 6 – Deployed a more structured and defined Managed Services strategy. SDM’s 2016 Systems Integrator of the Year (as Securadyne Systems).

No. 7 – Opened several new markets, including Atlanta, Ga., Austin, Texas, and Denver, Colo. SDM’s 2015 Systems Integrator of the Year.

No. 8 – SDM’s 2004 Systems Integrator of the Year.

No. 9 – Successfully deployed EXERO, a cloud-based security device management and health management software in order to provide predictive analytics to customers. Exero is a vital tool for predicting networks and maintaining compliance in regulated environments. SDM’s 2014 Systems Integrator of the Year.

No. 11 – Achieved highest revenue in company history in 2018.

No. 13 – Deployed cloud services and mobile apps for project management and the company’s service department.

No. 15 – SDM’s 2017 Systems Integrator of the Year.

No. 17 – Launched IST S.H.I.E.L.D LifeCycle Support & Managed Services Program, along with the associated marketing campaign and resource investment to meet expectations.

No. 20 – Added a Fire Suppression Division.

No. 21 – Company focused on education of and deployment of beta sites for AI, DAS, drones, etc.

No. 23 – Opened 24x7 Managed Services Center.

No. 24 – Acquired by Vector Security, June 2019 (www.SDMmag.com/Vector-acquires-ADS-security)

No. 28 – Landed three new Fortune 50 accounts.

No. 29 – Started new, national branch office expansion.

No. 31 – Accomplished fifth straight year of double-digit growth and consolidated two offices into one new corporate office.

No. 32 – In 2018, TRL completed $1.8 million worth of business related to the cannabis industry in California.

No. 33 – Company named 2018 Axis Education Market Partner of the Year, 2018 Milestone West Partner of the Year, 2018 Anixter Edge – #1 Edge Security Partner.

No. 34 – Signed three long-term contracts for future conversions and upgrades.

No. 39 – Achieved the best year in terms of net profit and total revenue in the company’s 49-year history.

No. 41 – Ojo started in 2003 as an IP video surveillance and IT networking company, and only became involved with other systems such as access, intrusion, intercom, etc., as recently as two or three years ago. In 2018 it set a specific goal to build sales in these new systems to exceed video system sales, and the company met its goal to become a true security systems integrator.

No. 42 – Company enhanced its project management capabilities, introduced a new website, and created business development strategies.

No. 46 – SDM’s 2018 SDM Dealer of the Year.

No. 50 – Launched a custom web portal that will allow the company to eclipse all of its previous internal capabilities. Also accomplished highly scientific measurements customer service processes.

No. 54 – Company went from $0 to $50,000 a month in recurring revenue.

No. 64 – Celebrated 50 years in business in 2018. Leigh J. Johnson started the company in 1968 by himself and it has grown to 65 employees. In 2018, the company’s 60-plus employees volunteered 1,000 hours to more than 40 organizations.

No. 75 – Celebrated 20-year anniversary in 2018. Entered into partnership with new monitoring center partner, expanding from two monitored locations to three, including monitoring center operated in company’s Suwanee, Ga., location.

No. 83 – Company went through conversion and upgrade to entirely new business operating system, Sedona Office, in 2018.

No. 84 – Transitioned central station technology to the cloud.

No. 85 – Completed software conversion to Sedona Office and experienced greater control over metrics from job costing to collections.

No. 88 – Entire company received training from the service industry leaders, the Ritz-Carlton company. Company worked together to define service values and company credo and refine it into a pocket-sized guide. Integrated all of this into company’s culture and daily practices throughout 2018.

No. 89 – Began implementation of the Sonitrol Standards and focused on creating processes for installation, service, customer service, etc., that will make these as efficient and customer-friendly as possible.

No. 92 – Completed two significant acquisitions and increased RMR by 13 percent.

No. 94 – Lost only a single customer in 2018.

No. 97 – Partnered with CIBC as a lender and secured a $5 million line of credit.

