2020 Top Systems Integrators Report: Strength in Numbers

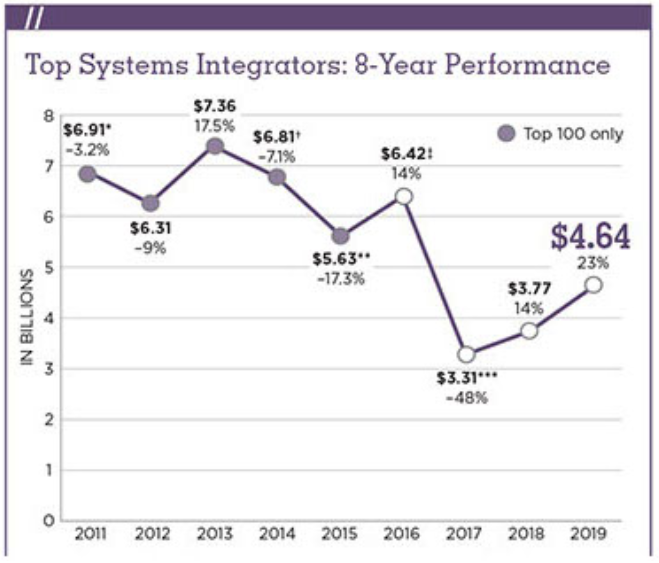

Security integrators ranked on the 25th Annual 2020 Top Systems Integrators Report collectively grew 23 percent in 2019 over the previous year, but the unpredictability of what lies ahead looms.

Last year was a year of revenue growth for many security integrators ranked on the 2020 Top Systems Integrators Report. For some, it was their best year of revenue growth in company history, and for others, the market was flat yet steady. Collectively, the nation’s largest security integrators grew their 2019 North American systems integration revenue by 23 percent over 2018. This is particularly solid evidence of a great year in the security industry as the year before was also a year of growth: those ranked on the Top Systems Integrators Report last year, saw a growth rate of 14 percent over their 2017 systems integration revenue.

One area in particular that many of this year’s Top Systems Integrators noted growth in was hosted and managed services. In fact, with so many security integrators focusing on growing their RMR through these types of services, SDM ranked the top 25 Top Systems Integrators by their reported Recurring Monthly Revenue or RMR for 2019. Top Systems Integrators saw RMR growth with $789.49 million in 2019 collectively, compared with $727.97 in 2018.

No. 35, Sound Inc. saw growth in all markets with hosted solutions. “The market continues to grow with emphasis on analytics and proactive monitoring,” the company reports.

Unlimited Technology Inc., ranked No. 9, writes, “The growth was strong. The segments that grew the most were managed services.”

Adds Valley Alarm, No. 100, “The market was extremely strong — especially in CCTV and access control. 2018 was good, but 2019 was stronger.”

Unlimited Technology’s $19M Project

Unlimited Technology earns the spot for the largest project in this year’s Top Systems Integrators Report, for its project for a large utility customer. For the project, the company implemented a new hyper convergence stretch cluster, including a DWDM transport network and three new data centers. This provided the customer the opportunity for all IT and OT infrastructures to meet the 800 series of NIST standards, while reducing cyber risk. The infrastructure provides the ability to meet future goals including AMI, substation automation, security and data center consolidation projects. Partnering with Pivot3, LogRhythm, IronNet and other equipment and software manufacturers, Unlimited Technology successfully integrated multiple platforms to provide end-to-end cyber monitoring and automated response based on a SOAR model. The implementation provides long-term reductions in operating costs while obtaining higher levels of network and data center reliability and functionality. To read about other Top Systems Integrators’ projects in 2019, click here.

The 2020 Top Systems Integrators Report ranks security integrator companies by their North American systems integration revenue, which includes solutions such as design, project management, product, installation, programming, start-up and training sold directly to an end-user customer or through a tier of contractors.

Total North American systems integration revenue — which is different from total annual revenue — for the 100 ranked companies reached $4.64 billion in 2019, a 23 percent increase over 2018. In addition, security integrators started 256,553 new projects in 2019, up from 167,894 in 2018.

But even with revenue growth, RMR growth and a 52 percent increase in new system starts over 2018, there are signs that the direction for 2020 is not set in stone.

About the SDM Top Systems Integrators Report

The SDM 2020 Top Systems Integrators Report ranks North American companies by their security systems integration revenue. This ranking is based on data provided to or, in a few cases, estimated by SDM. Ranked companies were asked to submit either an audited or reviewed financial statement, or a copy of their income tax return showing total gross receipts for the stated period. The vast majority of the firms ranked are privately held.