Ranked by Project Size

View/Download this table as a PDF

Surveillance Systems Inc.’s $15M Project

Surveillance Systems Inc. (SSI) takes the spot of largest project winner in this year’s Top Systems Integrators Report, for its project at the recently opened Encore Boston Harbor Casino. According to Todd Flowers, president of SSI, the scope of work included pulling more than 1.3 million feet of cable to 48 IDFs. The system includes 987 alarm devices, 427 Lenel card reader doors, three Code Blue poles with one base phone, and 3,487 Synectics cameras. The video management system is Synectics and is supported by Extreme Networks. Installation of this project required more than 60,000 man-hours. “SSI’s Greg Stowers did an amazing job coordinating and managing this project,” Flowers notes.

| Rank by Project Size | Company | Value of Largest Project | 2019 Rank |

| 1 | Surveillance Systems Inc. | $15,000,000 | 10 |

| 2 | Convergint Technologies | $14,710,000 | 1 |

| 3 | Advanced Electronic Solutions | $7,200,000 | 21 |

| 4 | NextGen Security LLC | $6,200,000 | 15 |

| 5 | Midstate Security Company | $6,000,000 | 37 |

| 6 | Unlimited Technology Inc. | $5,764,138 | 9 |

| 7 | G4S Secure Integration LLC | $5,566,730 | 5 |

| 8 | Minuteman Security Technologies Inc. | $4,515,680 | 29 |

| 9 | Sound Inc. | $4,500,000 | 30 |

| 10 | Integrated Security Technologies | $3,479,756 | 17 |

| 11 | Allied Universal Security Systems | $3,400,000 | 6 |

| 12 | RedRock Security & Cabling Inc. | $3,000,000 | 31 |

| 13 | A+ Technology & Security Solutions Inc. | $2,700,000 | 23 |

| 14 | PASS Security | $2,425,000 | 42 |

| 15 | Entech Sales and Service LLC | $2,357,825 | 16 |

| 16 | DynaFire Inc. | $2,200,000 | 20 |

| 17 | GSI | $2,097,400 | 14 |

| 18 | Ojo Technology | $2,000,000 | 41 |

| 19 | Engineered Security Systems | $2,000,000 | 62 |

| 20 | CGL Electronic Security Inc. | $1,766,000 | 43 |

| 21 | The Protection Bureau | $1,700,000 | 34 |

| 22 | 3Sixty Integrated | $1,498,000 | 36 |

| 23 | MidCo Inc. | $1,477,000 | 25 |

| 24 | Kastle Systems International | $1,400,000 | 7 |

| 25 | Apex Integrated Security Solutions Inc. | $1,373,000 | 68 |

| 26 | RFI Communications & Security Systems | $1,300,000 | 13 |

| 27 | Stone Security | $1,270,122 | 33 |

| 28 | Tech Systems Inc. | $1,144,280 | 8 |

| 29 | AFA Protective Systems Inc. | $1,100,000 | 12 |

| 30 | Detection Systems and Engineering Company | $1,000,000 | 67 |

| 31 | A3 Communications Inc. | $950,175 | 11 |

| 32 | Ackerman Security Systems | $950,000 | 50 |

| 33 | Ollivier Corporation | $948,205 | 54 |

| 34 | Vision Security Technologies | $900,000 | 49 |

| 35 | Sonitrol of Buffalo, Rochester, Toronto | $900,000 | 74 |

| 36 | Interface Security Systems Holdings Inc. | $850,000 | 22 |

| 37 | Sentry Communications & Security | $850,000 | 48 |

| 38 | Peak Alarm Co. Inc. | $775,000 | 59 |

| 39 | APL Access & Security Inc. | $750,000 | 52 |

| 40 | Electronic Security Concepts LLC | $698,000 | 69 |

| 41 | JSC Systems Inc. | $625,638 | 39 |

| 42 | Star Asset Security | $600,000 | 28 |

| 43 | New York Security Solutions | $560,000 | 72 |

| 44 | Wilson Fire | $540,000 | 73 |

| 45 | SCI Inc. | $540,000 | 80 |

| 46 | Guardian Protection Services | $536,271 | 53 |

| 47 | Will Electronics | $513,962 | 47 |

| 48 | Vector Security Inc. | $500,000 | 4 |

| 49 | TRL Systems Inc. | $500,000 | 32 |

| 50 | Skynet Integrations LLC | $480,000 | 90 |

| 51 | D/A Central Inc. | $453,000 | 55 |

| 52 | ADS Security L.P. | $417,361 | 24 |

| 53 | Sonitrol of Sacramento & Orange County, Cybex Security Solutions | $398,715 | 60 |