The main table, which begins on page 37, ranks 100 companies by their North American revenue in 2019 from their security system integration projects. Integration includes solutions such as design, project management, product, installation, programming, start-up, training and time-and-materials-based service sold directly to an end-user customer or through a tier of contractors. This includes revenue related to security, such as: access control, ID/badging, video surveillance/analytics, intrusion alarms, perimeter security, electronic gate entry, intercom/communications, fire protection, IT/networks, etc. It does not include recurring monthly revenue (RMR), as that is counted towards ranking on the SDM 100 (www.SDMmag.com/SDM100Report). However, due to the increasing focus from security integrators on increasing RMR through managed services, maintenance contracts and more, SDM ranked the Top 25 Top Systems Integrators this year on their reporting of this number on page 38.

Note: an e following the figure indicates it is an SDM estimate.

To find a company by name, use the alphabetical index

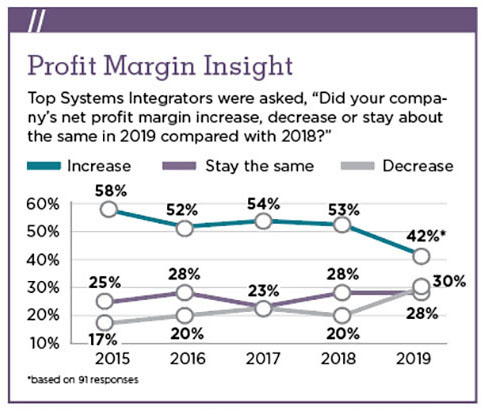

One indication that unpredictability looms is a downward change in the percent of Top Systems Integrators that reported an increase in profit margins for 2019. Since 2015, more than half of the Top Systems Integrator companies reported net profit margins increasing when compared over the previous year. In 2015, as many as 58 percent of the Top Systems Integrators reported their company’s net profit margin increasing over the previous year. For this year’s 2020 Top Systems Integrators Report, 42 percent reported an increase in profit margins in 2019, while 30 percent reported a decrease.

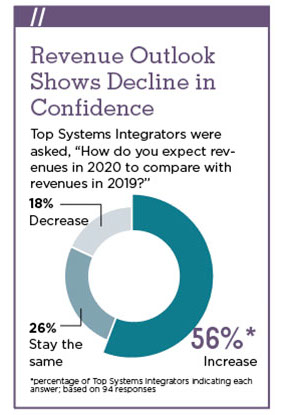

Though it was an overall solid year for security integrators, the untold story of what lies ahead as the world moves forward and through the COVID-19 pandemic threatens to overshadow the possibilities of 2020. Perhaps the biggest telltale sign that change is on the horizon one way or another is in the Top Systems Integrators’ response to revenue expectations for 2020. When asked, “How do you expect revenues in 2020 to compare with revenues in 2019?” 56 percent of Top Systems Integrators say they expect revenue to increase.

On the surface, more than half of this year’s companies predicting an increase sounds quite promising. Some of the Top Systems Integrators filled out their qualification forms before stay-at-home mandates came into place in response to COVID-19, though many filled it out when states were beginning to or already had shut down. In addition, when you look at last year’s response predicting revenue expectations for 2019, 91 percent of Top Systems Integrators expected revenue to increase in 2019 over 2018. A drop from 91 percent to 56 percent gives every indication that security integrators are aware the current state of the world will affect their businesses. The jury is just out on how much.

But many of this year’s Top Systems Integrators are determined to adapt to the changes. Though the majority of those companies ranked on the Top Systems Integrators Report noted COVID-19 as one of the biggest issues or trends to watch out for in 2020, many of them talked about possibilities and opportunities for the year ahead — perhaps a testament to the positive and creative leadership at many of these companies.

Writes Advanced Electronic Solutions, No. 24, “With the COVID-19 virus, we will see more occupancy detectors and remote monitoring with less on-site projects. With so many unknowns, the industry will have to adapt quickly.”

Though D/A Central Inc., No. 47, says COVID-19 “will tank the economy, [but] it will have people thinking about the long-term impact on security,” the company says it foresees temperature monitoring cameras and visitor management becoming a much larger priority moving forward.

Ranked No. 33, 3Sixty Integrated, says, “COVID-19 will impact our business in 2020 …The unpredictability of coronavirus could cause our key markets to have limited resources and inevitably lag our business operations.”