| 54 | Fleenor Security Systems | $391,292 | 70 |

| 55 | American Alarm & Communications | $374,868 | 35 |

| 56 | Dallas Security Systems Inc. & DSS Fire Inc. | $365,000 | 26 |

| 57 | Scarsdale Security Systems Inc. | $350,000 | 56 |

| 58 | Strategic Security Solutions | $350,000 | 58 |

| 59 | Key Security Designs Corporation | $340,000 | 94 |

| 60 | NVMC Solutions | $320,380 | 100 |

| 61 | General Security Inc. | $310,000 | 83 |

| 62 | FE Moran Security Solutions | $289,126 | 40 |

| 63 | Moon Security Services Inc. | $279,000 | 77 |

| 64 | Marquee Security | $270,000 | 99 |

| 65 | Custom Alarm | $257,860 | 64 |

| 66 | Security Equipment Inc. | $255,180 | 38 |

| 67 | Per Mar Security Services | $250,000 | 18 |

| 68 | Rapid Security Solutions LLC | $225,886 | 71 |

| 69 | Acadiana Security Plus | $200,390 | 87 |

| 70 | Mountain Alarm | $200,000 | 27 |

| 71 | Post Alarm Systems | $200,000 | 91 |

| 72 | Koorsen Fire & Security | $185,000 | 45 |

| 73 | Sonitrol New England | $181,255 | 57 |

| 74 | Valley Alarm | $172,873 | 92 |

| 75 | Briscoe Protective | $171,000 | 65 |

| 76 | Bates Security / Sonitrol of Lexington | $158,870 | 46 |

| 77 | Habitec Security | $150,000 | 84 |

| 78 | Advanced Security Systems | $149,000 | 88 |

| 79 | Sonitrol Security Services Inc. | $145,668 | 86 |

| 80 | Fortress Security | $135,000 | 97 |

| 81 | Sonitrol Security Systems of the Triangle | $125,000 | 89 |

| 82 | LOUD Security Systems Inc. | $117,635 | 85 |

| 83 | Sonitrol Pacific | $114,593 | 78 |

| 84 | Sonitrol SW Ohio | $106,558 | 76 |

These 84 security systems integrators reported having the highest-value security projects started in 2018. Projects less than $100,000 are not ranked here. Find out more about the largest project, done by Surveillance Systems Inc., on SDM's website at www.SDMmag.com/Top-Systems-Integrators-Report.

Source: SDM Top Systems Integrators Report, July 2019

View/Download this table as a PDF

| Company | 2019 Rank |

| 3Sixty Integrated | 36 |

| A+ Technology & Security Solutions Inc. | 23 |

| A3 Communications Inc. | 11 |

| Acadiana Security Plus | 87 |

| Ackerman Security Systems | 50 |

| ADS Security L.P. | 24 |

| ADT | 2 |

| Advanced Electronic Solutions | 21 |

| Advanced Security Systems | 88 |

| AFA Protective Systems Inc. | 12 |

| Alert Protective Services | 93 |

| Allied Universal Technology Services | 6 |

| American Alarm & Communications | 35 |

| Apex Integrated Security Solutions Inc. | 68 |

| APL Access & Security Inc. | 52 |

| Atlantic Coast Alarm Inc. | 61 |

| Atronic Alarms Inc. | 51 |

| Bates Security / Sonitrol of Lexington | 46 |

| Briscoe Protective | 65 |

| CGL Electronic Security Inc. | 43 |

| Convergint Technologies | 1 |

| Custom Alarm | 64 |

| D/A Central Inc. | 55 |

| Dallas Security Systems Inc. & DSS Fire Inc. | 26 |

| Detection Systems and Engineering Company | 67 |

| DynaFire Inc. | 20 |

| Electronic Security Concepts LLC | 69 |

| EMC Security | 75 |

| Engineered Security Systems | 62 |

| Entech Sales and Service LLC | 16 |

| FE Moran Security Solutions | 40 |

| Fleenor Security Systems | 70 |

| Fortress Security | 97 |

| G4S Secure Integration LLC | 5 |

| General Security Inc. | 83 |

| GHS Interactive Security LLC | 96 |

| GSI | 14 |

| Guardian Protection Services | 53 |

| Habitec Security | 84 |

| Integrated Security Technologies | 17 |

| Interface Security Systems Holdings Inc. | 22 |

| JSC Systems Inc. | 39 |

| Kastle Systems International | 7 |

| Key Security Designs Corporation | 94 |

| Kimberlite Corp. | 79 |

| Koorsen Fire & Security | 45 |

| LOUD Security Systems Inc. | 85 |

| Marquee Security | 99 |

| MidCo Inc. | 25 |

| Midstate Security Company | 37 |

| Minuteman Security Technologies Inc. | 29 |

| Moon Security Services Inc. | 77 |

| Mountain Alarm | 27 |

| New York Security Solutions | 72 |

| NextGen Security LLC | 15 |

| NVMC Solutions | 100 |

| Ojo Technology | 41 |

| Ollivier Corporation | 54 |

| PASS Security | 42 |

| Peak Alarm Co. Inc. | 59 |

| Per Mar Security Services | 18 |

| Post Alarm Systems | 91 |

| Rapid Security Solutions LLC | 71 |

| RedRock Security & Cabling Inc. | 31 |

| Redwire LLC | 81 |

| RFI Communications & Security Systems | 13 |

| Richmond Alarm Company | 82 |

| Scarsdale Security Systems Inc. | 56 |

| SCI Inc. | 80 |

| Secure Pacific Corporation | 95 |

| Securitas Electronic Security | 3 |

| Security Corporation | 19 |

| Security Equipment Inc. | 38 |

| Sentry Communications & Security | 48 |

| Skynet Integrations LLC | 90 |

| Sonitrol New England | 57 |

| Sonitrol of Buffalo, Rochester, Toronto | 74 |

| Sonitrol of Evansville Inc. | 98 |

| Sonitrol of Sacramento & Orange County, Cybex Security Solutions | 60 |

| Sonitrol Pacific | 78 |

| Sonitrol Security Services Inc. | 86 |

| Sonitrol Security Systems of the Triangle | 89 |

| Sonitrol SW Ohio | 76 |

| Sound Inc. | 30 |

| SSD Alarm | 44 |

| Star Asset Security | 28 |

| Stone Security | 33 |

| Strategic Security Solutions | 58 |

| Surveillance Systems Inc. | 10 |

| Tech Systems Inc. | 8 |

| The Protection Bureau | 34 |

| Titan Alarm Inc. | 66 |

| Trinity Wiring & Security Solutions | 63 |

| TRL Systems Inc. | 32 |

| Unlimited Technology Inc. | 9 |

| Valley Alarm | 92 |

| Vector Security Inc. | 4 |

| Vision Security Technologies | 49 |

| Will Electronics | 47 |

| Wilson Fire | 73 |

| Company | Total Revenue |

| ADT | $4,581,673,000 |

| Convergint Technologies | $1,068,385,542 |

| Securitas Electronic Security | $458,000,000 |

| Vector Security Inc. | $302,429,918 |

| Guardian Protection | $214,831,509 |

| G4S Secure Integration | $198,807,310 |

| Interface Security Systems Holdings Inc. | $163,119,858 |

| Koorsen Fire & Security | $134,781,100 |

| Allied Universal Technology Services | $121,000,000 |

| Entech Sales and Service LLC | $118,000,000 |

Among companies ranked on the Top Systems Integrators Report, these businesses reported (or were estimated by SDM) the highest total revenue in 2018: ADT, Convergint Technologies, and Securitas Electronic Security are the top three; Convergint exceeded $1 billion in revenue in 2018 for the first time.

| 2017 | 2018 | |

| Total North American systems integration revenue | $3.31 billion | $3.77 billion |

| New systems started | 104,788 | 167,894 |

| Total full-time employed | 38,322 | 38,770 |

| Business locations operated | 1,145 | 833 |

Total North American revenue from systems integration for the 100 largest security integrators reached $3.77 billion in 2018 from solutions such as design, project management, product, installation, programming, start-up, and training sold directly to an end-user customer or through a tier of contractors. It does not include recurring revenue from services and monitoring, as integrators were asked to report that amount separately in order to be ranked on the SDM 100, a report based on RMR in the security industry. A comparison between the top 100 companies ranked this year and the top 100 ranked in 2018 shows a 14 percent increase in systems integration revenue. However, among companies for which a year-to-year comparison could be made (comparing only those ranked in both years), security systems integration revenue actually increased 34 percent.

| 2017 | 2018 |

| 1. Corporate office space | 1. Corporate office space |

| 2. Education/ campus | 2. Education/ campus |

| 3. Healthcare | 3. Healthcare |

| 4. Government | 4. Industrial |

| 5. Industrial | 5. Retail/restaurant |

| 6. Retail/restaurant | 6. Government |

| 7. Financial/banking | 7. Utilities/critical infrastructure |

| 8. Utilities/critical infrastructure | 8. Transportation/distribution |

| 9. Hotel/hospitality | 9. Hotel/hospitality |

| 10. Transportation/distribution | 10. Entertainment/sports venues |

These top 10 market sectors provided the most significant portion of revenues to security integrators in 2018 ― and although the top three sectors remained the same as in 2017, both industrial and retail moved up in standing over the previous year. For the past several years, corporate office space/property management, education, and healthcare have steadfastly been among the top market sectors for security integrators.