3Sixty Integrated goes on to predict, “By the end of this outbreak, however, our key markets … will have to adapt to the new environment, and we believe an increased demand for security will contribute to that adaptation. Innovation and technology will be critical to facilitate remote, hands-off solutions to keep people secure. There will be an increase in no-contact solutions that are germ-free for access control and visitor management. Video solutions will be expected to do more than just surveillance by integrating with customer heat mapping and temperature tracking technology to monitor health, proximity and inventory. Remote options for security system management will become critical for accomplishing projects and collaborating with team members and clients during service and installation. Our response to every one of these factors will create a huge difference with acquiring and retaining current clients in 2020. Like many others, the security industry will have to fight to meet the demands of this new climate, and our focus on research, development, education and training will be at the core of this effort. As an 18-year-old security integrator, our mission to protect the community has never been more important. We aim to have courage, work smarter and unite to develop new solutions, innovate ideas and guide our clients through this new world of safety and security.”

While Strategic Security Solutions, ranked No. 56, believes that the coronavirus will “undoubtedly” have an impact on 2020 revenues, the company says it will put this time to good use. “We are using this slower period to build our company and processes so we are a stronger organization going forward. 2021 will be a game changer. We are investing in ourselves now so we can take our business to the next level.”

Charts

Source: SDM Top Systems Integrators Report, July 2020

While 42 percent of security integrators reported an increase in their net profit margin over the prior year, the amount of security integrators that reported a decrease in net profit margins compared with the prior year grew by 10 percentage points. For those integrators that reported a net profit margin decrease, the average decrease was 12 percent.

Source: SDM Top Systems Integrators Report, July 2020

Last year, 91 percent of Top Systems Integrators expected their 2019 revenue to exceed the prior year. This year shows a decline in confidence among the Top Systems Integrators as only 56 percent expect their revenue in 2020 to increase over 2019.

Source: SDM Top Systems Integrators Report, July 2020

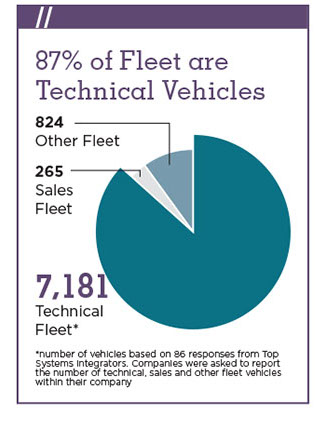

Top Systems Integrators were asked to report the number of vehicles in their fleet and break them down by technical, sales and other. Eighty-seven percent of vehicles were reported as technical.

Source: SDM Top Systems Integrators Report, July 2020

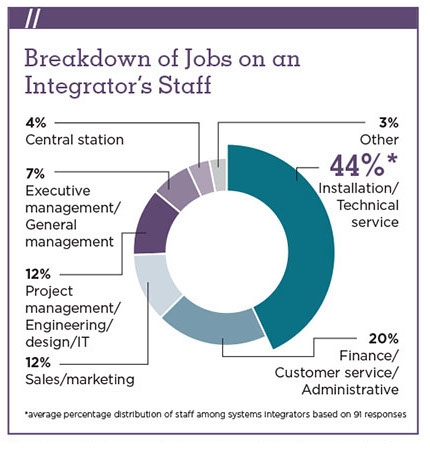

This chart, which you can use to compare job titles in your own company with industry averages, shows the average percentage distribution of job titles among all responding Top Systems Integrator companies. Forty-two percent of jobs are comprised of installation and technical service positions.

Source: SDM Top Systems Integrators Report, July 2020

Top Systems Integrators were asked to break out their 2019 sales revenue by type of product. The single largest category of revenue from products is from “integrated non-residential systems” that combine two or more different technology solutions. This is followed by video surveillance at 24 percent, and access control at 18 percent of sales revenue. Top Systems Integrators are asked to assign percentages to each product category that makes up part of their sales revenues; these responses are averaged by each category.

Source: SDM Top Systems Integrators Report, July 2020

Top Systems Integrators were asked to break out their 2019 revenue by type of service. The single largest category of revenue is from “system sales and installation,” comprising 56 percent of total revenue, followed by monitoring at 23 percent, and service contracts at 10 percent Top Systems Integrators are asked to assign percentages to each service category that makes up part of their sales revenues; these responses are averaged by each category.

| Company | Total Revenue |

| ADT | $5,125,657,000 |

| Convergint Technologies | $1,247,258,573 |

| Securitas Electronic Security | $533,000,000 |

| Vector Security Inc. | $360,261,608 |

| Guardian Protection | $210,434,428 |

| G4S Secure Integration | $178,634,394 |

| Allied Universal Technology Services | $173,297,000 |

| Interface Security Systems Holdings Inc. | $164,257,330 |

| Entech Sales and Service LLC | $121,357,000 |

| Kastle Systems International | $119,000,000 |

Among companies ranked on the Top Systems Integrators Report, these businesses reported the highest total revenue for 2019; ADT, Convergint Technologies and Securitas Electronic Security are the top three on the main rankings.

| 2018 | 2019 | |

| Total North American systems integration revenue | $3.77 billion | $4.64 billion |

| Total recurring monthly revenue (RMR) | $727.97 million | $789.49 million |

| New systems started | 167,894 | 256,553 |

| Total full-time employed | 38,770 | 38,376 |

| Business locations operated | 833 | 948 |

Total North American revenue from systems integration for the 100 largest security integrators reached $4.64 billion in 2019 from solutions such as design, project management, product, installation, programming, start-up, and training sold directly to an end-user customer or through a tier of contractors. It does not include recurring revenue from services and monitoring, as integrators were asked to report that amount separately. A comparison between the top 100 companies ranked this year and the top 100 ranked in 2019 shows a 23 percent increase in systems integration revenue. Among companies for which a year-to-year comparison could be made (comparing only those ranked in both years), security systems integration revenue increased by roughly the same amount at 22.7 percent. Total recurring monthly revenue is the sum of RMR as of Dec. 31, 2019.

| 2018 | 2019 |

| 1. Corporate office space | 1. Corporate office space |

| 2. Education/ campus | 2. Education/ campus |

| 3. Healthcare | 3. Healthcare |

| 4. Industrial | 4. Government |

| 5. Retail/restaurant | 5. Industrial |

| 6. Government | 6. Retail/restaurant |

| 7. Utilities/critical infrastructure | 7. Financial/banking |

| 8. Transportation/distribution | 8. Utilities/critical infrastructure |

| 9. Hotel/hospitality | 9. Hotel/hospitality |

| 10. Entertainment/sports venues | 10. Airport and Entertainment* |

Source: SDM Top Systems Integrators Report, July 2020

Top Systems Integrators were asked to rank the sectors that provided the most significant portion of their revenue. These top market sectors provided the most significant portion of revenues to security integrators in 2019 — and although the top three sectors remained the same as in 2018, government moved up two spots over the previous year. For the past several years, corporate office space/property management, education, and healthcare have steadfastly been among the top market sectors for security integrators.

North American systems integration revenue (as reported to or estimated by SDM) reached $4.64 billion in 2019, based on reporting from 100 Top Systems Integrators. This amount registers a 23 percent increase. (Note: It is important to read the footnotes above when referencing the results of each year, because the addition or removal of a large security integrator can have a major effect on total revenue.) For integrators whose revenue could be compared year-over-year, total systems integration revenue increased by roughly the same amount at 22.7 percent.

*Two major factors contributed to the decrease in systems integration revenue; ADT was not ranked, and Siemens Industry Inc. systems integration revenue was adjusted downward by an SDM estimate.

†Siemens Industry Inc., which had been ranked in the previous year using estimated systems integration revenue, was not ranked this year. On the surface, it appears that Top Systems Integrators revenue declined 7.1 percent in 2014. When Siemens is removed from this calculation for comparison purposes, however, systems integration revenue for the top 100 companies grew very slightly, at 0.35 percent year-over-year.

**A 17.34 percent decrease in systems integration revenue is attributable to the fact that several of the largest systems integrators either did not reply to SDM’s requests for information, could not comply due to restrictions of being publicly held, or were omitted due to acquisition (includes Diebold Security – will report in 2017 as Securitas Electronic Security Inc.; Stanley Convergent Security Solutions; Protection 1; Schneider Electric; SDI; DTT; and Dakota Security Systems, among the top 25).

††The 14 percent increase in systems integration revenue is attributed to the fact that several of the largest systems integrators that did not participate in the previous year were ranked in this year, including ADT, Securitas Electronic Security, and the combined entity of Johnson Controls/Tyco Integrated Security.

***The 48 percent decrease in systems integration revenue is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in the previous year are not ranked this year, including Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), VTI Security (declined to participate), NextGen Security LLC (declined to participate), and Genesis Security Systems LLC (acquired by Convergint Technologies).

†††The 48 percent decrease in systems integration revenue is attributed to the fact that several of the largest systems integrators among the top 25 that were ranked in 2017 are not ranked in 2018, including Johnson Controls (due to lack of publicly available information on its systems integration business), Kratos Public Safety & Security Solutions Inc. (acquired by Securitas ES), VTI Security (declined to participate), NextGen Security LLC (declined to participate), and Genesis Security Systems LLC (acquired by Convergint Technologies).

More From the Report

To gain additional information beyond that published in this issue and online, the complete SDM Top Systems Integrators Report & Database is available in Excel format. Included are mailing addresses, telephone numbers, website URLs, targeted vertical markets, branch office locations, and much more. SDM’s Top Systems Integrators Report & Database contains the information needed to target products and services to the systems integration market.

The cost of the report is $595. It may be ordered by contacting Jacquelyn Bean at 215-939-8967 or by emailing beanj@bnpmedia.com.