Charts

Source: SDM Top Systems Integrators Report, July 2019

More than nine of 10 Top Systems Integrators (91 percent) expect their 2019 revenues to exceed 2018’s, which is just slightly lower than the prior year’s 94 percent of integrators who thought the same.

Source: SDM Top Systems Integrators Report, July 2019

Top Systems Integrators have a positive outlook on the state of funding for their clients’ security projects, with 54 percent of integrators stating funding was better in 2018 compared with 2017 — down slightly from 56 percent the prior year.

Source: SDM Top Systems Integrators Report, July 2019

This chart, which you can use to compare job titles in your own company with industry averages, shows the average percentage distribution of job titles among Top Systems Integrator companies. Approximately one-third of jobs (34 percent) are comprised of installation and technical service positions.

Source: SDM Top Systems Integrators Report, July 2019

Top Systems Integrators were asked to break out their 2017 sales revenue by type of product. The single largest category of revenue from products is from “integrated non-residential systems” that combine two or more different technology solutions, comprising 34 percent of total sales revenue. This is followed by video surveillance, at 19 percent, and access control, at 14 percent of sales revenue.

Source: SDM Top Systems Integrators Report, July 2018

Top Systems Integrators were asked to break out their 2017 revenue by type of service. The single largest category of revenue is from “system sales and installation,” comprising 54 percent of total revenue, followed by monitoring, at 21 percent, and then service contracts, at 11 percent.

North American systems integration revenue (as reported to or estimated by SDM) reached $3.77 billion in 2018, based on reporting from 100 Top Systems Integrators. This amount registers a 14 percent increase. (Note: It is important to read the footnotes above when referencing the results of each year, because the addition or removal of a large security integrator can have a major effect on total revenue.) For integrators whose revenue could be compared year-over-year, total systems integration revenue actually increased 34 percent

*In the 2010 report, several notable companies did not participate, including SAIC, Red Hawk Security, North American Video, and National Security Systems Inc., which skewed the results. Among systems integrators for which a year-to-year comparison could be made, there was actually only a 4.4 percent decrease in performance between 2009 and 2010.

†Two major factors contributed to the decrease in systems integration revenue; ADT was not ranked, and Siemens Industry Inc. systems integration revenue was adjusted downward by an SDM estimate.

**Siemens Industry Inc., which had been ranked in 2014 using estimated systems integration revenue, was not ranked in 2015. On the surface, it appears that Top Systems Integrators revenue declined 7.1 percent in 2014. When Siemens is removed from this calculation for comparison purposes, however, systems integration revenue for the top 100 companies grew very slightly, at 0.35 percent year-over-year.

††A 17.34 percent decrease in systems integration revenue is attributable to the fact that several of the largest systems integrators either did not reply to SDM’s requests for information, could not comply due to restrictions of being publicly held, or were omitted due to acquisition (includes Diebold Security – will report in 2017 as Securitas Electronic Security Inc.; Stanley Convergent Security Solutions; Protection 1; Schneider Electric; SDI; DTT; and Dakota Security Systems, among the top 25).

***The 14 percent increase in systems integration revenue is attributed to the fact that several of the largest systems integrators that did not participate in 2016 are now ranked in 2017, including ADT, Securitas Electronic Security, and the combined entity of Johnson Controls/Tyco Integrated Security.

†††The 48 percent decrease in systems integration revenue is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in 2017 are not ranked in 2018, including Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), VTI Security (declined to participate), NextGen Security LLC (declined to participate), and Genesis Security Systems LLC (acquired by Convergint Technologies).

More From the Report

To gain additional information beyond that published in this issue and online, the complete SDM Top Systems Integrators Report & Database is available in Excel format. Included are mailing addresses, telephone numbers, website URLs, targeted vertical markets, branch office locations, and much more. SDM’s Top Systems Integrators Report & Database contains the information needed to target products and services to the systems integration market.

The cost of the report is $595. It may be ordered by contacting Jacquelyn Bean at 215-939-8967 or by emailing beanj@bnpmedia.com.